6 Must-Do Tips to Increase Your Personal Savings

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereLearn how to increase your personal savings when you follow these 6 tips!

Saving money is not so easy for many of us. You try to be a good thrifty person and save money but fail miserably every time.

Let's be real here for a minute.

Turning saving into a habit is not easy.

When your spending has become a habit it is hard to change overnight.

Spending our money is what companies want us to do!

Think about it.

The shopping malls exhibit their collection of fabulous clothes, the restaurants have mouth-watering dishes on their offering, and you are bound to cough up money.

But don't be sad, the good news is that we have 6 tips you should follow to increase your personal savings.

This year has brought along some golden rules of saving. Follow these rules to increase your personal savings dime by dime.

6 Tips You Should Follow to Increase Your Personal Savings

The first rule is:

Gluttony is bad

It may not be a sin, but it's bad for your finances. You may be a foodie who couldn’t resist themselves in front of lip-smacking dishes; but if saving money is on your mind, then don’t eat out more often. Restaurant bills increase the monthly spending. Cut down on them to save more.

Here comes the second rule:

What’s going on

We spend hours playing shootout games on XBox or PlayStation, and hardly care what’s going on around us. Don’t indulge yourself in useless entertainment activities. Instead, watch the news, join online forums to know what’s happening in international politics, and read the newspaper every day.

A Middle Eastern country announcing a sharp increase in oil prices indicates the prices of retail commodities will also increase.

When you hear this announcement, immediately make a list of food items, which are domestically produced and transported from a relatively nearby location. Why? Because such items will be cheaper. Staying informed about recent events helps you save.

The third rule is:

The two I's

Conceptualize the formula below

“I for increment and I for investment.”

You get an increment every year. How do you spend it? Pay out the grocery bill or the school fees of your kids. How about investing it? You managed to pay all the bills for the month before you got the increment, which means you could manage without the extra money that comes as a raise. My advice, don't let this money add up to your monthly budget, invest it in some ventures.

If you are not comfortable with the stock or bond market, go for other types of investments that involve less risk. Here’s an article that discusses several avenues leading to safe investment.

Set up a savings account with a bank that offers a decent rate of interest. Many banks allow customers to have high-yield checking and savings accounts. Find out if your bank offers any such scheme.

Pay down debts

Pay down debts

We often ignore credit card debts, which pushes us further into the tunnel of debt. Right after getting a notification from your bank that you have an outstanding balance, don’t let it grow; otherwise, you’d be trapped in the debt web.

Related posts:

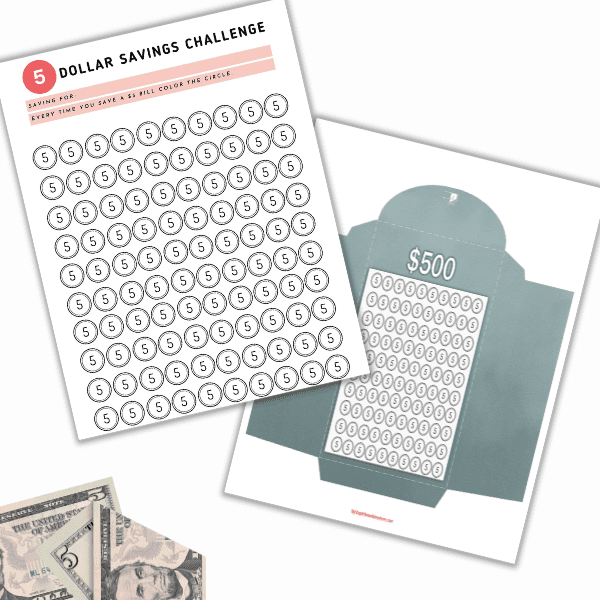

- 5 Things To Avoid During A Recession

- 6 Incredible Monthly Money Challenges

- 3 Smart Reasons to Refinance Your Mortgage

Oftentimes, people find it financially difficult to pay off all debts. A feasible strategy should be paying down one debt at a time. This would be financially less stressful for you. The result would be tremendously helpful. You’ll save more money that you ever saved before.

Experts also recommend everyone paying down debts early. A financial attorney called Leslie Tayne said: “confront debt head-on by identifying which credit card has the highest interest rate, and making it your goal to first swiftly pay off the credit card bearing the highest interest rate.”

Tax refund

Another financial expert called Scott Smith advised us to make use of tax refunds to set up and maintain an emergency fund. It’s indeed an excellent idea because having an emergency fund can help you pile up more money in your savings.

Many surveys have shown the money collected from tax refund is not used properly. You take Smith’s idea to change this. I am going to quote what Smith says, so you could get a precise idea as to what to do. He said “Maintaining at least three to six months’ worth of income will shelter you from credit-busting events like unemployment, increased cost of living, medical emergencies and home or auto damage.”

In case you are not informed, the tax season for this year will start from January 29 and the deadline for the return is April 17. Get ready with all the paperwork because we are fast approaching tax season, and file the return quickly.

Separate healthcare fund

You might be paying health insurance policy premiums every month, but that’s not enough. You need to have a separate fund for health care. It serves more purposes than one. If you are in a medical emergency, you don’t have to break your savings, yet quickly arrange cash. Besides, if the emergency fund grows, you might decide not to renew your health insurance as policies don’t cover many facilities nowadays.

What do you think about the six tips given here in this article? Do you agree with them? Would you like to share your ideas on this with us? Let us know in the comment section.

Tina Roth is the Founder and Editor of the ProFinanceBlog – a personal finance blog for better money management and developing money saving habits. Her articles inspire people to explore more on frugal living and especially, to help craft a financial secure life. Follow Tina on Facebook, Twitter, Google+.

4 Comments