5-10-20 Dollar Weekly Savings Challenge

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereThe 5-10-20 Dollar Savings Challenger is a great way to start building your savings while still having money left over for other expenses. This challenge provides structure and motivation to help you reach your financial goals in an achievable and efficient way.

What is the 5-10-20 Weekly Savings Challenge?

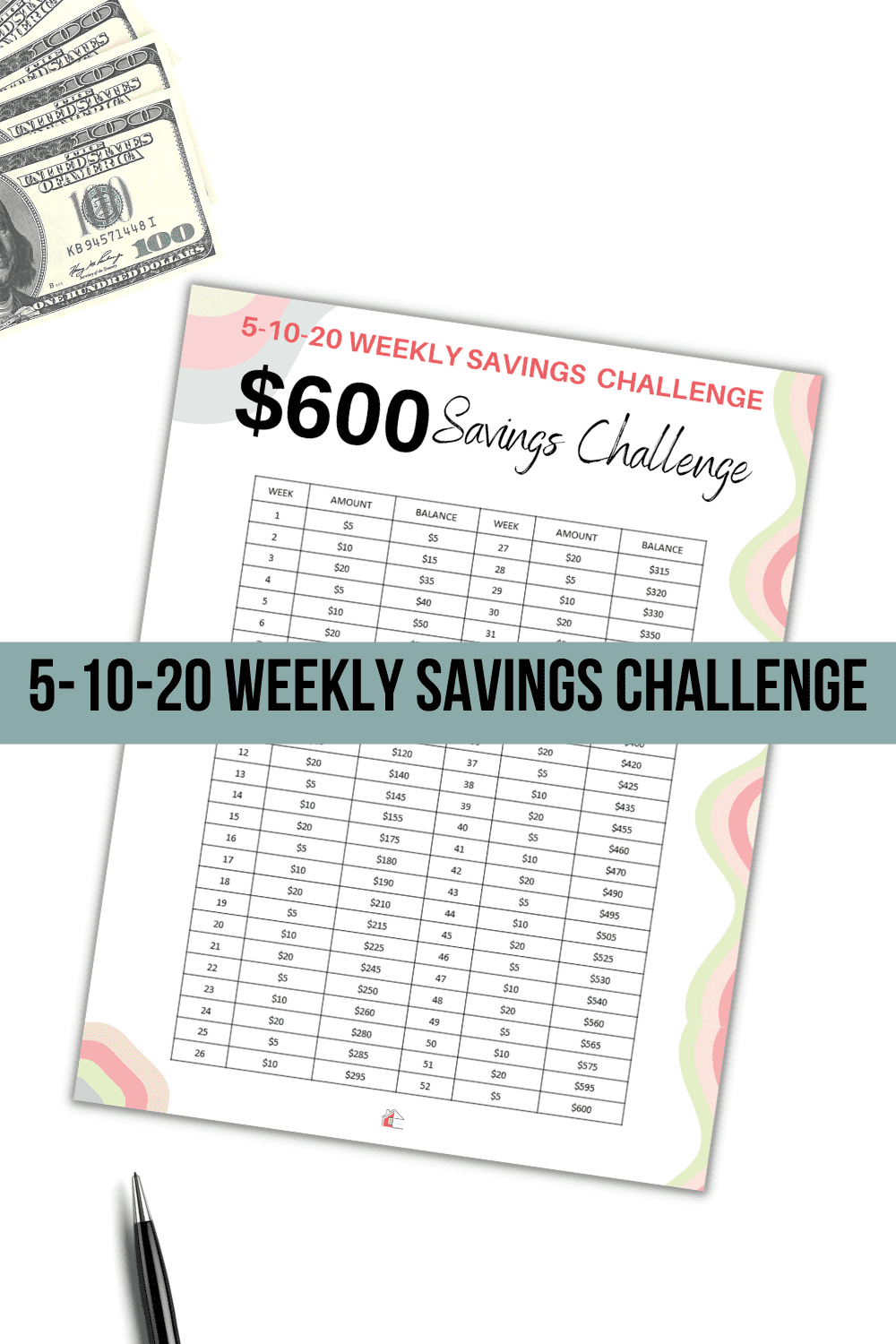

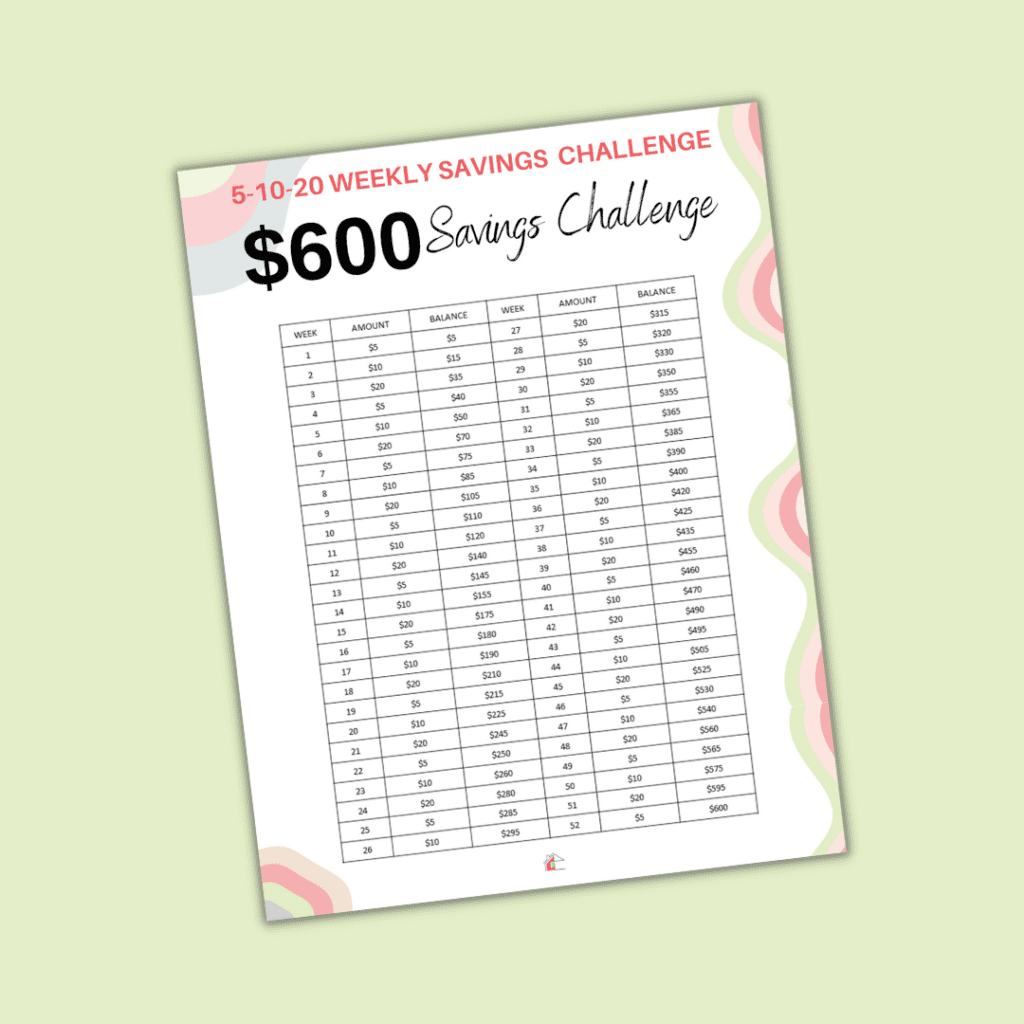

The 5-10-20 Weekly Savings Challenge helps you save money in an incremental way. You will save 5 dollars each week, 10 the following week, and 20 the next. This pattern continues for a total of 52 weeks. The benefit of this challenge is that it slowly increases your savings over time rather than expecting a large chunk up front.

How much can you save if you follow this pattern?

If you follow this pattern for 52 weeks, you will save $600. That money can go towards an emergency fund, a vacation, or any other financial goal you may have in mind.

What benefits will you get from this challenge?

This 5-10-20 savings challenge helps you save and provides structure and motivation to help you reach your financial goals. It also allows you to budget for other expenses as you only commit 5-10-20 dollars each week. This makes it easier to stay within your budget and still build savings.

How does the 5-10-20 Weekly Savings Challenge work?

The 5-10-20 Savings Challenge is an easy and achievable way to save your money each week. All you have to set aside is 5 dollars the first week, 10 dollars the following week, and 20 dollars for the next. This pattern then continues for the full 52 weeks or until you have reached your savings goal.

Are there different ways to do this challenge?

Yes, there are other variations of the 5-10-20 Savings Challenge. For example, you can choose to save 5-10-25 or 5-10-15 instead. The 5-10-20 Savings Challenge is just one way to help you build your savings and reach your financial goals.

You don't have to do this weekly or for a year. You can also do 5-10-20 every two weeks or even 5-10-20 every month if you prefer or even whenever you have a $5, $10, or $20 bill.

Where can I save the money?

You can save the money in a separate high-interest savings account or an envelope. You can also choose to invest the money in stocks, funds, or kid's college fund. You can also save it cash and use a jar or cash envelopes to keep track of your progress.

Remember that the purpose of the challenge is to save, and saving the money the way you want is the important part.

What are the benefits of this challenge?

The benefits of the 2-10-20 savings challenges are various. For starters, this challenge is a kid and teen-friendly challenge. It is easier to save 5 dollars one week and then 10 the next and 20 the next, plus you can still have money left over each week.

It is also an efficient way to save as you only commit 5-10-20 dollars each week, and it helps to set goals and track progress.

Furthermore, it encourages you to start building an emergency fund or saving up for a vacation while still having money for other expenses.

Low-income families or single parents can also benefit from this 5-10-20 weekly savings challenge as it helps to build greater financial security.

Finally, different variations of the 5-10-20 savings challenges depend on your preferences and needs.

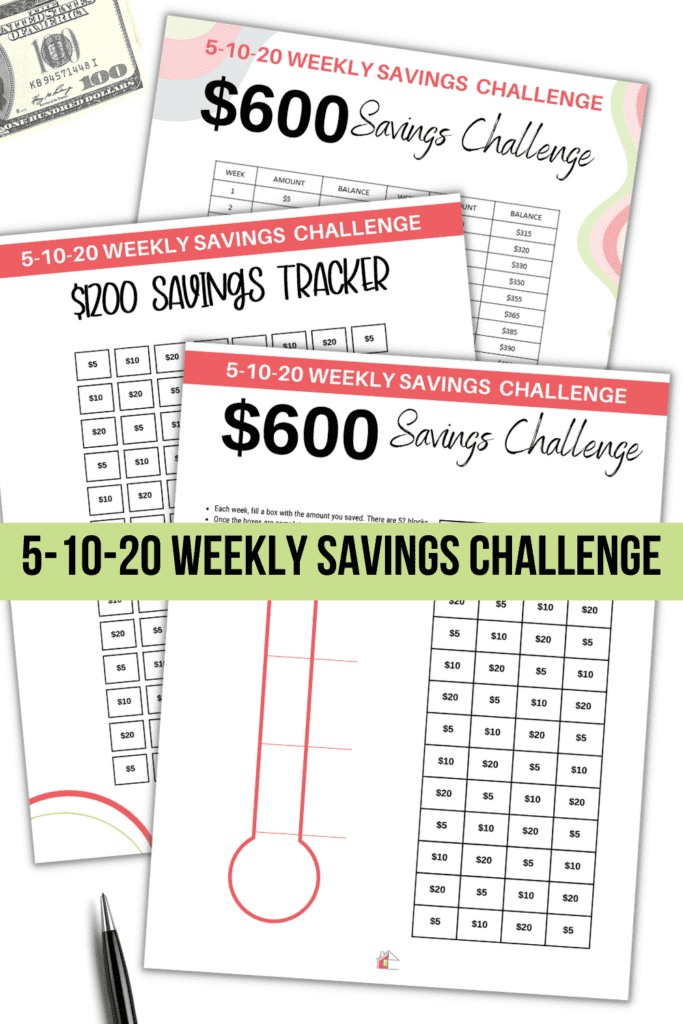

5-10-20 Weekly Savings Printable

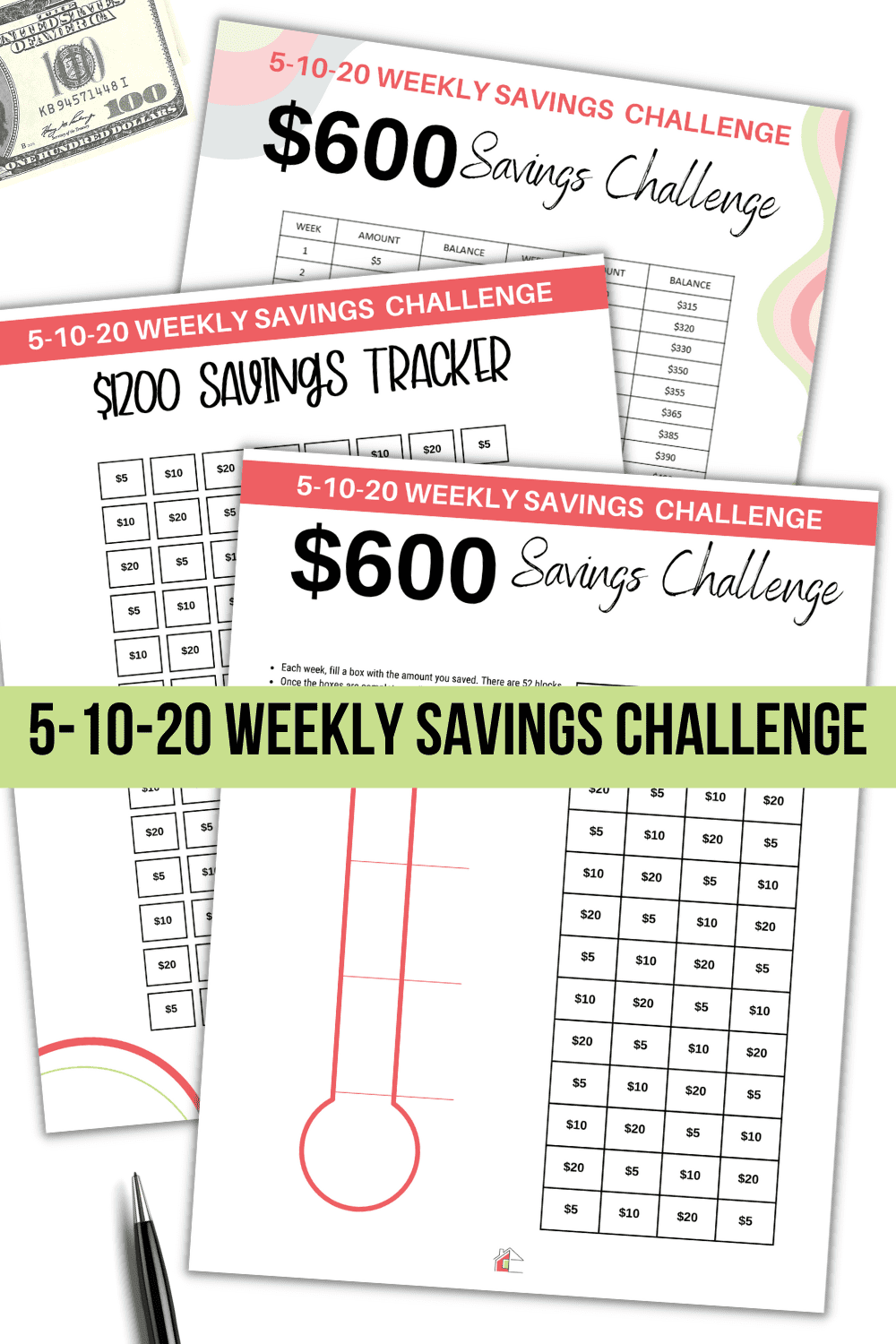

We have created a 5-10-20 Savings Challenge Printable to help you track your progress. The printable includes a weekly tracker to fill in the amount saved and a total tracker to see how much you have saved each week.

To get this freebie, join our email list, and we will send the 5-10-20 Savings Challenge Printable to your inbox.

So what are you waiting for? Start your 5-10-20 Weekly Savings Challenge today and watch your savings grow! You can do it!