5 Tips To Avoid Financial Stress In 2024

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereIn today's fast-paced and uncertain world, financial stress has become a common issue that many people face. Financial stress can significantly impact mental and physical health, Whether due to mounting debt, a lack of savings, or living beyond one's means.

However, it is possible to avoid this stress and manage your finances effectively in order to create a more stable and secure financial future. This article will explore three tips to help you avoid financial stress in 2024.

Understanding the impact of financial stress

Financial stress can take a toll on various aspects of your life. It can lead to anxiety, depression, and sleep problems, affecting both your mental and physical well-being. Also, financial stress can strain relationships, causing conflicts and disagreements with loved ones. Therefore, it is crucial to recognize the impact of financial stress and take proactive steps to minimize it.

The importance of managing finances in 2024

As we head into 2024, it's essential to prioritize managing your finances effectively. With the possibility of a recession, it becomes even more critical to economize your budget, pay down debt, and save money. Taking control of your finances can minimize financial stress and build a strong foundation for the future.

- Economize your budget: Start by assessing your expenses and identifying areas where you can cut back. Look for unnecessary subscriptions, excessive entertainment spending, or frequent dining out. By making minor adjustments to your spending habits, you can free up more money to allocate towards savings or paying off debt.

- Pay down debt: Debt can be a significant source of financial stress. Make it a priority to pay off high-interest debts as soon as possible. Consider creating a debt repayment plan and allocating a portion of your income towards it every month. This will reduce your financial burden and improve your credit score over time.

- Save money: Saving money is crucial for building a secure financial future. Set realistic savings goals and create a budget that includes a savings category. Consider automating your savings by setting up regular transfers to a separate account. Even small amounts can add up over time, providing a financial safety net for unexpected expenses or emergencies.

By implementing these three tips, you can avoid financial stress and have more control over your financial situation in 2024. Remember that it's important to stick to your plan and be consistent with your financial habits. Seek advice from trusted financial professionals if needed, and be proactive in your approach to managing your finances.

Financial stress is a common issue that can have a detrimental impact on mental and physical well-being. However, by understanding the impact of financial stress and managing your finances effectively, you can avoid unnecessary stress and build a more stable financial future. Prioritize economizing your budget, paying down debt, and saving money in 2024. You can reduce financial stress and gain peace of mind with careful planning and consistent effort.

Step 1: Set Clear Financial Goals

Identifying your financial priorities

The first step towards avoiding financial stress in 2024 is to set clear financial goals. This involves identifying your priorities and understanding what you want to achieve financially. Whether saving for a down payment on a house, paying off debt, or building an emergency fund, having specific goals in mind can help you stay motivated and on track.

Take some time to reflect on your current financial situation and think about where you want to be in the future. Consider your short-term goals, such as paying off credit card debt, and your long-term goals, like retirement savings. You can develop a clear roadmap for your financial journey by understanding your priorities.

Creating a realistic budget

Once you have your goals in mind, it's important to create a budget that works for you. A budget is a financial roadmap that helps you allocate your income toward your goals and expenses. Start by tracking your income and expenses for a few months to get a clear picture of where your money is going.

Next, analyze your spending habits and identify areas to cut back. This may involve reducing discretionary spending, such as eating out or entertainment expenses. Look for ways to save on fixed monthly expenses, such as renegotiating your internet or cable bill. By making minor adjustments to your spending habits, you can free up more money to allocate towards your goals.

When creating your budget, be realistic, and don't forget to account for unexpected expenses. Set aside funds for emergencies, car repairs, and other unforeseen events. By planning for the unexpected, you can reduce the stress of financial surprises.

Remember, a budget is a living document that should be reviewed and adjusted regularly. As your financial situation changes, make sure to update your budget accordingly. You can maintain financial stability and avoid unnecessary stress by staying on top of your budget and monitoring your progress toward your goals.

Step 2: Build an Emergency Fund

The importance of an emergency fund

No matter how carefully you plan, unexpected expenses can always pop up. Whether it's a medical emergency, car repair, or sudden job loss, an emergency fund can provide a safety net and help you avoid financial stress.

An emergency fund is a savings account designated explicitly for unexpected expenses. Having at least three to six months' living expenses in your emergency fund is recommended. This money should be easily accessible, such as in a high-yield savings account.

How to build an emergency fund

Building an emergency fund takes time and discipline. Start by setting up automatic transfers from your checking account to your emergency fund. Even if you can only afford to save a small amount each month, it's important to start somewhere. Over time, these small contributions will help you build a solid emergency fund.

Consider cutting back on non-essential expenses to free up more money for your emergency fund. This may involve reducing dining out, shopping less, or finding ways to save on monthly bills. Every little bit counts and will contribute to your overall financial stability.

Remember, it's important to replenish your emergency fund after you dip into it. When you use funds from your emergency fund, make it a priority to build it back up. This will ensure that you always have a safety net in place and can avoid financial stress in emergencies.

Step 3: Seek Professional Help if Needed

The benefits of professional financial advice

Managing your finances can be overwhelming, especially if you have complex financial situations or significant debt. Seeking professional help from a financial advisor can provide valuable guidance and help you make informed decisions about your finances.

A financial advisor can provide personalized advice based on your specific goals, risk tolerance, and financial situation. They can help you create a comprehensive financial plan, evaluate investment options, and provide strategies for paying off debt. With their expertise, you can navigate financial challenges with confidence and set yourself up for long-term success.

Choosing the right financial advisor

When selecting a financial advisor, it's essential to do your research and choose someone who is qualified and trustworthy. Look for advisors who are certified financial planners (CFPs) and have a fiduciary duty to act in your best interest. Ask for referrals from friends or family members who have had positive experiences with financial advisors.

During your initial consultation with a potential advisor, ask about their investment philosophy, fee structure, and approach to client relationships. It's important to find someone who aligns with your values and communication style. Remember, financial advisors are there to help you achieve your financial goals, so don't hesitate to ask questions and ensure that you feel comfortable working with them.

In conclusion, avoiding financial stress in 2024 requires proactive steps and careful planning. By setting clear financial goals, creating a realistic budget, building an emergency fund, and seeking professional help if needed, you can set yourself up for financial stability and peace of mind. Remember, financial success is a journey, and with consistency and determination, you can achieve your goals and avoid unnecessary stress along the way.

Step 4: Build an Emergency Fund

The importance of having a financial safety net

When it comes to avoiding financial stress, one of the most important steps you can take is to build an emergency fund. An emergency fund serves as a financial safety net, providing you with a cushion to fall back on in case of unexpected expenses or financial emergencies. It offers peace of mind knowing that you have funds readily available to cover unforeseen costs without resorting to credit cards, loans, or other forms of debt.

Having an emergency fund not only helps you avoid the stress of scrambling for money in times of crisis but also protects your long-term financial stability. Without an emergency fund, you may find yourself constantly relying on credit or facing the potential of falling into debt when faced with unexpected expenses. By having a financial safety net in place, you can avoid these pitfalls and maintain control over your finances.

Strategies to save for emergencies

Now that you understand the importance of having an emergency fund, let's explore some strategies to help you save for emergencies:

Strategy 1: Make saving money a habit. Consistency is key when it comes to growing your savings account. Make saving money a priority by setting aside a portion of your income each month specifically for your emergency fund. Treat it like any other bill or expense that needs to be paid. Automate your savings if possible, so that a portion of your paycheck is directly deposited into your emergency fund, making it effortless to save.

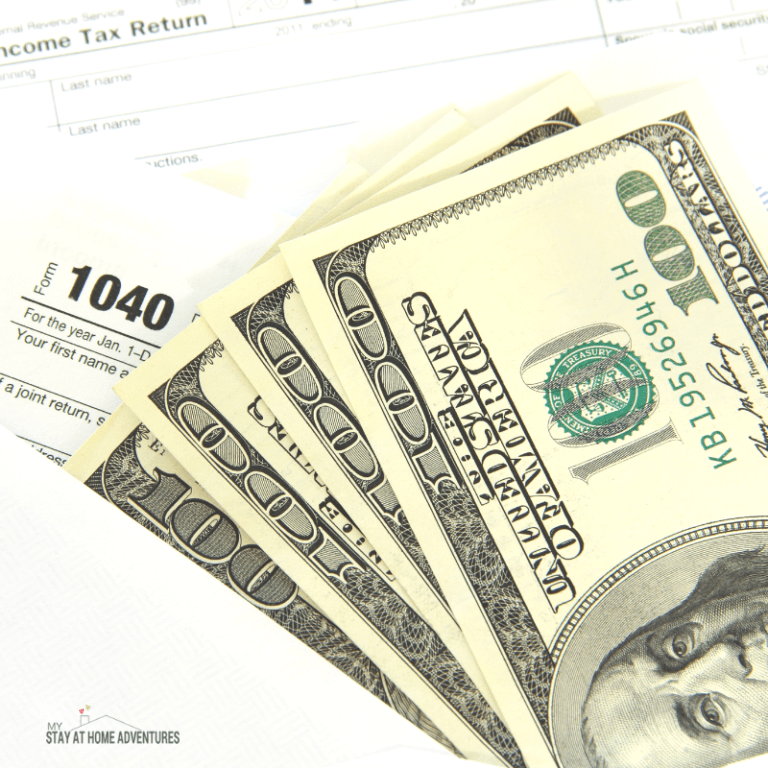

Strategy 2: Manage your income schedule. If your income schedule allows for it, consider adjusting the timing of your bill payments to align with your paychecks. By coordinating your bill due dates and paydays, you can better manage your cash flow and ensure that you have enough money left over to contribute to your emergency fund. This strategy can help you avoid the stress of trying to cover bills and save for emergencies at the same time.

Strategy 3: Make the most of financial windfalls. Whenever you receive unexpected income, such as a bonus, tax refund, or monetary gift, resist the urge to splurge on unnecessary expenses. Instead, use these financial windfalls as an opportunity to boost your emergency fund. Consider allocating a portion or even the entirety of these windfalls toward your savings. This allows you to accelerate your progress in building your emergency fund and provides a safety net for future unexpected events.

These three trusted strategies are great ways to save, and they can help you prepare for and recover from unplanned expenses. Building an emergency fund is not an overnight process, but with consistent effort and discipline, you can steadily grow your financial safety net.

Remember, the goal is to have three to six months' worth of living expenses saved up, so don't be discouraged if it takes some time to reach that milestone. The important thing is that you start now and remain committed to your savings goals.

Building an emergency fund is an essential step in avoiding financial stress in 2024. It provides you with the peace of mind and financial security to navigate unexpected expenses without resorting to debt. By making saving money a habit, managing your income schedule, and making the most of financial windfalls, you can steadily grow your emergency fund and protect your financial well-being. Start today and take control of your financial future.

Step 5: Reduce Debt and Expenses

Managing debts effectively

One of the key ways to avoid financial stress in 2024 is to manage your debts effectively. Mounting debts can quickly become overwhelming and contribute to financial stress. Here are some tips to help you manage your debts effectively:

- Create a repayment plan: Start by assessing all your debts and creating a repayment plan. Prioritize your debts based on their interest rates and focus on paying off higher-interest debts first. Consider utilizing debt consolidation options or negotiating with creditors for better repayment terms.

- Stick to a budget: Creating and sticking to a budget is essential for managing your debts. Allocate a portion of your income towards debt repayment and avoid unnecessary expenses. By tracking your spending and making conscious choices about where your money goes, you can free up more funds to put towards paying off your debts.

- Seek professional help: If you’re feeling overwhelmed with your debts, it may be beneficial to seek professional help. Financial advisors or credit counselors can provide guidance and support in managing your debts. They can help you negotiate better repayment terms, create a personalized plan, and provide strategies for debt reduction.

Tips for cutting unnecessary expenses

Reducing your expenses is another effective way to avoid financial stress in 2024. By cutting unnecessary expenses, you can free up more money to save, invest, or pay off debts. Here are some tips for cutting unnecessary expenses:

- Review your subscriptions: Evaluate all your subscriptions, such as streaming services, gym memberships, or magazine subscriptions. Determine if you are truly using and benefiting from each subscription. Cancel any subscriptions that you no longer need or can live without.

- Reduce dining out: Eating out can quickly add up and impact your finances. Instead of dining out frequently, consider cooking at home more often. Meal planning and preparing your own meals can save you money and also allow you to have more control over your food choices.

- Shop smart: When it comes to shopping, look for deals, discounts, and opportunities to save money. Compare prices, use coupons, and consider buying in bulk for items that you regularly use. Avoid impulse buying and only purchase items that you truly need.

- Reevaluate your housing costs: Housing costs, such as rent or mortgage payments, can be a significant expense. Consider if there are opportunities to reduce your housing costs, such as downsizing to a smaller space or refinancing your mortgage to get a lower interest rate.

- Save on utilities: Look for ways to save on your utility bills. Turn off lights when not in use, unplug electronics when not needed, and consider investing in energy-efficient appliances. These small changes can add up and result in significant savings over time.

By implementing these tips and making conscious choices about where your money goes, you can reduce your expenses and have more control over your finances. This will help you avoid unnecessary financial stress and improve your overall financial well-being.

By following the three steps of building an emergency fund, managing debts effectively, and cutting unnecessary expenses, you can avoid financial stress in 2024. Building an emergency fund provides a safety net while managing debts and reducing expenses helps improve your long-term financial stability.

Take control of your finances, make conscious choices, and prioritize your financial well-being. With dedication and perseverance, you can achieve financial peace of mind in the coming year.

Avoiding financial stress in 2024 requires a proactive approach and a commitment to managing your finances effectively. By following the three steps of building an emergency fund, managing debts effectively, and cutting unnecessary expenses, you can take control of your financial well-being and avoid unnecessary stress.

Reviewing the three steps to avoid financial stress in 2024

The first step to avoiding financial stress is building an emergency fund. Having a safety net of savings can provide peace of mind and help you navigate unexpected expenses or income fluctuations. Start by setting a specific savings goal and consistently contribute to your emergency fund. By having this financial cushion, you can avoid going into debt or relying on credit cards to cover unforeseen expenses.

The second step is managing debts effectively. Mounting debts can quickly become overwhelming and contribute to financial stress. Start by creating a repayment plan, prioritizing your debts based on their interest rates.

Focus on paying off higher-interest debts first and consider utilizing debt consolidation options or negotiating with creditors for better repayment terms. Stick to a budget and allocate a portion of your income towards debt repayment. Avoid unnecessary expenses and track your spending to free up more funds to put towards paying off your debts.

If you're feeling overwhelmed, consider seeking professional help from financial advisors or credit counselors who can provide guidance and support in managing your debts.

The third step is cutting unnecessary expenses. By reducing your expenses, you can free up more money to save, invest, or pay off debts. Review your subscriptions and cancel any that you no longer need or can live without. Reduce dining out and consider cooking at home more often. Shop smart by looking for deals and discounts, comparing prices, and avoiding impulse buying.

Reevaluate your housing costs and see if there are opportunities to reduce them, such as downsizing or refinancing your mortgage. Look for ways to save on utilities by being mindful of energy usage. By implementing these tips and making conscious choices about where your money goes, you can reduce your expenses and have more control over your finances.

Taking control of your financial future

Taking control of your financial future requires discipline, planning, and dedication. Start by assessing your current financial situation and setting clear goals. Whether it's saving for a down payment on a house, paying off debts, or achieving financial independence, having a clear vision of your financial goals can motivate you to make smart financial decisions.

In addition to the three steps mentioned above, it's important to educate yourself about personal finance. Stay informed about money management strategies, investment options, and financial planning. The more knowledge you have, the better equipped you'll be to make informed decisions that align with your goals.

It's also important to regularly review and adjust your financial plan as needed. Life circumstances and financial goals can change over time, so it's essential to regularly reassess and make necessary adjustments. This includes monitoring your budget, tracking your expenses, and periodically reviewing your investments and financial accounts.

Remember, avoiding financial stress is not about completely depriving yourself or living a life of constant sacrifice. It's about finding a balance between enjoying the present and securing your financial future. By making conscious choices, prioritizing your financial well-being, and taking control of your finances, you can avoid unnecessary stress and achieve financial peace of mind in 2024 and beyond.

5 Comments