Tips to Successfully Complete The 52 Week Saving Challenge

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereYou want to try this 52 Week Saving Challenge or 52 Week Money Challenge but you are not so sure about it, good news I got you covered!

Alright, where did 2019 go because I am sitting here writing about 2020 money-saving goals and it seems like I was just doing this for this year, like a few weeks ago!

If you have been following my personal blog, My Stay At Home Adventures, every Thursday during 2014 (well sometimes Fridays) I posted my weekly recap of my 52 Week Saving Challenge journey.

Mind you I just wrote it diary style and didn't care about editing, I just wanted to give you a heads up, I managed to keep up with this money-saving challenge for the entire year.

By the end of 2014, I managed to save $1368 and decided to continue to save a set amount each week for 2015.

Many asked how did I manage to stick with this financial challenge successfully.

To answer your questions, I have 9 Tips to Successfully Complete The 52 Week Saving Challenge to show you how it can be done!

What’s the 52 Week Saving Challenge?

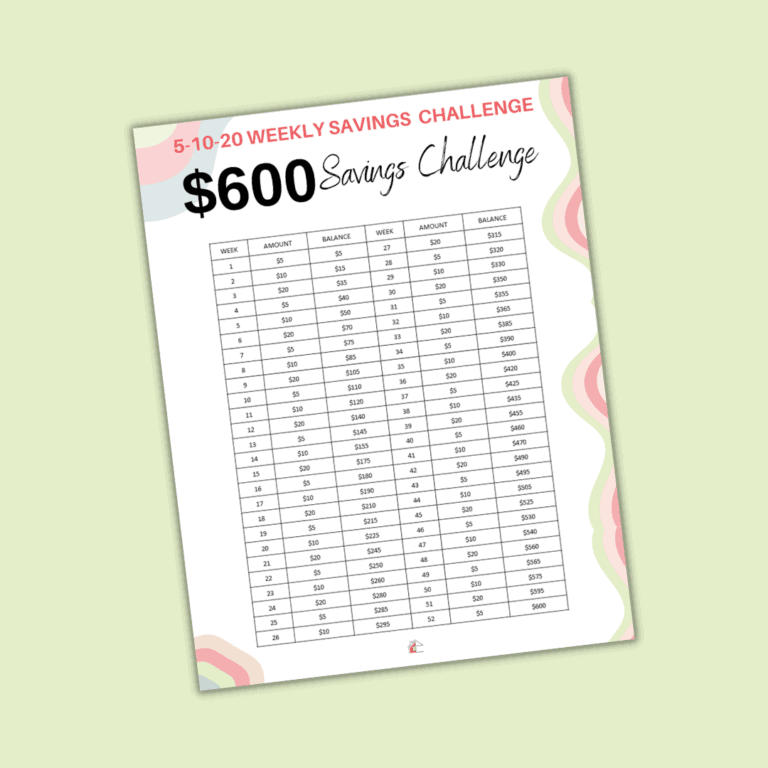

The 52 Week Saving Challenge, also known as 52 Week Money Challenge, is a yearlong weekly challenge where you set aside a set amount of money.

You can save this weekly set amount into a checking account.

I used my CapitalOne360 checking account (no fees!). You can also save it in a jar. The point of this challenge is to save money.

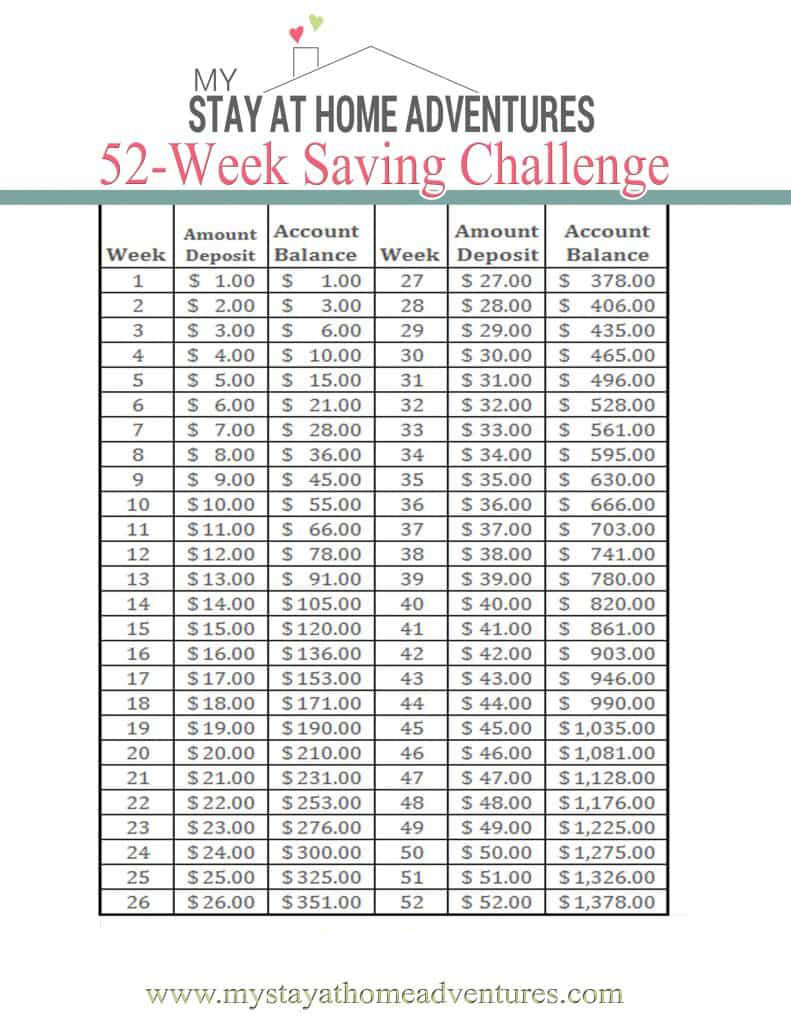

You start the challenge with week 1, where you save $1.

On week 2 you save $2 and so on.

As the weeks increase, so does the weekly saving amount until you reach week 52 where you will save $52. The goal is to reach $1378 when you reach week 52.

What makes this a challenge?

As simple as it looks at first, saving a weekly amount that increases each week will be difficult without planning.

Sure, we can save $15 a month total in January, but could you save over $200 a month later on?

That’s why I enjoyed doing this challenge because it required planning in order to achieve it.

9 Tips to Successfully Complete The 52 Week Saving Challenge

Decide if the 52 Week Saving Challenge is right for you

Many people love the idea, and the concept, of this financial challenge. They noticed the $ 1-week savings, instead of the entire picture. As I stated above, the amount you save each week will increase, that’s what makes it a challenge.

Create a plan

You are about to start this challenge, to succeed in any challenge you have to plan.

Planning is key to succeeding in this challenge. Print your 52 Week Saving Challenge pdf or print the latest 2015 version here.

Decide what method you are going to save this amount. I recommend opening another checking account.

Again, I used CapitalOne360 checking account because there are no fees. You want to make sure that where your money is going is not easily accessible.

In July 2016 we started using Digit to save money and honestly, it is not a bad idea to use this app for this challenge.

All you have to do is command via text how much money to pull each week and that is it.

I think it is even easier to create a Digit account vs. creating another bank account. If you are new to the 52 Week Saving Challenge and want to do it, then I suggest you check out Digit!

Decide how you are going to start this challenge

You created a plan, have your transfer date set, and your account setup. You have printed the transfer sheets, and now it's time to decide which way you want to start this challenge.

By looking at this challenge, you can see that your highest amount is toward the end of the year, November and December.

During the last two months of the year is when we spend more money, and we knew it was going to be challenging for us.

Since we spend less money at the beginning of the year, we decided to attack this challenge strong by doing this 52 Week Challenge reversed.

Starting with week one, we transferred $52 to our checking account.

The key to this 52 Week Saving Challenge is to set aside money, and like any other challenge, having a good plan is key.

Create a Budget

The good thing about this challenge is that it's year-long, and you know the amounts that need to be saved each week.

Add up all the weekly savings, so you have a monthly total. Use that monthly total every time you work on your budget each month.

For example, if you are starting this challenge reversed in January, know that you are going to need to budget $250 (we transferred every Thursday) for that month.

By including this monthly amount in your budget, it will eliminate surprises.

Again, planning is key to succeeding in the 52 Week Saving Challenge.

Get visual

Have fun and create a fun chart where it's visible to everyone that’s involved.

If you are using this money for a vacation, put a picture or anything that will remind you why this challenge is important.

Stay motivated

Sometimes we get into a down mood, and it's hard to get motivated. Read a blog that motivates you.

Talk about the challenge with someone. Stay motivated, look at your visual, read financial blogs.

Accountability

For me to stay focused, and have some accountability, I will write a weekly post about it each week.

I’m not saying you should start a money blog, but if you do, please leave me your link; I would love to read your progress.

Anyway, creating a visual and a chart is a form of accountability since if the chart stays empty for a week or two, you will feel a sense of guilt.

I do suggest you write it on a calendar, if you are not into blogging, in order to hold yourself accountable.

Find other ways to make money

Let’s face it and be honest, saving each week a high amount was rough, very rough.

Since we knew we were going to need to make extra money to meet each weekly saving amount, I tried ways to make extra money.

I earned free gift cards; I held a yard sale; I made extra money to accommodate my budget.

Don’t give up!

Life is unpredictable. I wrote each week, and I went through some downtime.

I lost an uncle in the summer of 2014 and got married the same year too. We were paying for our daughter's Disney trip too.

We had a lot of events going on that year because life throws us curveballs, we could have just given up and quit this challenge.

Check out these money posts:

- 8 Tips To Help Save Money When Money Is the Last Thing On Our Minds

- 4 Financial Challenges Your Entire Family Can Do

- 6 Everyday Money Wasting Habits You Need To Stop Today

My Advice

The money challenge is going to get tough for some of you and that's good! That's why it is called a challenge, my friend. So here's what you are going to do:

- Don’t quit.

- Keep going.

- You skip a week, keep going.

- In order to finish this challenge, you must keep going.

If you did this challenge, or are reading all the ways to succeed in this challenge, you will know that it's not about the fastest way to reach $1378.

It's about saving money and the challenges of saving money. If at the end of this challenge you managed to save $500, you did it.

You managed to save.

Once you complete this challenge, it makes you want to keep going; you will want to challenge yourself to save more money.

The key to finish this 52 Week Saving Challenge is to plan and keep motivated.

I hope these tips help you succeed in this financial challenge and not give up like many others. I never imagined that something that I found so cute in social media, turned out to be such a great experience, financially and mentally.

Having set the goal to save for Christmas, and not worrying about where and how were we going to be able to come up with money this Christmas, was rewarding.

We were even able to purchase other things we needed with this money.

What other tips do you have to successfully complete the 52 Week Saving Challenge?

This is great! I really want to try this challenge starting in January so these tips are perfect 🙂

That’s great! I’ll be you cheerleader!!!

So great! You should be proud for setting such a great goal and then achieving it! 🙂

Thank you Michelle for the kind words. 🙂

I love how the monthly goals are staggered. SO much more realistic, because we all know there are certain months that pose a challenge (lots of birthdays, family event that requires travel, etc)

I think that’s the reason many people don’t finish this challenge because they don’t see the entire picture. Can you really be able to save $200 a month? I made sure we looked at it before we decided to start it and write about it.

I absolutely love this post. I think I’ll try doing the challenge starting in January but, I’ll save my money in a jar! Thank you for the great tips!!! I’m pinning it!!

Thank you Kim!

I so want to do this next year! I suck at saving and really need to go on a budget from next year.

You can do it! It takes planning but is doable.

This is so practical and smart and most importantly simple 😀

Thank you PM!!

Thank you for the great tips for this challenge and sticking to your budget.

Thank you for the kind words. 🙂

Very good strategy of saving money:) Thanks for great tips!

Thank you llona!

Ahh, tips to live by! Thanks for sharing! I’m going to get my savings on. 🙂

Thank you Sarah.

I love your tips for being successful at this challenge and making it right for you and your family. Thanks!

Thank you Laura for the kind words.

Thanks for breaking down ways to make this manageable. I’ve pinned it to come back to after the holiday craziness is over.

Thank you. I’m very glad this post helps you.

Thank you for being encouraging and inspiring when it comes to saving. You have a nice plan layed out there. You really make it look doable. I guess we should all be saving! 🙂

Thank you Angel. Is doable and as long as you save is what’s important.

I’m always intrigued by this challenge, and I think you’ve got some great tips on helping succeed at it!

Thank you!

I sooo need to do this. It would take off stress at the end of the year with unexpected expenses. I love the idea of reversing the amounts saved. Thank you for sharing.

Thank you Alana. Hope this helps.