How Can I Increase My Savings Quickly

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereWe all want to save more money, but sometimes it can seem impossible. The good news is that there are plenty of quick and easy ways to increase your savings, regardless of your income or financial situation.

Let's share some simple tips and tricks to help you boost your savings and achieve your financial goals.

Remember that not all tips and tricks will work for everyone, so it's important to find the strategies that suit you best.

Let's get started!

Establish Your Budget

To save money fast, it's crucial to establish a budget. This means taking an honest look at your income and expenses and creating a plan for how your money will be allocated each month.

By including saving in your budget, you can ensure that you set aside money each month for emergencies and future goals. It's important to realize your spending habits and make adjustments where necessary.

One helpful tip is to track your spending for a month or two and see where you can cut back. Sacrifices may need to be made, but they will be worth it in the long run.

You can make saving even easier by automating good habits, such as transferring money into savings every paycheck or using rewards credit cards for purchases.

Stick to a Budget

Once you have established your budget, the key is to stick to it. This means being mindful of your spending habits and making conscious choices about where your money goes. It might be tempting to splurge on unnecessary purchases, but remember that every dollar you spend takes away from your savings goals.

One helpful strategy is to track and review your spending regularly, so you can make adjustments as needed. Another approach is automating your savings by setting up transfers every paycheck, so you don't have to think about it.

By sticking to your budget, you'll be on your way to increasing your savings quickly and achieving your financial goals.

You might enjoy these posts:

- 4 Ways To Save Money When You Are Living Paycheck To Paycheck

- Financial Habits (You Need to Follow Today)

- Free Cash Envelope Template

Obtain a Higher-Paying Job

If you are looking to increase your savings quickly, obtaining a higher-paying job could be the solution. It is important to evaluate your current job and determine if you have the potential to earn more, whether through a promotion or an increase in salary.

If not, it may be time to explore other job opportunities that offer a higher salary. However, before jumping ship, it is important to research potential job options, ensure that the company culture aligns with your values, and consider their benefits, such as retirement plans and healthcare.

Finding the right job opportunity may take time, but the financial rewards of a higher salary could be worth the effort in the long run. Remember to include saving in your budget so that you can make the most of your increased income.

Include Saving in Your Budget

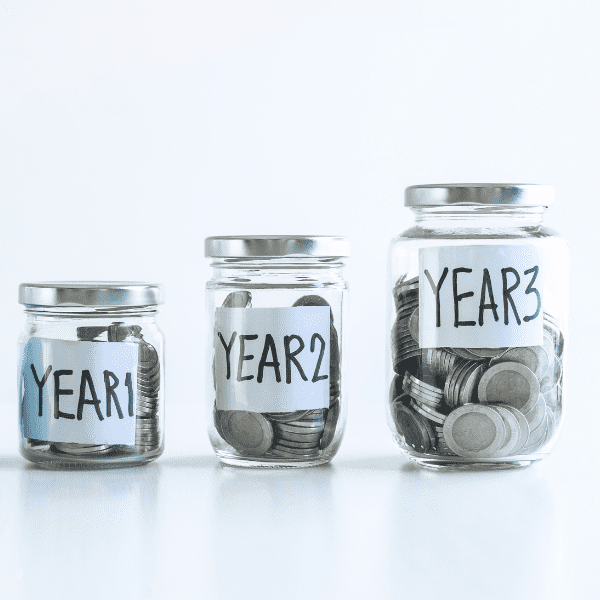

Including saving in your budget is one of the key steps to increasing your savings quickly. Setting aside a specific amount of money from your income is essential to save regularly. When creating a budget, make sure to allocate a percentage of your income towards savings.

Start small and increase the amount gradually as you get comfortable with the process. Try to make saving a priority and reduce your discretionary expenses.

You can also use various tools like apps and spreadsheets (we offer a library of resources) to track your expenses and record your savings progress.

By including savings in your budget, you'll be able to achieve your financial goals faster and build a secure future for yourself. Remember, every little bit counts, so start today and watch your savings grow over time.

Realize Your Spending Habits

To increase savings, it's important to realize your spending habits. It's easy to get caught up in mindless spending without fully realizing how much money you're actually throwing away.

By tracking every single expense, you'll better understand where your money goes and where you can cut back.

This can seem daunting at first, but it's worth it to take a closer look at your habits and make adjustments accordingly.

Once you realize your spending habits, you can create a budget that works for you and make smarter financial decisions. Remember, every little bit counts when it comes to saving money.

Increase Your 401k Contribution

One effective strategy for boosting your savings quickly is to increase your 401(k) contribution. It may seem like a small change, but even a 1% increase can make a big difference in the long run. By contributing more to your 401(k) account, you're taking advantage of the tax benefits and compounding interest that come with these retirement plans.

Plus, contributing more now means you'll have more money in your account when you're ready to retire. Consider setting up automatic transfers each paycheck to ensure your contributions are consistent and intentional.

If you're unsure how to allocate your contributions or which investments are best for you, consult a financial advisor or use online resources to educate yourself.

Increasing your 401(k) contribution can be a simple yet effective way to boost your savings and build a stronger financial foundation for your future.

Set Up Transfers Every Paycheck

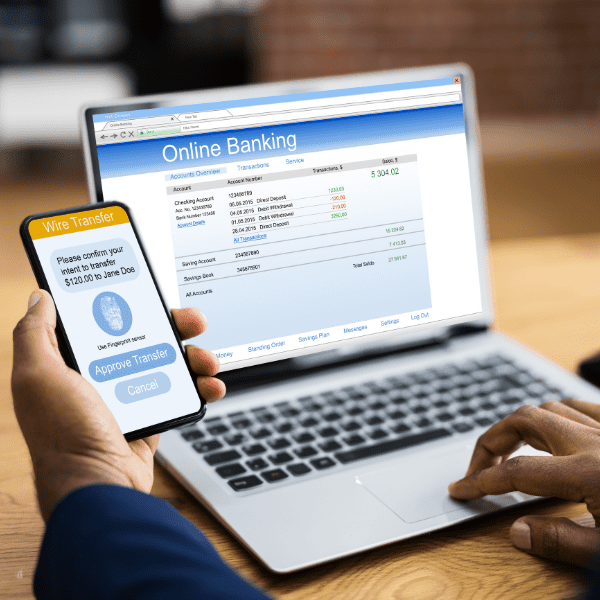

One effective way to increase your savings quickly is to set up transfers every paycheck. Automating your savings can take the guesswork out of it and make it easy to stick to your budget.

With automatic transfers, you can set up a specific amount to move from your checking account to your savings account with each paycheck. Then, you can adjust the amount you transfer as your financial situation changes.

With this method, you won't have to worry about remembering to save anything or feel tempted to spend it before you have a chance to put it away. This is a valuable tool for improving your financial well-being and building up your savings for the future.

Use Rewards Credit Cards

Another way to increase savings quickly is by taking advantage of rewards credit cards. Individuals can earn rewards by using a credit card that offers cashback or points for purchases while making their usual expenses.

However, using the right card and sticking to a budget is important to avoid overspending and accruing debt. Additionally, transferring unused points or considering having multiple rewards credit cards can maximize rewards-earning potential.

Individuals can earn extra funds towards their savings goals by incorporating rewards credit cards into their overall financial strategy.

Earn Points for Purchases

One way to increase your savings quickly is to earn points for your purchases through rewards, credit cards, and apps. Using the right credit card or refund apps at the right time can maximize your rewards and save money in the long run.

Our favorites apps and sites:

It's essential to establish a budget and stick to it so that you can use your rewards wisely. In addition to earning points on purchases, you can also automate your savings with an app and take advantage of bonus offers.

Realizing your spending habits and making small changes can make a big difference in your savings. So make sure to stack your receipts into categories and keep track of your spending to stay on top of your finances.

Increasing one's savings quickly requires a combination of disciplined budgeting and mindful spending habits. Establishing and sticking to a budget is essential, ensuring that saving is included in the plan. Increased earnings can also contribute to savings, highlighting the importance of obtaining a higher-paying job.

Understanding one's spending habits is crucial, allowing for effective management of assets and realistic goal-setting. Additionally, increasing contributions to 401k plans and setting up transfers every paycheck can aid in savings growth.

Finally, it is worth considering using rewards credit cards to earn points for purchases, which can be redeemed for savings or other benefits. By incorporating these strategies, individuals can set themselves up for long-term financial security and peace of mind.

Love all of your tips! Having a financial challenge sounds like something I would definitely consider.

Thank you so much Ros!

Thanks for sharing these tips!

You inspire me to start saving now.

I have been struggling in saving my money, this would really help me.

I want to save money for this new year, hope it is not yet too late.

One of my best money savings tips is to be more energy conscious. Turning off lights, setting the thermostat up or down a few degrees, and investing in minor home repairs like window sealing and low flow faucets really add up quickly!