8 Tips for Saving Money Each Month

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereSaving money can be a challenge, but it's not impossible. In fact, with a few simple tips and tricks, you can start saving money each and every month. And the money you can use for future expenses or simply have in your savings account. So what are you waiting for? Start reading these tips and see how much money you can save!

Americans now have an average of $9,000 less in savings than they did last year, according to Northwestern Mutual's recent 2022 Planning & Progress. According to 60% of American adults, the pandemic was the issue.

What is the best way to save money every month?

Here are a few tips to get you started:

– Make a budget and stick to it. This is probably the most important tip on this list. You need to know how much money you have coming in and going out each month to make necessary adjustments.

– Automate your savings. Have a certain amount of money automatically transferred into your savings account each month, so you're not tempted to spend it.

– Cut back on unnecessary expenses. For example, do you really need that coffee every day? Or those new shoes? Start evaluating your spending and see where you can cut back.

– Take advantage of discounts. When you need to make a purchase, look for coupons or discounts to help you save money.

– Invest in yourself. One of the best ways to save money is to invest in yourself. This could be anything from taking a financial planning course to investing in a high-yield savings account.

– Live below your means. This tip goes hand-in-hand with cutting back on unnecessary expenses. If you're spending more money than you must come in each month, it's time to make some changes.

– Make a plan. Finally, one of the best tips for saving money each month is to make a plan. Decide how much you want to save and create a realistic budget to help you reach your goal.

How much money should you save each month?

The answer to this question depends on several factors, including your income, expenses, and financial goals. However, most financial experts recommend saving at least 20% of your monthly income.

So if you make $5000 per month, you should aim to save at least $1000 per month. But, of course, this is just a general guideline, and you may need to adjust your savings goals based on your unique circumstances.

No matter how much you save each month, the important thing is that you start seeing your savings grow. Then, with a little bit of effort, you can reach your financial goals and enjoy a brighter future.

You might enjoy these posts:

What is the 30-day rule for saving money?

The 30-day rule is a simple way to help you save money each month. It means that for any non-essential purchase, you wait 30 days before buying it. This gives you time to think about whether you really need the item and also allows you to save up the money if you decide to go ahead with the purchase.

Of course, the 30-day rule isn't for everyone. For example, if you're able to impulse control, you may not need to wait 30 days before making a purchase. However, if you find that you often make impulsive buys that you later regret, the 30-day rule can be a helpful way to save money each month.

What is the 50 30 20 rule with money?

The 50 30 20 rule is a simple way to manage your finances. It involves dividing your income into three categories:

– 50% for essential expenses like food, housing, and transportation

– 30% for discretionary expenses like entertainment and dining out

– 20% for savings and debt repayment

This rule can help ensure you're not spending too much on non-essential expenses and putting enough money away each month.

Now 50 30 20 rule does not apply to everyone, and here's why.

The 50 30 20 rule is a great starting point for managing your finances, but it's not necessarily the right fit for everyone. Your income, expenses, and financial goals will all play a role in how you should divide your money each month. So if the 50 30 20 rule doesn't work for you, don't be afraid to adjust it to fit your needs.

What should you do if the 50 30 20 rule doesn't work for you?

There is no right or wrong answer to this question. Everyone's financial situation is different, so what works for one person may not work for another. If the 50 30 20 rule doesn't work for you, try experimenting with different percentages until you find a system that works for your budget and lifestyle.

There are other ways to budget your money besides the 50 30 20 rule.

There are several ways to budget your money, so if the 50 30 20 rule doesn't work for you, other options are available. For example, you could try the envelope system, dividing your cash into different categories and only spending what's allocated for each category. Or you could use a software program like Mint or YNAB to track your spending and create a budget that works for you.

No matter what method you use, the important thing is that you find a system that helps you save money each month. Then, with a little bit of effort, you can reach your financial goals and enjoy a brighter future.

What are some tips for saving money each month?

Here are eight tips for saving money each month:

1- Don't eat out as much

To help you start saving money this month, reduce the amount of time you eat out. By doing this, you can save money on both food and tips. If you eat out, look for coupons or discounts to help you save money.

Try cooking more meals at home to help you reduce the amount of time you eat out. This can be a great way to save money and also allows you to control the quality of the food you're eating.

If eating out is a challenge for you, I suggest you create a monthly challenge, grab a calendar, and mark each day you eat out with the amount you spent on your calendar. Then, at the end of the month, count how many times you have eaten out and how much you spent.

The following month, challenge yourself to reduce the amount of time and money you will spend that month.

2- Cut back on unnecessary expenses

We all have expenses we don't need, so take a close look at your budget and see where you can cut back. For example, do you really need that cup of coffee every day? Can you shop around for insurance and reduce it for the following month?

Not sure where to start? A great place to start is with your discretionary expenses. What are discretionary expenses? You can live without these expenses, so cutting back on them can help you save money each month.

Some common discretionary expenses include:

- Dining out

- Entertainment

- Shopping

- Travel

If you're looking for ways to reduce your discretionary expenses, here are a few tips:

- Set a budget for discretionary expenses and stick to it

- Find free or low-cost entertainment options

- Shop around for better deals on things like insurance and cell phone plans

You can free up more money each month to save by cutting back on your discretionary expenses.

Even small changes can add up, so take a close look at your budget and see where you can cut back. You may be surprised at how much money you can save each month by making a few simple changes.

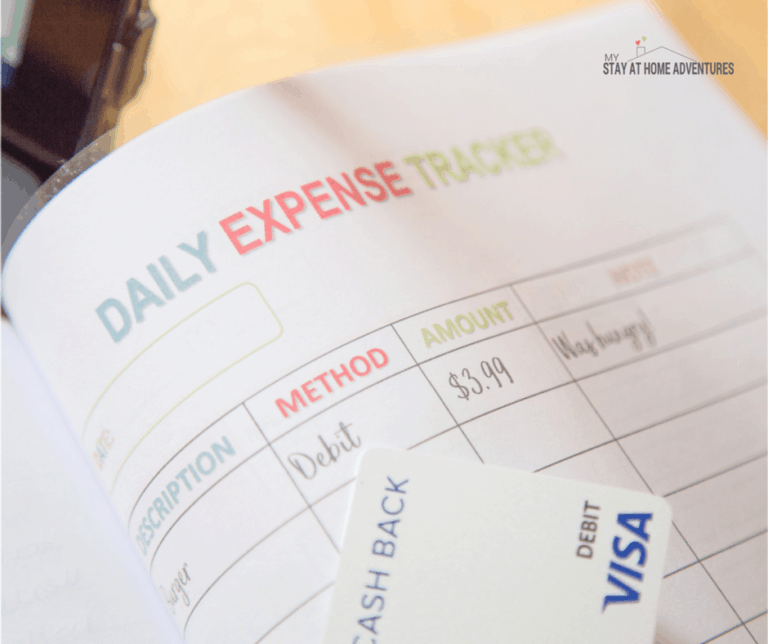

3- Create a budget and stick

Without a budget, you are not going to succeed at saving money. To save money each month, you need to know where your money is going. So first, track your monthly spending to see where your money is going, and then create a budget that allocates your income into different categories.

Not sure how to create a budget? Here's a quick summary of how to start a budget:

– Determine your income: This is the money you have coming in each month. Include all sources of income, such as your salary, tips, child support, and alimony.

– Determine your expenses: This is the money you have going out each month. First, include all of your fixed expenses, such as your rent or mortgage, car payment, and insurance. Then include your variable expenses, such as your food, transportation, and entertainment.

– Determine your savings goals: This is the money you want to save each month. Include both short-term and long-term savings goals in your budget.

– Create your budget: Once you know how much money you have coming in and going out each month, you can create your budget. Be sure to include a buffer for unexpected expenses.

– Stick to your budget: Your budget will only work if you stick to it. That means tracking your spending and making adjustments as needed.

Once you have created a budget, make sure you stick to it. It's easy to overspend when you don't have a budget, so make sure you stick to the budget you've created.

4- Pay yourself first

One of the best tips for saving money each month is to pay yourself first. This means that before you pay your bills or go out to eat, you put money into savings. And doing this can be a difficult habit to start, but it's worth it in the long run.

Unsure on how you can start paying yourself first? Here are some tips and ideas to help you get started:

– Set up a direct deposit from your paycheck into your savings account. This way, you won't even see the money and will be less likely to spend it.

– Have a certain amount automatically transferred from your checking account into your savings account each month.

– When you get paid, put the money you want to save into your savings account right away. Then you can use the rest of your money for bills and other expenses.

If you're not used to paying yourself first, start small. Begin by putting $20 into savings each month and then increase the amount as you get more comfortable.

Paying yourself first is a great way to make sure you are saving money each month. It may be challenging to start, but once you start paying yourself first, you'll see your savings grow.

5- Create a savings goal

It can be difficult to save money if you don't have a specific goal in mind. So, one of the best tips for saving money each month is to create a savings goal.

Not sure how to create a goal? Here are some tips to help you get started:

– Decide what you want to save for: Do you want to save for a house down payment, a new car, or retirement?

– Set a realistic goal: Make sure your goal is something that you can realistically achieve.

– Create a plan: Once you have decided on your goal and set a realistic goal, you need to create a plan. This plan will help you reach your goal.

– Set a deadline: A deadline will help you stay on track and ensure you reach your goal.

– Track your progress: Tracking your progress will help you stay motivated and on track to reach your goal.

Think about what you want to save for, and then create a plan to reach that goal. Once you have a savings goal, you'll be more motivated to save money each month.

6- Save your change

One of the easiest ways to save money each month is to save your change. This can be a great way to start saving if you're not used to budgeting or saving money.

Here are some tips for saving your change:

- Keep a jar or container in your home and put all of your change in it at the end of each day.

- Once you have a full jar, take it to the bank and deposit it into your savings account.

- Every time you get a $20 bill, put $19 in your savings account and spend the $01.

- When you go out to eat, put the change from your bill in your savings account.

Saving your change is an easy way to start saving money each month. It may not seem like a lot, but it can add up over time.

7- Take advantage of sales

Another great tip for saving money each month is to take advantage of sales. This means waiting for items you need to go on sale and then buying them. This can help you save a lot of money over time.

Here are some tips for taking advantage of sales:

– Make a list of the items you need, and then wait for them to go on sale.

– When an item you need goes on sale, buy it and put it in your pantry or freezer.

– If you see an item you think you may need in the future, buy it and put it in your pantry or freezer.

– Take advantage of clearance sales and buy items you need or think you may need in the future.

By taking advantage of sales, you can save money each month on the items that you need. This is a great way to stretch your budget and make your money go further.

8- Live below your means

One of the best tips for saving money each month is to live below your means. This means spending less than you make and saving the rest.

This can be difficult if you're used to spending all of your money, but it's important to remember that living below your means doesn't mean living without. It just means making smart choices with your money and spending less than you earn.

If you're not sure how to live below your means, here are some tips:

- Make a budget and stick to it.

- Track your spending and see where you can cut back.

- Live simply and don't try to keep up with the Joneses.

- Save money each month, so you have a cushion in case of emergencies.

Living below your means is a great way to save money each month. It may take some time to adjust, but it's worth it in the long run.

Saving money each month can be challenging, but starting somewhere is essential. These tips can help you get started on your journey to financial freedom. Just remember to be patient and stick to your plan. Soon, you'll start seeing your savings grow.

Do you have any tips for saving money each month? Could you share them in the comments below?

3 Comments