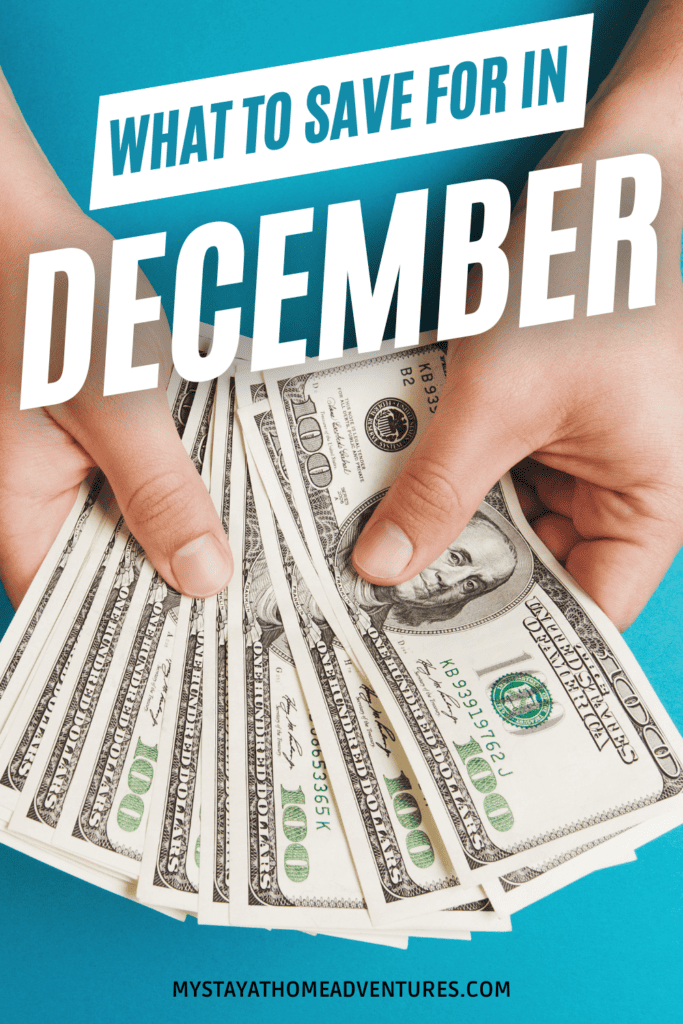

10 Things To Save For In December (Is Not Christmas Shopping)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereDecember is a month known for its holiday shopping frenzy, but it's also a crucial time for saving money. While it's tempting to splurge on Christmas gifts, there are other important things to save for in December. By planning and budgeting wisely, you can ensure a more secure financial future.

The importance of saving in December

- Emergency Fund: Unforeseen expenses can arise at any time. Saving in December allows you to build up an emergency fund for unexpected situations.

- Travel: December is a popular time for vacations. By saving in advance, you can enjoy a well-deserved getaway without worrying about financial strain.

Tips for managing holiday expenses

- Create a budget: Determine how much you can afford to spend on gifts, travel, and other holiday expenses. Stick to the budget to avoid overspending.

- Shop smart: Look for sales, discounts, and coupons when shopping for gifts—comparison shop to get the best deals.

- Limit dining out: Instead of eating out frequently, consider cooking at home. This will help you save money and also enjoy quality time with loved ones.

- Consider handmade gifts: Get creative and make personalized gifts for your friends and family. This not only saves money but also adds a personal touch.

Focusing on these important savings goals and being mindful of your spending can make December a month of financial growth rather than excessive shopping.

Valentine's Day

Saving for purchases for Valentine's Day

Love is in the air, and so are the expenses that come with Valentine's Day. Instead of relying on last-minute purchases, it's a great idea to start setting aside some funds in December to make the most of this special day. Whether you're planning a romantic dinner, buying gifts, or going on a weekend getaway, saving ahead of time can help ease the financial burden.

Taxes

December is a month of holiday cheer and a great time to start thinking about taxes. As the year comes to an end, it's essential to prepare for the upcoming tax season. By taking action now, you can reduce your tax liability and potentially increase your refund. One of the significant advantages of saving for taxes in December is that you still have time to make deductible contributions to retirement accounts, which can lower your taxable income.

It's also important to note that for self-employed individuals, quarterly taxes are due in January. Don't forget to set aside funds to cover these obligations and consider consulting with a tax professional to make sure you are in compliance with all the necessary requirements. Planning ahead and being proactive in December can save you from unnecessary stress and financial strain when tax season arrives.

TVs

Best time to buy a new TV in January

If you are in need of a new TV, December is a great time to start saving. The best time to purchase a new TV is actually in January during the post-holiday sales. Retailers often offer significant discounts to clear out their remaining inventory from the previous year. So, hold off on that impulse buy this December and wait for the deals in January!

Setting a budget and avoiding overspending

When saving for a big-ticket item like a TV, setting a budget is crucial. Decide how much you are willing to spend and stick to it. Avoid overspending by researching prices, comparing different models, and looking for the best deals. Consider saving up for a few months if necessary to ensure that you can afford the TV of your dreams without breaking the bank.

Remember, it's not just about the holiday season. By being strategic and saving for other items this December, you can make smart purchases and avoid getting caught up in the Christmas shopping madness.

Fitness Equipment

Investing in fitness equipment during December

December is not just for holiday shopping; it's also a great time to invest in fitness equipment. With the year coming to an end, many people start planning their New Year resolutions, and getting fit is often at the top of the list.

By taking advantage of December sales and discounts, you can save money while setting yourself up for success in the coming year. Fitness equipment such as treadmills, dumbbells, exercise bikes, and yoga mats can be purchased at discounted prices during this time.

Creating a home gym for New Year resolutions

Instead of signing up for an expensive gym membership, consider creating a home gym. Investing in fitness equipment allows you to exercise conveniently and comfortably without the need to travel to a gym.

Having a dedicated space at home for your workouts also eliminates the need to wait for machines or deal with overcrowded gyms. Plus, with the ongoing COVID-19 pandemic, having a home gym provides a safe and hygienic option for staying active.

By saving for fitness equipment in December, you'll be ready to kickstart your fitness journey in the new year and achieve your health goals. Remember, investing in your physical well-being is always a good idea!

Bedding, Linens, and Towels

As the holiday season approaches, it's not just about Christmas shopping. December is a great time to save on items that may not be on your typical holiday shopping list, such as bedding, linens, and towels.

Taking advantage of post-Christmas sales for these items

After the holiday rush, retailers often offer discounts and promotions on bedding, linens, and towels. This is the perfect opportunity to upgrade your bedroom or bathroom essentials at a fraction of the cost. Keep an eye out for clearance sales, online deals, and coupon codes that can help you save even more.

Refreshing your home essentials

December is also a time for reflection and renewal, making it an ideal moment to refresh your home. Investing in new bedding, linens, and towels can give your living spaces a fresh and cozy feel. Plus, with the extra guests that often come with the holiday season, having high-quality and comfortable essentials is essential for their comfort.

So, while you're making your holiday shopping list, don't forget to consider these often-overlooked items. Take advantage of the post-Christmas sales and give your home a little extra love this December.

As the holiday season approaches, many people are focused on Christmas shopping. However, there are other things to consider saving for in December that can help you prepare for the future. One area to focus on is Christmas decorations and gifts for next year.

Saving money on future Christmas expenses

By saving for Christmas decorations and gifts in December, you can spread out the cost over a longer period of time. This allows you to budget more effectively and avoid the stress of last-minute shopping.

Buying discounted decorations and gifts during December

December is a great time to buy Christmas decorations and gifts for the following year because many stores offer discounts and promotions during this time. You can take advantage of these sales to get high-quality items at a lower price.

By planning ahead and saving for Christmas decorations and gifts in December, you can reduce stress and financial strain during the holiday season. It's a smart way to prepare for the future while also enjoying the festivities of the current holiday season. So, consider setting aside some money this December for future Christmas expenses.

Subscription Services

If you're looking to make the most of your savings this December, it's essential to consider factors beyond Christmas shopping. One area worth exploring is subscription services.

Saving money by taking advantage of year-end deals

December is a great time to evaluate your subscription services and take advantage of year-end deals. Many providers offer discounts or special promotions during this period, allowing you to save money while enjoying the same benefits. You can further maximize your savings by reviewing your subscriptions and identifying any that are no longer necessary or cost-effective.

Evaluating and optimizing your subscription services

Take the opportunity to evaluate each subscription service you have. Assess its value and whether it aligns with your current needs and budget. If you find any services that are unutilized or no longer beneficial, consider canceling or downgrading them. Additionally, explore alternative providers or plans offering better terms or discounts. Optimizing your subscriptions can result in significant savings over time.

By focusing on subscription services and taking advantage of year-end deals, you can make strategic financial decisions beyond traditional holiday expenses. It's an opportunity to save money, optimize your spending, and improve your overall.

Home Improvement Projects

Planning and saving for home improvement projects

As winter approaches, it's a great time to focus on home improvement projects. Maybe you've been dreaming of renovating your kitchen or finally fixing that leaky roof. December is the perfect month to start planning and saving for these projects. Assess the repairs or upgrades you need, set a budget, and begin saving money. This way, when the weather warms up, you'll have the funds available and a clear plan of action to tackle the project.

Taking advantage of winter sales for tools and supplies

While most people are busy shopping for holiday gifts, you can take advantage of winter sales to stock up on tools and supplies for your home improvement projects. Many retailers offer significant discounts during this time, so keep an eye out for deals on power tools, paint, flooring materials, and other supplies you may need. By purchasing these items during the winter sales, you can save some money and be ready to start your projects when the time is right.

Remember, December is not just about Christmas shopping. It's also a great opportunity to focus on your home and invest in improving its value and comfort.

Travel and Vacations

Saving for future travel plans during December

As the holiday season approaches, it's easy to get caught up in the Christmas shopping frenzy. However, instead of splurging all your money on gifts, consider setting some aside for future travel plans.

For example, you can start saving for a fun water activity such as Key West Snorkeling in Florida for the summer season.

December is a great time to start saving for your dream vacation because you can take advantage of various discounts and deals available during the holiday season.

Booking discounted flights and accommodations

While December is known for Christmas shopping, it's also a time when airlines and hotels offer discounted rates to attract more customers. By saving for your vacation during this time, you can book flights and accommodations at a fraction of the normal price. Take advantage of these deals and make your travel dreams a reality.

So, this December, don't just focus on Christmas shopping. Set aside some money for future travel plans and take advantage of the discounts and deals available during the holiday season. Treat yourself to a well-deserved vacation and create memories that will last a lifetime.

Calendars and Planners

When it comes to things to save for in December, calendars and planners often get overlooked. However, it's worth mentioning that stores commonly offer significant discounts on these items once January begins, sometimes even before the end of December. So, if you don't mind missing a few days at the beginning of the new year, it's a great opportunity to save money by setting aside some cash and purchasing a discounted calendar or planner later. It's a practical way to organize your schedule while being mindful of your budget.

Miscellaneous Expenses

Unexpected expenses to save for in December

December is a month filled with celebrations and festivities, but it's also important to plan for unexpected expenses that may arise during this time. Here are some miscellaneous expenses to save for in December that are not related to Christmas shopping:

- Home repairs: Winter weather can bring about unforeseen repairs, such as roof leaks or furnace issues. Setting aside some money for these emergencies can save you from financial stress.

- Car maintenance: Winter conditions can take a toll on your vehicle. Save for unexpected repairs or maintenance such as snow tires, battery replacement, or engine check-ups.

- Travel expenses: If you plan on traveling during the holidays, allocate funds for transportation, accommodation, and unexpected costs like lost luggage or medical emergencies.

Budgeting for emergencies and financial surprises

It's always wise to have a financial safety net. By setting aside money for emergencies and unexpected expenses, you can ensure that you are prepared for any situation that arises. Here are some tips for budgeting for emergencies:

- Create an emergency fund: Start saving a portion of your income specifically for emergencies. Aim to build a fund that covers at least three to six months of expenses.

- Prioritize savings: Put aside a fixed amount each month towards your emergency fund. Treat it like any other bill or expense.

- Review your budget regularly: Assess your expenses and income regularly to make sure your emergency fund is growing at a steady pace.

By being proactive and saving for unexpected expenses, you can avoid financial stress and have peace of mind during the holiday season.

In conclusion, there are many worthwhile things to save for in December that go beyond the realm of Christmas shopping. From winter getaways to investments in personal growth, this month offers a unique opportunity to prepare for the future and indulge in experiences that will enrich our lives.

By prioritizing these 10 things, we can make the most of this festive season and ensure that our December is not only filled with holiday cheer but also with lasting memories and important milestones. So, start saving, set your goals, and make this December a month of abundance, fulfillment, and purpose. Happy saving!

Christmas is a spending time. And it makes us spend more on decorations like Irish Christmas tress, designer christmas wreaths , tinsel garlands, string lights etc.