What does taking control of your finances mean?

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereWhen it comes to personal finances, taking control is crucial for a successful and secure financial future. However, what exactly does taking control of your finances mean? Let's delve into this topic further.

What does taking control of your finances mean?

Taking control of your finances means being proactive and intentional about managing your money. It involves making informed decisions, setting financial goals, creating a budget, and tracking your expenses. By taking control, you are ensuring that your money is being utilized effectively and efficiently and working towards a stable financial situation.

Here are some key aspects of taking control of your finances:

- Understanding your financial situation: This includes assessing your income, expenses, debts, and assets. Knowing where you stand financially is essential for making informed decisions.

- Setting financial goals: Identify your short-term and long-term goals, such as saving for retirement, paying off debts, or buying a home. Setting clear goals helps you stay focused and motivated.

- Creating a budget: A budget allows you to allocate your income towards different expenses, savings, and investments. It helps you prioritize your spending and avoid unnecessary debt.

- Tracking your expenses: Keeping track of your expenses allows you to identify areas where you can cut back and save money. It also helps you stay accountable to your budget.

- Saving and investing: Taking control of your finances means prioritizing saving and investing for the future. This includes building an emergency fund, contributing to retirement accounts, and exploring investment opportunities.

By taking control of your finances, you are empowering yourself to make sound financial decisions, achieve your goals, and pave the way for a secure and prosperous future.

Understanding your current financial situation

Taking control of your finances is essential for achieving financial stability and peace of mind. It means being aware of your income, expenses, debts, and budget on a regular basis. By understanding where your money comes from and where it goes, you can make informed decisions to improve your financial health.

Assessing your income, expenses, and debts

To take control of your finances, start by assessing your income, including your salary, bonuses, investments, and any other sources of money coming in. Next, evaluate your expenses, such as rent or mortgage payments, utilities, groceries, transportation, and entertainment.

Don't forget to account for any debts you have, including credit card balances, loans, and outstanding bills. This assessment will give you a clear picture of your financial situation.

Tracking your monthly budget

Once you understand your income, expenses, and debts, tracking your monthly budget is crucial. Create a detailed budget that includes all your income sources and categorizes your expenses. This will help you identify areas where you can cut costs and save money. Use budgeting tools or apps to track your spending and stay organized.

Regularly reviewing and adjusting your budget will enable you to stay on top of your finances and achieve your financial

Setting financial goals

When it comes to taking control of your finances, setting clear goals is crucial. You can create a roadmap for your financial journey by establishing financial objectives.

Short-term and long-term goals

You hope to achieve short-term goals within the next year or so. These might include paying off debt, creating an emergency fund, or saving up for a vacation.

Long-term goals, on the other hand, are typically objectives you want to achieve in five years or more, such as buying a home, funding your retirement, or starting a business.

Prioritizing your objectives

When prioritizing your financial objectives, consider your current situation and what matters most to you. It's important to strike a balance between short-term and long-term goals and between your wants and needs.

By doing so, you can make better decisions about allocating your resources and ensure that your financial journey aligns with your values and aspirations.

Creating a budget

Taking control of your finances involves creating a budget that helps you manage your income and expenses effectively.

Allocating funds for essentials, savings, and discretionary spending

- Essentials: Start by allocating funds for your essential expenses, such as housing, utilities, groceries, and transportation. These are the necessary expenses that you cannot do without.

- Savings: Set aside a portion of your income for savings. This can be for short-term goals like emergencies or long-term goals like retirement. Paying yourself first ensures that you build a financial buffer and secure your future.

- Discretionary spending: Allocate a portion of your budget for discretionary spending, which includes entertainment, eating out, and hobbies. This allows you to enjoy the present while still being mindful of your financial goals.

Tips for sticking to your budget

- Track your expenses: Keep a record of all your expenses to stay aware of your spending habits and identify areas where you can cut back.

- Set realistic goals: Make sure your budget aligns with your financial goals and aspirations. Set achievable targets to stay motivated and committed.

- Review and adjust: Regularly review your budget to see if it's working for you. Adjust as needed to accommodate any changes in your income or expenses.

Taking control of your finances means being conscious of how you allocate and spend your money. You can achieve financial stability and peace of mind by creating a budget and sticking to it.

Managing debt

Taking control of your finances means effectively managing your debt. It involves implementing strategies to pay off your debts and exploring consolidation and negotiation options.

Strategies for paying off debt

To take control of your finances, consider the following strategies for paying off your debts:

- Snowball Method: Start by paying off your smallest debts first while making minimum payments on larger debts. As you pay off smaller debts, you gain momentum and motivation to tackle larger debts.

- Avalanche Method: Prioritize paying off debts with the highest interest rates. Focusing on high-interest debts minimizes the amount of interest you accumulate over time.

Consolidation and negotiation options

Taking control of your finances also involves exploring consolidation and negotiation options to manage your debt effectively:

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate. This simplifies your payments and may reduce your overall interest costs.

- Debt Negotiation: Reach out to your creditors to negotiate repayment terms that work for you. They may be willing to lower interest rates, waive fees, or create a more manageable repayment plan.

By implementing these strategies and exploring consolidation and negotiation options, you can take control of your finances and work towards financial freedom.

Remember, it's important to create a budget, track your expenses, and make consistently on-time payments to manage your effectively

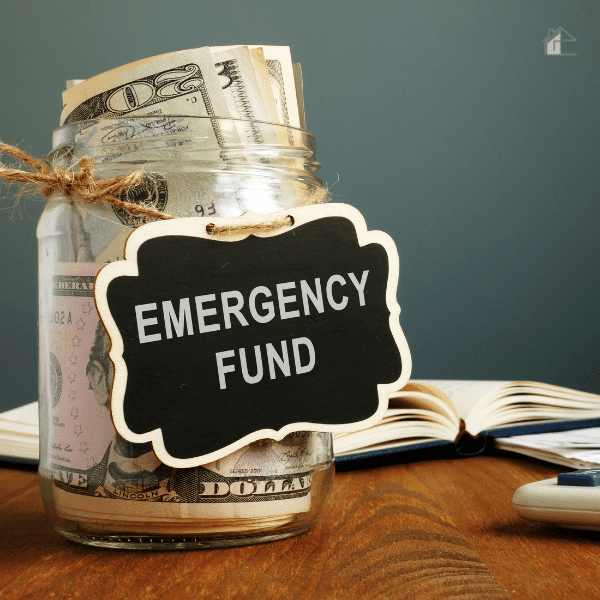

Building an emergency fund

Taking control of your finances means having the ability to handle unexpected financial challenges and emergencies. One important aspect of this is building an emergency fund.

Importance of having a financial safety net

Having a financial safety net like an emergency fund provides you with peace of mind and financial stability. It allows you to cover unexpected expenses without relying on credit cards or loans, preventing you from going into debt.

An emergency fund also gives you the freedom to make decisions based on your long-term financial goals rather than being forced to make short-term compromises. It serves as a safety net during job loss, medical issues, or unforeseen emergencies, ensuring you control your finances.

Saving for the future

Taking control of your finances means planning for the future and being prepared for unexpected expenses. Two important aspects of financial control are retirement planning and investing and saving for education and healthcare expenses.

Retirement planning and investing

Planning for retirement is crucial to ensure financial security in your later years. This involves regularly setting aside a portion of your income and investing it in retirement savings accounts or other investment vehicles. You can enjoy a comfortable and stress-free retirement by taking control of your retirement planning.

Education and healthcare expenses

Taking control of your finances also means saving for future education expenses, whether it be for yourself or your children. This may involve setting up a college savings account or investing in education-related funds.

Also, having a dedicated savings plan for healthcare expenses can help cover medical costs and ensure you are financially prepared for any unforeseen medical emergencies.

By taking control of your finances and focusing on saving for the future, you can have peace of mind knowing that you are financially prepared for retirement, education expenses, and healthcare costs. Making these important financial decisions will lead you to long-term financial security and stability.

Investing wisely

Taking control of your finances means being proactive and deliberate in handling and managing your money. It involves making smart decisions to secure your financial future. One aspect of taking control of your finances is investing wisely. Here are a couple of key points to consider:

Understanding different investment options

To invest wisely, it's important to understand the various investment options available to you. This includes stocks, bonds, mutual funds, and real estate. Each option comes with its risks and potential returns, so it's important to research and seek professional advice if needed.

Diversification and risk management

Another important aspect of investing wisely is diversification and risk management. Spreading your investments across different asset classes and sectors can help minimize risk. By diversifying your portfolio, you are not relying on a single investment to determine your financial success.

It's also crucial to regularly review and adjust your investment strategy based on your goals, risk tolerance, and market conditions.

Taking control of your finances means being proactive in managing your money and making informed decisions. Investing wisely allows you to grow your wealth and secure your financial future. Remember to educate yourself, seek advice when needed, and stay updated on market trends to make the most out of your investments.

Keeping track of your credit score

Taking control of your finances means being aware of your credit score and actively monitoring it. Your credit score is a numerical representation of your creditworthiness and is used by lenders, landlords, and insurance companies to assess your financial reliability. Here are some key steps to help you take control of your credit score:

Monitoring your credit report

Regularly reviewing your credit report is essential to ensure its accuracy. You can request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Check for any errors or discrepancies and report them immediately.

Improving and maintaining a good credit score

To improve your credit score, pay your bills on time, reduce your credit card balances, and avoid new credit card applications. You can consider diversifying your credit mix by combining credit cards, loans, and mortgage accounts. Maintaining a good credit score requires consistent, responsible financial behavior.

Remember, a good credit score can open doors to favorable interest rates, better loan terms, and increased financial opportunities. By actively monitoring your credit score and taking steps to improve it, you are taking control of your financial

Seeking professional advice

Taking control of your finances means understanding your financial situation and making informed decisions. While it's possible to manage your finances on your own, there are times when seeking professional advice can be beneficial.

When to consult a financial advisor or planner

It is advisable to consult a financial advisor or planner in the following situations:

- Complex financial situations: If your finances are more complicated, such as managing investments, planning for retirement, or dealing with tax issues, a professional can provide valuable guidance.

- Major life events: Events like getting married, having a child, purchasing a home, or starting a business can significantly impact your finances. Seeking advice during these stages can help you make the right financial decisions.

Choosing the right professional for your needs

When selecting a financial advisor or planner, consider the following criteria:

- Qualifications and expertise: Look for certified professionals with relevant experience in the areas you need assistance with.

- Trust and compatibility: Working with someone you trust and feel comfortable discussing your financial goals and concerns is important.

- Fee structure: Understand how the professional charges for their services, whether it's a flat fee, hourly rate, or a percentage of assets under management.

Remember that taking control of your finances means making informed decisions, and seeking professional advice can help you navigate complex financial situations and make the most of your financial resources.

Reviewing and adjusting your financial plan

Regularly evaluating and adapting your financial strategy

Taking control of your finances means regularly reviewing and adjusting your financial plan to align with your goals and circumstances. It involves evaluating your current income, expenses, debts, investments, and savings to make informed decisions.

By regularly reviewing your financial strategy, you can identify areas for improvement, make necessary adjustments, and stay on track to meet your financial goals. This may include creating a budget, reducing unnecessary expenses, increasing your savings, diversifying your investments, or paying off debts strategically.

Taking control of your finances also means being proactive about financial education and staying informed about economic trends, tax laws, and investment opportunities. This will enable you to make more informed decisions and take advantage of potential opportunities.

Also, it's important to monitor your progress and regularly adjust as needed. Life circumstances change, and your financial plan should be flexible enough to accommodate these changes. By constantly evaluating and adapting your financial strategy, you can ensure that you are on the right path toward financial security and success.

Remember, taking control of your finances is an ongoing process that requires discipline, patience, and a willingness to make changes when necessary. By taking these steps, you can gain greater control over your financial future and work towards achieving your long-term financial goals.

Taking control of your finances: a path to financial freedom

When it comes to your financial well-being, taking control of your finances is crucial. It means clearly understanding your income, expenses, and assets and actively managing them to achieve your financial goals. Taking control of your finances lets you make informed decisions about spending, saving, and investing.

It helps you avoid unnecessary debt, build an emergency fund, and plan for your future. By taking control of your finances, you are paving the way toward financial freedom and creating a solid foundation for your financial well-being. So start today and take charge of your financial

You’re so right that sometimes it takes a couple of tries to get the budget right, and you have to set it up the way that makes sense for YOU, not someone else!

Exactly. Thank you Skye!

It is so important to make your budget work for you!

Indeed, Sharon. 🙂

These are great tips!! Budget is everything.

I agree Ivette.

Great tips! Writing things down helps a ton!

Sure does Olivia.

These are awesome tips! My boyfriend and I are living for the first time, and it’s great having a two-income household, but it’s still tough to manage finances in a new place, because we always want to buy things to make it more homey.

You can make your home more homey, just spend wisely and plan. Is not worth getting yourself into financial trouble because you want to make your home more homey. Make a plan, budget, and you will see! Thank you Tiffany.

Great tips! I could always use budgeting help.

Xoxo,

Summer Ann

www.simplysummerann.com

Thank you Summer! I’m here to help. 🙂

let me just add something from the paying off debt end of it – if it’s between your savings and your debt, use the savings to pay off your debt!

Thank you for commenting Andi. Sadly, most people are so in debt that they don’t even have any amount save.

These are great tips, thank you! Budgeting has been a learning process for us.

Thanks Ashley. Budgeting is a process but you will get there. Remember to make it work for you.

My Husband and I started Dave Ramey’s Financial Peace University last year and it changed our marriage, finances, and our lives all together.

We read Dave Ramsey’s book and that’s what started it all for us, Amanda. I think it changes lives!

I could not get by without my written budget. Great tips!

Thank you Shanta!