3 Easy Ways to Save $50 Every Week Starting Now!

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereIf you’re looking for quick ways to save $50 per week, you can achieve this goal with just a few small adjustments to your everyday habits. Saving doesn’t have to mean giving up things you enjoy or making major sacrifices. Instead, focusing on cutting unnecessary costs in key areas can help you save that extra cash in no time. Whether you’re planning for a big financial goal, trying to cut back on spending, or simply want more breathing room in your budget, there are simple strategies to make this happen.

Why Save $50 Per Week?

Saving $50 per week might seem like a small amount, but over time, it can lead to significant financial benefits. By consistently setting aside this amount, you’ll accumulate $2,600 in a year, which can act as a solid emergency fund, help pay off debt, or support future financial goals like a vacation, home improvement project, or retirement savings.

Developing the habit of regularly saving also helps build financial discipline, making it easier to manage your budget, avoid unnecessary debt, and prepare for unexpected expenses. Saving a manageable amount like $50 per week is achievable for most people with small lifestyle adjustments, such as cutting back on discretionary spending or being mindful of daily purchases, and the long-term rewards far outweigh the initial effort.

Below are three practical and actionable ways to start saving $50 per week right away.

1. Cut Back on Groceries by Planning Ahead

Groceries are one of the most flexible areas of your budget, making them a great place to start if you’re trying to save money quickly. With a bit of planning and strategic shopping, you can easily reduce your weekly grocery bill by $20 or more without sacrificing the quality or quantity of the food you’re buying.

One of the easiest ways to do this is by meal planning. Each week, plan your meals based on what’s on sale at your local grocery store or what’s already in your pantry. Many grocery stores offer discounts on fresh produce, meat, and pantry staples in their weekly flyers, or through loyalty programs. By building your meals around these discounted items, you can ensure you’re making the most of your budget.

It’s also a good idea to create a strict shopping list and stick to it. Impulse purchases are one of the quickest ways to overspend at the grocery store. Avoid shopping when you’re hungry and steer clear of the aisles where you’re most likely to make impulse buys.

Another way to reduce your grocery spending is by switching to store-brand items. Many store brands offer the same quality as national brands but are often priced 20% to 30% lower. When you’re buying staple items like pasta, rice, or canned goods, choosing the store brand can make a noticeable difference in your grocery bill without affecting your meals.

Consider buying in bulk for non-perishable items or things you know you’ll use regularly. Bulk items often have a lower cost per unit, allowing you to stock up and save money in the long run. For example, bulk rice, flour, or pasta can be stored for months, and buying these items in larger quantities can help stretch your budget over time.

Finally, meal prepping is an excellent way to avoid overspending on food. By preparing your meals in advance, you can eliminate the temptation to order takeout on busy nights, and you’ll also reduce food waste by using up ingredients before they spoil.

Quick Tips:

- Plan meals around weekly grocery sales.

- Create a shopping list and stick to it to avoid impulse buys.

- Opt for store-brand products for pantry staples and essentials.

- Buy in bulk for non-perishable goods to reduce your overall costs.

- Meal prep ahead of time to prevent last-minute takeout.

2. Eat at Home and Skip Takeout

Eating out, even just once or twice a week, can add up quickly. Whether it’s grabbing a quick takeout meal after work or stopping by a restaurant for dinner, dining out is one of the fastest ways to blow your budget. By committing to eating at home, you can easily save $25 or more every week.

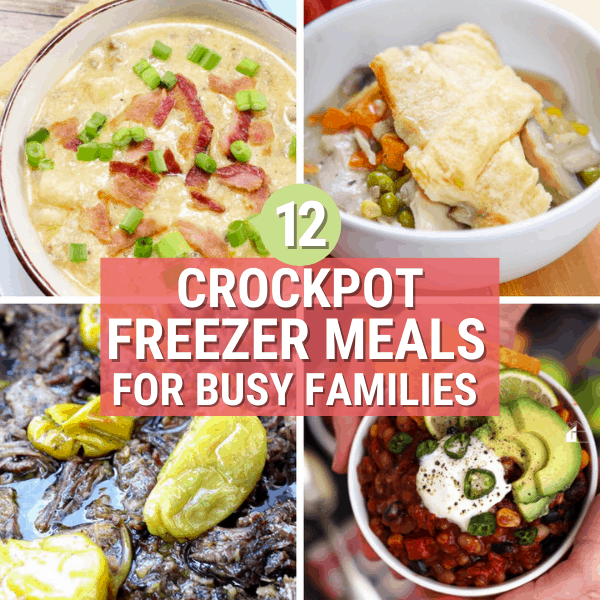

If you find yourself pressed for time and reaching for the takeout menu too often, batch cooking might be the solution. Batch cooking involves preparing larger quantities of meals and freezing them for future use. When you’re too busy or tired to cook from scratch, having pre-made meals in the freezer will help you resist the urge to order takeout.

In addition to saving money, batch cooking also saves time. You can prepare all your meals for the week in one go, meaning less time spent in the kitchen throughout the week. It also ensures you always have a nutritious meal on hand, helping you avoid the extra calories and cost that come with fast food and takeout.

If you’re someone who regularly buys lunch at work, consider packing your own lunch instead. A homemade lunch is not only healthier, but it’s also far cheaper than the $10 to $15 you might spend at a café or restaurant. Packing your own lunch just a few times a week can add up to significant savings over the course of a month.

Another simple but effective strategy is to make your coffee at home. Many people don’t realize how much they spend on their daily coffee habit. If you buy a $4 cup of coffee each weekday, that adds up to $20 per week. By brewing your own coffee at home, you’ll see immediate savings.

Quick Tips:

- Cook at home instead of dining out or ordering takeout.

- Batch cook meals and freeze them for quick, easy dinners.

- Pack your own lunch for work to avoid spending $10-15 per meal.

- Brew your coffee at home to save $4-5 per day.

3. Eliminate Non-Essential Daily Purchases

It’s easy to underestimate how much you’re spending on small, non-essential items each day. Whether it’s snacks from a vending machine, drinks from a convenience store, or quick trips to a café, these purchases can add up faster than you think. By cutting back on these everyday expenses, you can quickly save $15 or more each week.

For instance, if you’re used to grabbing a snack or drink on the go, consider packing your own snacks instead. Buying snacks in bulk and portioning them out for the week is far cheaper than buying individual servings at a convenience store or vending machine. The same goes for drinks—carrying a refillable water bottle is much more economical (and environmentally friendly) than buying bottled water or soft drinks every day.

If you’re unsure where your money is going, try tracking your spending for a week. Write down every purchase you make, no matter how small. You’ll likely be surprised at how much you’re spending on non-essential items, and tracking your expenses will help you identify areas where you can cut back.

Impulse buys are another area where small savings can quickly add up. Many stores design their layouts to encourage impulse purchases—especially at the checkout line. By avoiding these small splurges and sticking to your shopping list, you can avoid spending money on things you don’t really need.

Quick Tips:

- Pack snacks and drinks from home to avoid unnecessary purchases at convenience stores.

- Carry a refillable water bottle to save on bottled drinks.

- Track your spending for one week to identify areas where you can cut back.

- Avoid impulse purchases by sticking to your shopping list.

Additional Quick Ways to Boost Your Savings

Once you’ve incorporated the above strategies, here are a few more ways to save even more money each week:

- Use Cash for Non-Essential Spending: One quick way to control your spending is to use cash for discretionary purchases like entertainment, snacks, or personal treats. By setting a weekly cash limit, you can easily stay within your budget. Once the cash is gone, you’ll know it’s time to stop spending.

- Wait 24 Hours Before Making Any Non-Essential Purchase: Impulse purchases can wreck your savings plans. To combat this, follow the 24-hour rule: when you see something you want to buy that’s not essential, wait 24 hours before making the purchase. This cooling-off period often leads to realizing you don’t actually need the item.

- Limit Convenience Purchases: Spending a few dollars here and there on convenience items—like bottled water, snacks, or coffee—can add up quickly. Instead, bring these items from home. Packing snacks, carrying a refillable water bottle, and making your own coffee are small adjustments that can save you $5-10 a week.

| Expense | Action | Estimated Savings (Per Week) |

|---|---|---|

| Groceries | Meal planning, shopping sales, store brands | $20 |

| Eating out (takeout or delivery) | Cook at home, pack lunches | $25 |

| Coffee shop visits | Make coffee at home, bring a travel mug | $15 |

| Convenience store snacks | Bring snacks from home | $10 |

| Impulse purchases at checkout | Avoid checkout splurges | $5 |

| Discretionary spending (e.g., entertainment, personal treats) | Use cash only to limit spending | $10-20 |

Total Weekly Savings Potential: $75+

By following these three core strategies and incorporating additional tips, you can quickly save $50 or more each week. Whether it's by cutting down on grocery costs, eating more meals at home, or eliminating non-essential purchases, these small changes can make a big difference. Start implementing these steps today, and you’ll see your savings grow without making major sacrifices.

Good tips. Thank you!

Savings=Earnings. Nice blog, I would love to read more