Start an Emergency Fund Now To Avoid A Financial Crisis Later

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereTo avoid any financial emergencies in the future, it is recommended that you start an emergency fund now. However, it can be hard to create one with a lot going on in life and trying to save for other life necessities.

The good news is that if you just take a few minutes a day and put a bit of money away into a savings account, your emergency fund will be growing over time.

Remember your first paycheck? Do you remember where you spent it at?

Now, I'm pretty sure you quickly spent it and never thought about debt and starting an emergency fund, but hey, you weren't alone.

Fast forward to now, and if you have debt and have no emergency fund, then we are here to help you out. So, start an emergency fund if you want to take control of your finances and get out of debt.

Don't have debt? Then start an emergency fund to help you keep away from debt, my friend!

You heard right start saving money.

You will be surprised how saving money for unplanned events will help you reduce your debt if you have debt and do not have an emergency fund read why you need to have an emergency fund.

You might like these posts:

Below are reasons to start an emergency fund as soon as possible:

Not having an emergency fund will cost you more money.

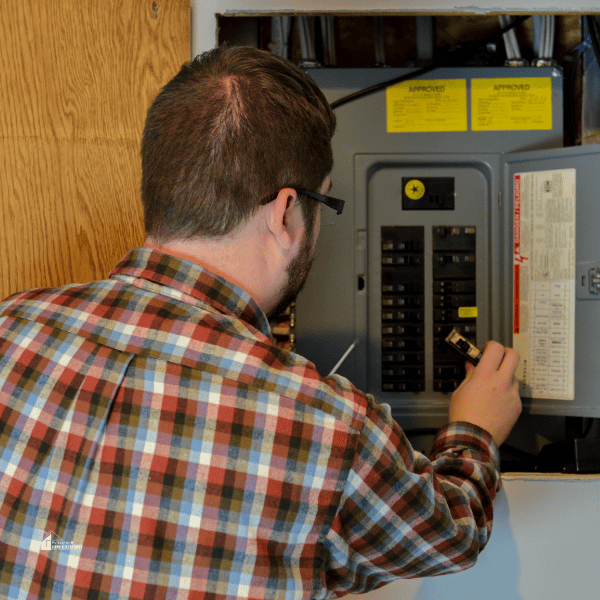

If you don't have the funds to pay for an emergency, it will cost you more money. It becomes a cycle where millions of people seem to fall into every day. Your car breaks down, and you don't have money saved. What do you do?

Without money to fix your car, you decide to charge it to your credit card. Unfortunately, a credit card will charge you an outrageous interest amount if not paid in full.

Paying the minimum balance on your credit card debt will cost you a lot of money on interest, and it will take years.

If you don't use your credit card and use a cash advance place, you will pay fees and interests. This will cost you a lot of money and sometimes create more financial problems than solutions.

Deciding not to pay one of your bills and use that money to pay for your car service bill will pay a late fee for not paying your bill one time. The amount you didn't pay will double the following month as well.

If services are shut down, a service reinstated fee could be added to services. Again, wasting your hard-earned money and your level of stress continues.

Do you see the effects of not having an emergency fund?

Credit cards, cash loan services, and not paying your bills are no ways to pay for emergencies. An emergency fund is what you need to pay for the unexpected. Saving money is free and stress-free.

Credit cards are NOT emergency funds!

How much money should you save?

An emergency fund amount varies. However, experts always suggest having an emergency fund to cover 3-6 months' worth of expenses.

If you are on a set income and having over $2000 will affect your benefits, start with $500 until you get things taken care of, and then increase it to $1000.

Low-income earner? Start an emergency fund at your own pace. You can start small and watch your funds grow. Just start somewhere.

Set an amount that is good for you. If you think $5000 will help you through 3 months, then go for it. On the other hand, if you have a job or career that won't keep you unemployed for an extended period, keep it low.

Now that work is available, you can be more honest and keep the emergency fund to what works for you and your family.

How to get started?

There are so many ways to start your emergency fund. The amount you save is your personal decision. Never compare your financial situation with others, ever!

My suggestion is not to have your funds in the same checking account you use to pay bills. An emergency account should not be easily accessible. Instead, find a saving way that will prevent you from spending the money you set aside for emergencies.

When I started my emergency fund, I barely made enough. So I would automatically transfer $25 a week from my checking into my saving accounts. As time passed, I didn't miss that $25 weekly transfer.

Another vital thing to remember when opening a savings account is to pay attention to your banking institution, as many will require a minimum balance of at least $100. If not, they will charge you a fee.

Again, the way you start your emergency fund is up to you. Saving the loose change, saving all your $5 bills, 52 Week Saving Plan, how you save is up to you. Just remember that something is better than nothing.

Conclusion

Having an emergency fund is essential and should be considered a top priority. An emergency fund will keep you away from getting into more debt and paying more money.

Starting an emergency fund is as simple as putting away a few extra bucks. But, whatever the amount you decide to set aside, remember that an emergency fund is a difference between financial failure and financial success.

As time passes, you will realize that the debt cycle you seemed to be stuck in is broken because of your emergency fund.

I hope this article helped you to start saving for an emergency fund.

If you have any questions, comments, or concerns, please feel free to leave a comment below.

Thanks for reading!

Great tips! Thanks for sharing.

Thank you for commenting Paris.

wrong wrong wrong – debt must be paid off FIRST even before STARTING an emergency fund!

Andi, each debt journey is different and it the financial world each advice is different. What worked for you might not work for others. It worked for me and for many others so I guess my “wrong” way was best thing for us.

My hubby and I have been on the Dave Ramsey plan for 2 years now and it changed our life. I could not live with out my budget envelope system. It really takes alot of discipline to save, but it’s so worth it!

Amen! Shanta, I tell anyone, Dave Ramsey is what started it all for us many years ago. The book was the best investment EVER!!

This is such a great idea! Thanks for the tips!

Thank You Olivia.

Great tips!

Thank you Genevive.

It’s so important to have an emergency fund. If nothing else it gives you a little peace of mind. Thanks for sharing.

Summer Ann

www.simplysummerann.com

Sure does, Summer. Thank you !

Sounds like Dave Ramsey advice to me! Great principles to live by.

Thank You.

Have an emergency fund is always a good option in these times, excellent advices!

Thank you. Thank you for commenting.

awesome tips!

would love if you stopped by for a visit: http://StorybookApothecary.com ♥ I’m doing a holiday giveaway event if you’re interested in winning some beauty products !