Don’t Let Your Finances Get In The Way Of Your Summer Fun

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereThis sounds so easy said than done: Don't let your finances get in the way of your summer fun!

Summer is here, and if you are like me, you will know that the summer season can affect our family's personal finances fast. As much as we love our finances, we can't allow it to stop us from enjoying one of our family's favorite times of the year.

Why do summers affect our finances?

During the rest of the year, our children are in school; we don't go anywhere that requires much spending. I can keep track of our finances with no distraction at all.

Then summer arrives and back to school shopping season begins and keeping ourselves cool during the summer costs money. It seems that our grocery budget goes up and our entertainment budget.

That being said, we can't let our finances go, but we can't just let it ruin our summer either. Our finances are important to us; our family is extremely important as well. There are many ways to enjoy your summer without busting your financial goals.

To enjoy your summer and have fun without it ruining your finances, below you will find ideas to help you enjoy your summer with your family and worry less about the finances.

7 Ways To NOT Let Your Finances Get In The Way Of Your Summer Fun

Related posts:

- 5 Unusual Fall Family Getaway Ideas To Try This Year

- 13 Easy Breezy Ways To Save Money This Summer

- 10 Ways To Save and Manage Money On a Low Income

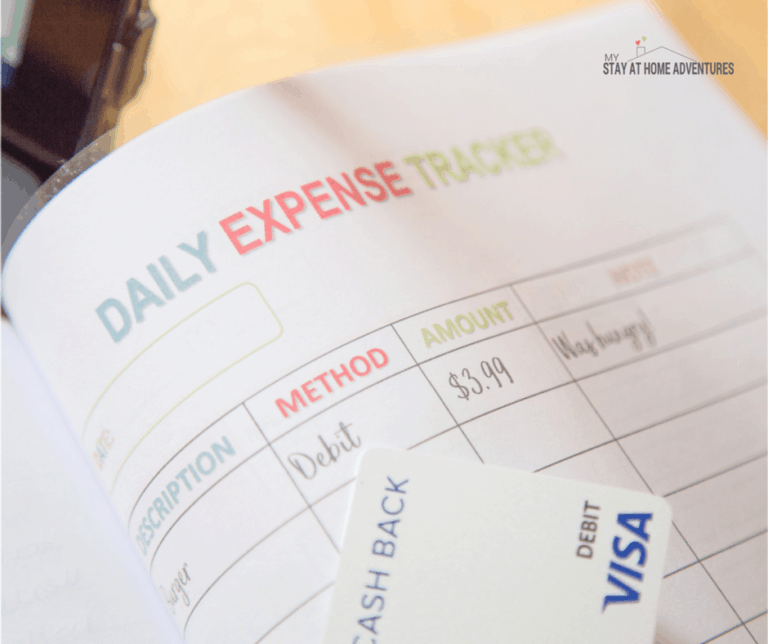

Create a summer budget.

I wrote about creating a budget specifically for the summer seasons to help us maintain our finances during this time. We created a summer budget for many reasons:

- Fun summer outings – During the summer, we love to go on outings, visit the local park or museum, or go to the community pool. These outings, regardless of how inexpensive they are, can add up.

- Community pool fees – We are lucky to have a community pool within walking distance to our home. It's pretty inexpensive, and my teenage daughter enjoys it.

- Back to school – July starts back to school season, and I simply love the deals on office supplies and school supplies. Having this money budgeted allows us to spend money on back to school.

- Family gatherings – During the summer, we enjoy picnics, family gatherings, birthdays, you name it. This budget also allows us to enjoy these activities without affecting us financially.

Create a summer plan.

Without a plan, you are most likely to spend money. Creating a summer plan goes with creating a summer budget. If you have a family, create a summer plan for them to make them feel involved in the process. By setting up a plan together, it will help you stay focused on your plans and spend less money.

Keep it realistic.

Don't make plans you can't keep and are out of your budget. Learn to say no and to stick to your budget and summer plans. If you decide to take a spontaneous trip to the beach, know that this will affect your previously set summer plans.

Don't plan on going overseas on a family vacation if you don't have the money for it; this will surely affect your finances during the summer. Though you will think you will enjoy a spontaneous adventure, your finances won't.

Vacation or Staycation

During your planning, decide if a vacation or staycation will work with your finances. There are many great ways to enjoy a staycation such as:

- Less travel – This will save you money on gas and hotels.

- No fees – You don’t pay lodge fees or any other travel expenses related to your vacation.

- Less stress – You know that when you have a big vacation on your mind, this creates stress, the stress of making sure you don’t forget anything (or a kid).

However, vacations are amazing; I am honest when I say I love to splurge on vacations without going broke. Start by writing down the pros and cons of taking a vacation and take it from there.

If you are heading on vacation, search for discounts and rewards clubs that will help you save money or give you free nights.

The point is not to let your vacation or staycation affect your finances.

Find the bargains

We love to enjoy our summer afternoons as a family by heading out to get ice cream. Although we surely could eat ice cream at home, we enjoy heading to Sonic or our local favorite ice cream parlor and enjoy the company.

To save money and enjoy ourselves, we look for bargains. Many restaurants offer happy hours and 50% off drinks; sounds great to me! Kids eat free on certain days too; I'm in!

Search around and find the best deals on travel, find the best times to save on an amusement park trip. Check sites like Groupon and affordable local deals for you and your family.

Free events

During the summer, you will able to find free events locally. Our local community will be having a ton of free local events for the entire family, and we are looking forward to it.

These events are for everyone and you will be able to find events such as free music at the park, to community days filled with rides and fireworks.

Even stores have free events for the family like Home Depot, Toys R Us, etc. The point is that fun and free events are enjoyable and, well, free!

Related topics:

- 8 Simple Everyday Kitchen Saving Tips That Works!

- Why Having A Summer Budget Works

- Getting Healthy for Summer (9 Frugal Ways to Stay Healthy)

Buy discounted gift cards

We love Cold Stones; we love to eat at Red Lobster, we also love to purchase discount gift cards to help us save money. If you know your family loves ice cream, or there's a big celebration going on, purchase a gift card at a lower price.

Stores like Sam's Club, BJ's Wharehouse, etc., offer gift cards for a lesser price. Also, sites like Raise.com offers a variety of gift cards at a discount price. They also offer deals on top of that.

Some of these gift cards are also e-gift cards where you can print them online instead of heading out to the store to get them or waiting in the mail for them.

There are other sites that sell discounted gift cards at a lower price; this is a great way to save money during the summer.

Add those discounted gift cards with deals and coupons, and you can score big. Always do some research on the site if you are going to buy discounted gift cards online; there are, unfortunately, some scam sites out there.

You can also earn free gift cards and use those to help you out during the summer months.

Related posts:

- Ways to Save on Your Summer Vacation(Opens in a new browser tab)

- 9 Things to Do This Summer That Won't Bust the Budget(Opens in a new browser tab)

- 7 Quick Ways to Make Money For Christmas You Can Do Today!(Opens in a new browser tab)

Conclusion

Make this summertime memorable without letting your finances get in the way. With careful planning and research, you can enjoy the summer without breaking the budget. Family is important, creating a memorable summer is important, and affordable as well.

Remember that to stay within your budget, always create a realistic plan and budget for this summer. As always, the best things in life are free, and your finances shouldn't be in the way of your summer fun.

4 Comments