7 Things You Can Do The Day After Christmas To Save Money

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereAfter the hustle and bustle of Christmas Day has passed, it's time to start thinking about ways to save money. Planning and taking action the day after Christmas can help you make the most of your budget and avoid overspending during the holiday season. By implementing the following strategies, you can enjoy the post-Christmas sales and save money for the upcoming year.

Why it's important to save money after Christmas

Saving money after Christmas is crucial for several reasons. Firstly, many stores offer significant discounts on holiday items, decorations, and even gift sets. These sales allow you to stock up on supplies for the next holiday season at a fraction of the cost.

Also, saving money after Christmas helps you recover from any financial strain that the holiday might have caused. It allows you to start the new year with a more secure financial situation and avoid unnecessary debt.

The benefits of taking action immediately

Taking action immediately after Christmas can lead to several benefits. First and foremost, you will have access to the best sales and discounts. Many stores start their post-Christmas sales the day after, so being proactive can ensure you don't miss out on any great deals. Secondly, spreading out your spending allows you to manage your budget effectively.

By purchasing items gradually, you can avoid overspending and make more thoughtful purchase decisions. Finally, starting early gives you ample time to search for the perfect gifts for friends and family, without feeling rushed or pressured.

With these strategies in mind, you can save money and have a more enjoyable and stress-free holiday season.

Create a Budget

Assessing your post-Christmas financial situation

The day after Christmas is the perfect time to assess your financial situation and determine how much you can save. Take a moment to review your bank statements and credit card bills to see how much you spent during the holiday season.

This will give you a clear understanding of where your money went and help identify areas where you can cut back in the future. By assessing your financial situation, you can make informed decisions about how much you can save and create a realistic budget for the upcoming year.

Setting a budget for the upcoming year

Now that you clearly understand your post-Christmas financial situation, it's time to set a budget for the upcoming year. Consider how much you want to save and what expenses you anticipate in the coming months. This could include upcoming birthdays, vacations, or home repairs.

Consider these expenses and allocate a specific amount of money toward monthly savings. By setting a budget, you'll have a clear plan in place and be able to track your progress throughout the year.

Return or Exchange Gifts

Understanding return policies

The day after Christmas is the perfect time to assess your post-holiday financial situation and make some money-saving moves. One of the first things you can do is to understand the return policies of the stores where you received your gifts. Knowing the return period and requirements will help you determine if you're eligible for a refund or exchange.

How to effectively return or exchange unwanted gifts

If you received gifts that aren't quite right for you, don't worry! Many stores allow you to return or exchange items with a valid receipt. Start by checking the return period, which is typically 30 days from the date of purchase. For example, if you received a gift on December 1st, you have until December 31st to qualify for a refund or exchange.

To effectively return or exchange your gifts, make sure to keep the items in their original packaging and bring the receipt with you. Some stores may require the original packaging and proof of purchase to process the return or exchange smoothly.

By understanding the return policies and following the necessary steps, you can make the most of your unwanted gifts and potentially save money or find something better suited to your needs.

Take Advantage of Sales

Finding the best post-Christmas sales

The day after Christmas is not just about returning or exchanging gifts; it's also a prime time to score some amazing deals. Many retailers offer substantial discounts on various items as a way to clear out their holiday inventory.

To find the best post-Christmas sales, check out the websites or flyers of your favorite stores. Some retailers even send out special emails or notifications to loyal customers with exclusive deals and promo codes. Take advantage of these sales to save money on items you've been eyeing or to stock up on essentials.

Tips for getting the most out of your shopping

To make the most of post-Christmas sales, it's important to plan ahead and be strategic in your approach. Here are some tips to help you get the most out of your shopping:

- Make a list: Before heading out to the stores, make a list of the items you want to purchase. This will help you stay focused and avoid impulse buys.

- Research prices: Do some research beforehand to compare prices and ensure you're getting the best deal. Websites and apps like PriceGrabber can help you find the lowest price for the items on your list.

- Use coupons and promo codes: Look for extra savings by using coupons or promo codes. Many retailers offer additional discounts during post-holiday sales, so take advantage of these opportunities.

- Shop online: If you don't want to brave the crowds, consider shopping online. Many online retailers also offer post-Christmas sales, and you can often find exclusive deals and discounts.

- Check return policies: Before making a purchase, make sure to check the return policies. While most retailers have extended return periods during the holiday season, it's always good to know the rules in case you need to return or exchange an item.

By following these tips, you can make the most of the post-Christmas sales and save money on the items you've been wanting.

Save on Next Year's Decorations

Smart ways to buy discounted Christmas decorations

After Christmas, many retailers offer significant discounts on Christmas decorations to make room for new inventory. This presents the perfect opportunity for you to snag some amazing deals and save money on decorations for next year. Here are some smart ways to buy discounted Christmas decorations:

- Shop in-store clearance: Visit your favorite retailers and check their clearance sections. You can find great discounts on ornaments, lights, trees, and other festive decor items.

- Online sales and auctions: Explore online marketplaces and websites that specialize in discounted items. Look for Christmas decoration sales or auctions where you can bid on items and potentially get them at a lower price.

- Check out thrift stores and yard sales: Thrift stores often have a variety of lightly used decorations at affordable prices. Yard sales can also be a hidden treasure trove of festive decor.

- Use reward points and gift cards: If you have reward points or gift cards from previous purchases, consider using them to buy Christmas decorations. This way, you can save even more on your holiday decor expenses.

Storing decorations properly for future use

To ensure that your discounted Christmas decorations last for many years to come, it's essential to store them properly. Here are some tips for storing decorations:

- Use storage containers: Invest in durable plastic storage containers to protect your decorations from dust, moisture, and damage. Label each container according to its contents to easily find what you need next year.

- Wrap delicate items: Wrap fragile ornaments and decorations in tissue paper or bubble wrap to prevent breakage during storage.

- Store lights tangle-free: Wind Christmas lights around a piece of cardboard or use specialized light storage reels to keep them untangled and ready to use next year.

- Keep artificial trees in proper storage bags: If you have an artificial Christmas tree, store it in a tree storage bag to protect it from dust and possible damage. Follow the manufacturer's instructions for disassembly and storage.

By taking advantage of post-Christmas sales and storing your decorations properly, you can save money and enjoy beautiful, festive decor year after year. Happy decorating!

Meal Planning and Leftovers

Using leftovers to create delicious meals

After the hustle and bustle of the holidays, the day after Christmas provides a perfect opportunity to save money by utilizing the leftovers from your holiday feast. Instead of letting the extra food go to waste, get creative with your meals and transform those leftovers into delicious dishes.

Here are five things you can do the day after Christmas to save money:

- Make a turkey sandwich buffet: Slice up some leftover turkey, gather an array of condiments and bread options, and set up a sandwich buffet for your family. Everyone can create their own unique sandwich using the leftovers and enjoy a tasty meal without any additional cooking.

- Whip up a hearty soup: Use any leftover vegetables, meat, and broth to make a flavorful soup. Simply sauté the vegetables, add the broth, and simmer until all the flavors meld together. You can even throw in some leftover mashed potatoes or stuffing for added richness.

- Create a holiday-inspired breakfast: Transform leftover ham or bacon into a breakfast feast. Make a ham and cheese omelet, or use the bacon to top off some fluffy pancakes. The combination of savory and sweet will make for a satisfying morning meal.

- Prepare a turkey pot pie: Combine leftover turkey, vegetables, and gravy to make a comforting pot pie. Simply line a pie dish with pie crust, fill it with the mixture, cover with another layer of pie crust, and bake until golden and bubbling. This is a sure way to turn leftovers into a crowd-pleasing meal.

- Make a festive salad: Take any leftover salad greens, vegetables, and meat to create a vibrant and refreshing salad. Add some dried cranberries, toasted nuts, and a homemade vinaigrette for a burst of flavor. This way, you can use up leftovers and make a healthy meal at the same time.

By utilizing your leftovers creatively, you can not only save money but also enjoy delicious meals without any extra cooking. Don't let those holiday leftovers go to waste – give them new life and discover a whole new world of flavors.

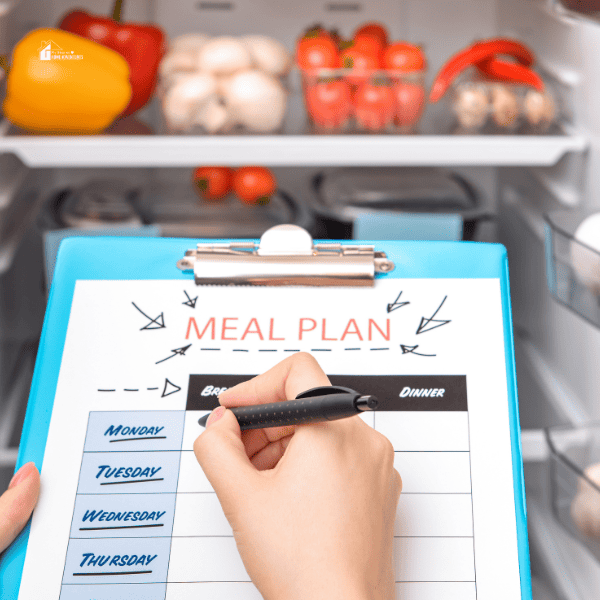

Meal planning to minimize food waste

In addition to using leftovers, another effective way to save money and reduce food waste is through meal planning. Planning your meals in advance allows you to take inventory of what you already have on hand, helping you avoid unnecessary purchases and ensuring that everything is used in a timely manner. Here's why meal planning is so important:

- Reduces leftover food: By planning your meals, you can use up ingredients that you already have in your fridge, freezer, and pantry. This means less food leftover at the end of the week and less chance of it going to waste.

- Encourages home cooking: When you have a meal plan in place, you're more likely to cook at home instead of relying on takeout or dining out. This not only saves money but also allows you to have better control over the ingredients and portion sizes, leading to healthier meals.

- Emphasizes enjoying what you have: Meal planning promotes the idea of enjoying the food you already have on hand, rather than constantly buying new ingredients. This helps you appreciate the variety of meals that can be made using the resources you already possess.

- Reduces grocery expenses: When you plan your meals in advance, you only buy what you need, reducing the chance of impulse purchases or buying excess items that end up going to waste. This can lead to significant savings over time.

- Includes a ‘leftovers' night: Meal planning often involves scheduling a ‘leftovers' night into your week. This is a designated day where you can use up any remaining food from previous meals, preventing it from becoming waste.

By taking the time to plan your meals, you can minimize food waste, save money, and enjoy the satisfaction of being less wasteful. So next time you're thinking about what to cook, consider the benefits of meal planning and make the most of the ingredients you already have on hand.

Cut Back on Unnecessary Expenses

Identifying and reducing unnecessary expenses

After the holiday season, taking a step back and assessing your expenses is important. Here are five things you can do the day after Christmas to save money and cut back on unnecessary expenses:

- Return or exchange unwanted gifts: If you received any gifts that you don't need or want, consider returning or exchanging them. This can help you save money by getting something more useful or by receiving a refund to put towards other expenses.

- Reevaluate your subscriptions: Take a look at the subscriptions you have and determine if you are fully utilizing them. If you find that you aren't using certain subscriptions or memberships, consider canceling or downgrading them to save money each month.

- Review your insurance policies: This is a great time to review your insurance policies and see if you can get a better deal. Shop around for better rates on auto, home, or health insurance to ensure you're not overpaying.

- Meal plan and reduce food waste: By planning your meals in advance and using leftovers creatively, you can save money on groceries and reduce food waste. Create a meal plan for the week and shop accordingly, using up ingredients you already have on hand.

- Shop the sales wisely: Take advantage of post-holiday sales, but be mindful of your purchases. Stick to a list and only buy items that you truly need or have been waiting to purchase at a discounted price.

Saving money on bills and subscriptions

In addition to identifying and reducing unnecessary expenses, there are also ways to save money on your regular bills and subscriptions. Here are a few tips:

- Bundle your services: If you have multiple services, such as cable, internet, and phone, consider bundling them with one provider. Bundling can often lead to discounted rates and lower overall costs.

- Negotiate with service providers: Don't be afraid to negotiate your bills. Reach out to your service providers and see if you can get a better rate or ask about any promotions or discounts that may be available.

- Reduce energy consumption: Look for ways to save on utility costs by reducing energy consumption. This can include using energy-efficient appliances, sealing air leaks, and adjusting your thermostat.

- Consider downsizing: If your housing expenses are a large portion of your monthly budget, consider downsizing to a more affordable option. This could be moving to a smaller home, finding a roommate, or exploring other housing alternatives.

By implementing these strategies, you can significantly reduce your household expenses and save money in the long run. Take the time to assess your spending habits, make adjustments where necessary, and watch your savings grow.

Start a Savings Challenge

Motivating yourself to save more

After the hustle and bustle of the holiday season, it's a great time to start a savings challenge to set yourself up for financial success in the coming year. Saving money can sometimes feel daunting or challenging, but with the right motivation, you can make it a fun and rewarding experience. Here are a few ideas to help you stay motivated and save more:

- Set a clear financial goal: Determine what you're saving for, whether it's a vacation, emergency fund, or a down payment for a house. Having a specific goal in mind can help keep you focused and motivated to save.

- Track your progress: Put a visual reminder of your savings goal somewhere you'll see it every day, like a savings tracker chart or a jar where you can physically see your savings grow. Updating it regularly will give you a sense of accomplishment and keep you motivated.

- Reward yourself: Set milestones along the way and reward yourself when you reach them. Whether it's treating yourself to a small indulgence or having a special night out, celebrating your achievements can serve as positive reinforcement.

- Get an accountability partner: Invite a friend or family member to join the savings challenge with you. Having someone to share your progress and challenges with can provide support and keep you accountable.

Ideas for fun and effective savings challenges

- The 52-week money-saving challenge: This is a popular challenge where you save a specific amount of money each week based on the week number. For example, in week 1, you save $1, in week 2, $2, and so on. By the end of the year, you'll have saved $1,378.

- The spare change challenge: Collect all your spare change and deposit it into a savings account or a jar. Over time, these small amounts can add up significantly.

- The no-spend challenge: Challenge yourself to go a certain number of days or weeks without spending money on non-essential items. This can help you break the habit of impulse buying and increase your savings.

- The matching challenge: For every dollar you save, match it with an additional contribution from your own pocket. This challenge not only helps you save but also encourages you to be more mindful of your spending.

Remember, the key to a successful savings challenge is consistency and discipline. Adjust the challenge to fit your financial situation and make it a fun and effective tool to achieve your savings goals.

Conclusion

After the hustle and bustle of the holiday season, it's essential to take a moment to reassess your finances and find ways to save money. By implementing simple actions the day after Christmas, you can make a significant impact on your financial well-being. Here are five things you can do to save money and set yourself up for a prosperous future:

The long-term benefits of post-Christmas money-saving actions

- Take advantage of clearance sales: Retailers have steep discounts on holiday merchandise after Christmas. It's the perfect time to stock up on decorations, wrapping paper, and even gifts for next year.

- Return unwanted gifts: If you receive gifts that you don't need or want, consider returning them and using the store credit to purchase something more practical or save the money for future expenses.

- Create a budget for the upcoming year: Take this opportunity to set financial goals and create a budget for the following year. Evaluate your spending habits, identify areas where you can cut back, and prioritize saving.

- Review your subscriptions and memberships: Go through your monthly expenses and evaluate if you're getting value from all your subscriptions and memberships. Cancel anything that is unnecessary or no longer used.

- Plan for next year's holiday season: Start planning early for next year's holiday season. Set up a holiday budget, create a shopping list, and utilize money-saving strategies like participating in Secret Santa potlucks and setting spending limits.

Final tips and reminders

- Remember to stick to your goals and stay disciplined when it comes to saving money.

- Start small and gradually increase your savings over time.

- Find ways to make saving money enjoyable, like turning it into a challenge or competition.

- Involve your friends and family in your money-saving goals for support and accountability.

- Stay consistent with your saving efforts and track your progress regularly.

By implementing these money-saving actions the day after Christmas and following through with continued financial discipline, you can make significant strides toward building a more secure and prosperous future.

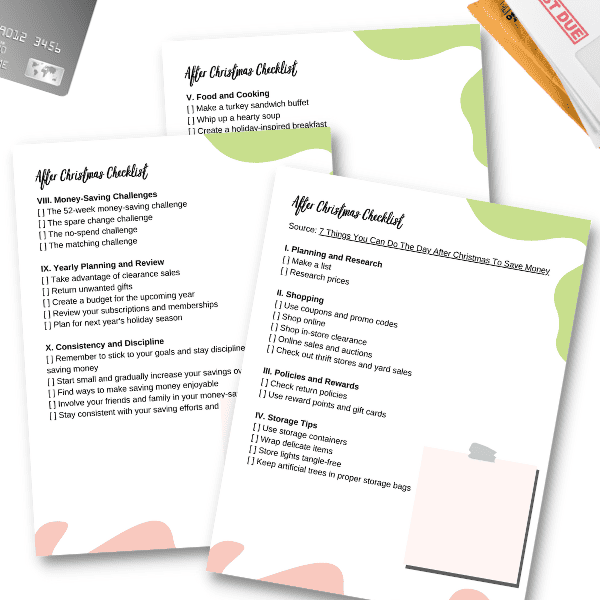

Free Printables Checklist

Click the download button, and these printables will automatically download depending on your device.

Use the checklist to help you get started!