How To Use Budget Binder Printables

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereLet's talk about our Budget Binder printables and how they are helping us save money and many others.

The 2021 budget binder is the updated version of our popular budget binder. One we continue to use to help us manage our money.

Budgeting is important and everyone, no matter the income, should be know everything about their finances.

Tracking your spending and income is crucial, and you need to make sure that you are using the right tool to help you tackle your finances.

What is a budget binder?

A resource for tracking your spending as well as managing and planning your financial goals

Why do you need a budget binder?

It is always recommended to use a budget binder to help you track your income, expenses. It helps you manage your finances and pay off any debt.

A budget binder helps you keep track of every penny earned and every penny spent.

Who needs a budget binder?

Anyone that earns and spends money. Again, a budget binder is a resource to help keep track of your finances.

I’m on a set income do I need a budget binder?

Yes, you need a budget binder. No matter your income, keeping track of your finances is important if you are earning and spending.

I am living paycheck to paycheck and have no clue how to use a budget binder?

Good news! You will! And I will show you how to use my budget binder, and if you continue to follow and use this binder, you will no longer live paycheck to paycheck.

What do I need to create a budget binder?

Good question! This budget binder is a digital product, and this means that you download it and print the pages you need and want to use.

To make a budget binder, you are going to need:

- Calculator

- 3 Ring Binder – We use a 2” binder.

- Divider

- Pencils

- 3 hole puncher

- Copy paper – We use this paper from Walmart paper, and you can order it when you order your Walmart Groceries.

How to organize a budget binder?

Below you are going to learn how to use our budget binder printables.

Once you have your supplies gathered, it is time to make sure you take the time and gather all your expenses and income from the last three months and be ready to work on this budget.

Would you please ensure that you have your schedule clear and ready to tackle your budget because this is not a 30-minute job?

You will make sure that you will pay all of your attention to your budget planning, and if this is your first time doing this, you must allow time for this.

Would you please take a look inside my personal budget binder on the video below?

What you are going to do is print the year goals sheets, and these are:

- Yearly Financial Plan Sheet

- Yearly Financial Goal Sheet

- Paycheck Calendar Sheet

- Full Debt Overview Sheet

- Debt Paydown Sheet

- Debt Priority Sheet

Know that you can print as many as you need, and I will recommend having additional blank paper too. There are more sheets of paper to print, but if you have not used this binder before and need some help getting started, print the sheets listed above.

Know your why!

Before we begin budgeting using the budget binder, it is time to take some time to soul search and find out your why.

Why are you doing this?

Why?!

Do you want to kill debt? Do you want a stress-free life? Please write it down. Writing down your why is important, and a higher chance that you will stick to your budget because you have a clear reason you are doing this.

Getting Started to Budget

Now it is time to enjoy a money date and start your new adventure, your money adventure.

You are going to look at your finances. You are going to write down all your income, expenses, and debt.

Let me prepare you and say that this will be a hard part for many people because of the reality of how your finances will be there on your face.

This is going to be hard to take for many of you!

BUT that’s OK! We had those brutal honest moments too.

The truth was that we avoided doing this because we were afraid to see our financial reality face to face.

In this part, you are going to have to be honest with yourself and accept it.

You will write down ALL of your income, all of your expenses, and your debt.

Log into your bank accounts, credit card accounts and start tracking.

Once you are done writing everything down, it is time to come up with a financial plan.

What do you want to accomplish with your money? What are your financial goals for the future? Write it down on a blank piece of paper. Dare to dream big!

Once you have your goals written down, it is time to break them down and start planning. How are you going to make this happen? Break it down and write those plans down.

In 2021 I want to pay one credit card off.

I would love to increase my emergency fund to $2000.

These are just samples.

So why we recommend writing your goals and plans down?

By writing your goals and plans down, it makes it real! When feeling down and need motivation, it is a great way to open your budget binder and look at your goals and plans.

How to use the Yearly Financial Plan Sheet

The yearly financial plan sheet has three sections:

- Long-term goals

- Short-term goals

- Action Plan

Planning is key to your success, and it is important to write your yearly plans to stay motivated and keep track of your goals.

Now, as the months pass by and you are working on your finances, you might change your plans for the year, and that is OK!

Nothing is set in stone, and as you find a rhythm that works for you and your family, it will change.

If your yearly long-term plan is to save $400 each month on your grocery category for a total of $4800 by using coupons and three months in, you realized that this is not working because:

A – Cutting couponing takes way too much time

B – You do not see results

C – You found that meal planning and using a shopping list works for you

Then it's OK to change your yearly plan. If you plan to eliminate debt, write it down and write down how you plan to get this done.

You don’t need to have more than one plan. If you want to focus on just eliminating debt, then do that. Your finances are your own and no one else!

How to use the yearly financial goals sheet

The yearly financial goal sheet is set up the same way as the yearly financial goals.

- Long-term goals

- Short-term goals

- Action Plan

It’s such a great way to break down your goals and your plans and keep them realistic. So here’s a realistic goal sample for you.

If you are in a credit card debt of $15,000 and you want to pay your debt and save money, you keep your debt goals and goals realistic.

Meaning you will write, kill $15000 in credit card debt and save $20,000 when you have never worked on your finances before or your income doesn’t allow it at this time.

Your long-term goals are to kill $15,000 in credit card debt and save $20,000.

Your short-term will be:

Pay down one credit card down to $0 and save $5000 in 2 years.

Your action plan will be something like research on how to reduce my credit card payments. Stop using credit cards and pay $100 extra on this particular credit card.

For the saving goal, my action plan is to analyze my spending, see what categories I can cut down, and write an action plan on how to get there.

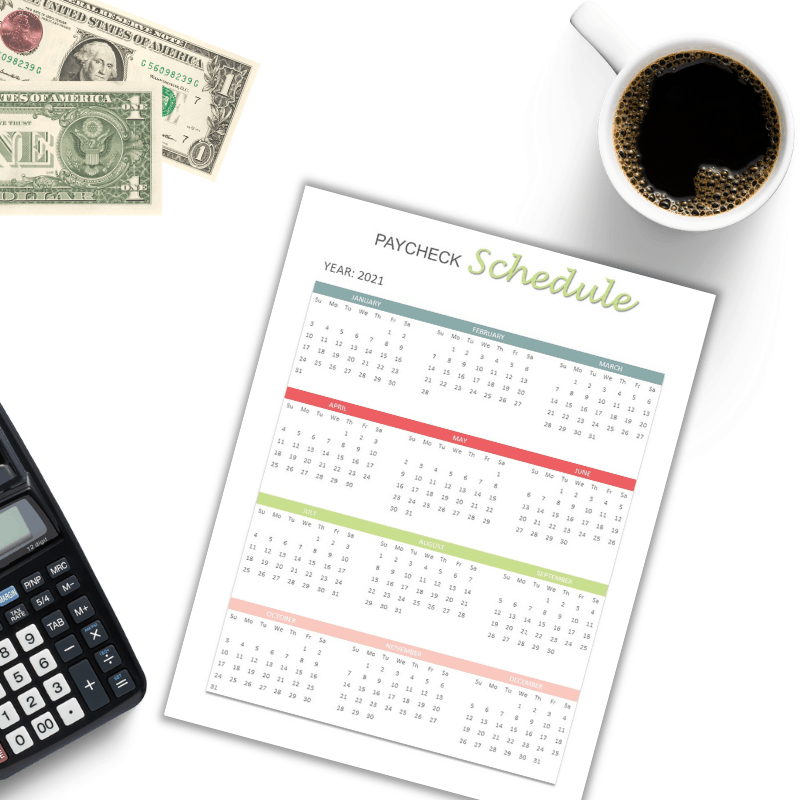

How to use the Paycheck Calendar sheet

Planning is key, and when you are about to start budgeting, it is best to know when you will get paid.

Using the paycheck calendar sheet, circle the dates you are going to receive a paycheck or income.

Once you are done, look at the sheet and see what months you will get an extra paycheck.

- 6 Things You Are Not Doing That Are Costing You Money

- 8 Tips for Saving Money Each Month

- Money Goals (Top 6 Goals For 2019)

Use this sheet each month to create your monthly budget to see when you will be getting paid. It makes it easier to have it all in one binder.

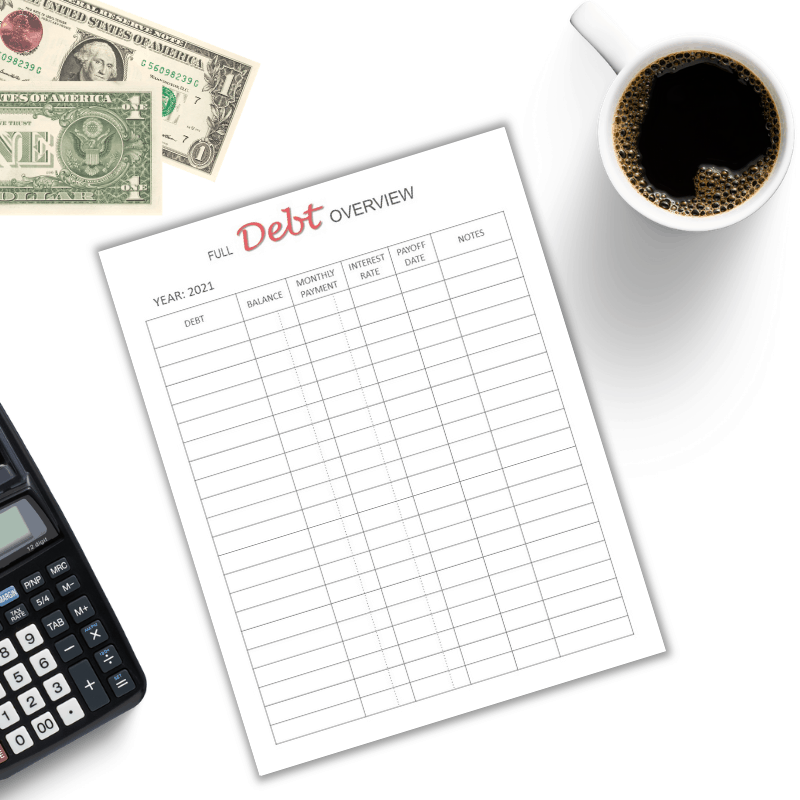

How to use the Full Debt Overview Sheet

Use the Full Debt Overview sheet to write down ALL of your debt and if you need to print more than one sheet, go ahead!

If you need some clarification on what debt is, debt is money owed to a party, lender, or collector.

On this sheet, you are going to write down:

Debt – The name of the credit card or loan. Amazon credit card, Visa card #1, a name that you will recognize.

Balance – You are going to write down the balance you owe. If you are starting the binder right now and creating a financial plan or goal for this, write the balance as of today.

Monthly Payment – The minimum amount that is due on this debt each month.

Interest Rate – Write down the interest in this account.

Payoff Date – The date you are planning on paying this debt off.

Notes – Any notes you need to write down.

The Full Debt Overview Sheet helps you see all your debt in one sheet, which might hurt a bit but is a reality check we need.

This sheet will help you plan your debt pay-off method. For example, do you want to start with the lowest balanced account, or do you want to start with the highest interest rate?

This is a personal choice, and whatever way you decide to pay your debt is the right one for you! Remember, it’s called personal finances for a reason. It’s personal! You don’t need to do it one way because someone else told you to do it that way.

Eliminate your debt on your terms as long as you are doing it!

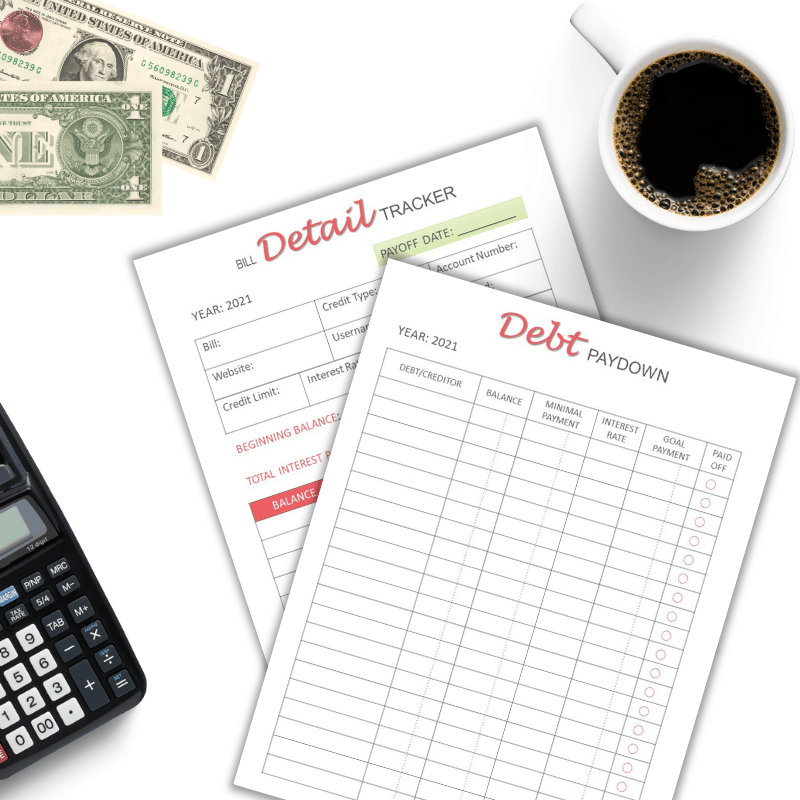

How to use the Debt Paydown Sheet

Once you have written down all of your debt and have come up with a debt pay-off plan, the Debt Paydown Sheet is the next step.

To keep your finances organized and in the same binder, you will write down your goal payments for these accounts.

Again, the goal payment might change as the months pass and you pay off accounts, but it is a great idea to start with a plan.

Debt/Creditor – Write down the name of your debt or creditor.

Balance – Write down the total balance owed on the account.

Minimal Payment – Write down the minimum payment required for this account.

Goal Payment – Write down the goal payment you set for this account.

Paid Off – Check or mark once it is paid off.

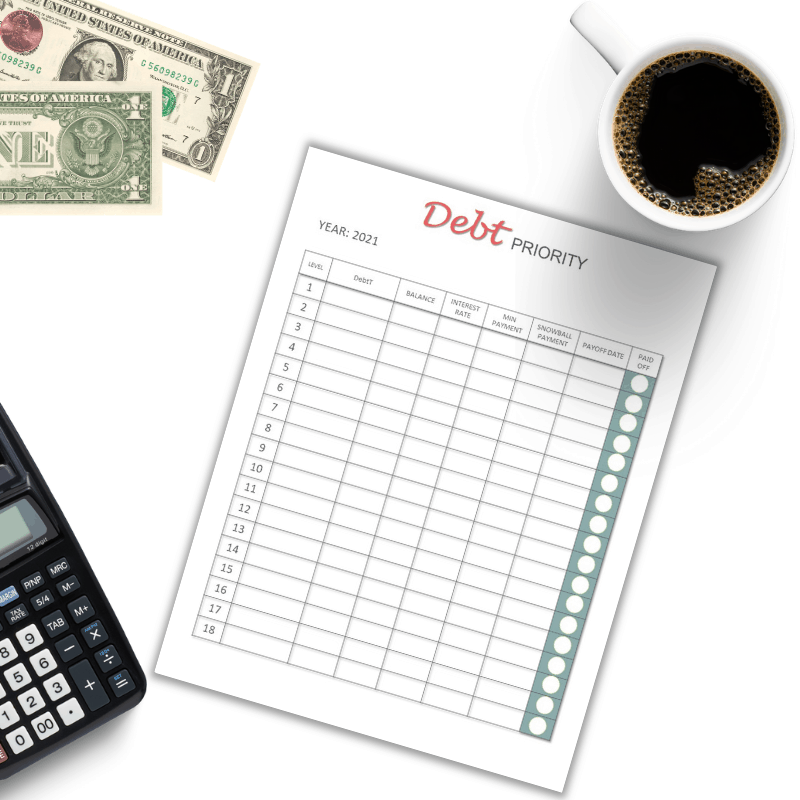

How to use the Debt Priority Sheet

If you like to be organized and have your debt prioritize, this is the sheet. Once you have decided on how you want to pay your debt, write it down by priority level.

#1 being the highest level, the priority debt you want to pay off debt. This sheet is perfect if you are doing the debt snowball method.

The sheets called Bill Detail Tracker and Debt Paydown is detailed sheets to write down every information regarding each account.

We decided to update the Snowball Debt Tracker and call it Bill Detail Tracker and Debt Paydown.

If you have multiple credit cards, we recommend using multiple sheets for the Bill Detail Tracker.

You decide if you want to follow the debt snowball method or the avalanche method.

With the Debt Paydown printable, you can track your payment and plan what your goal payment is going to be.

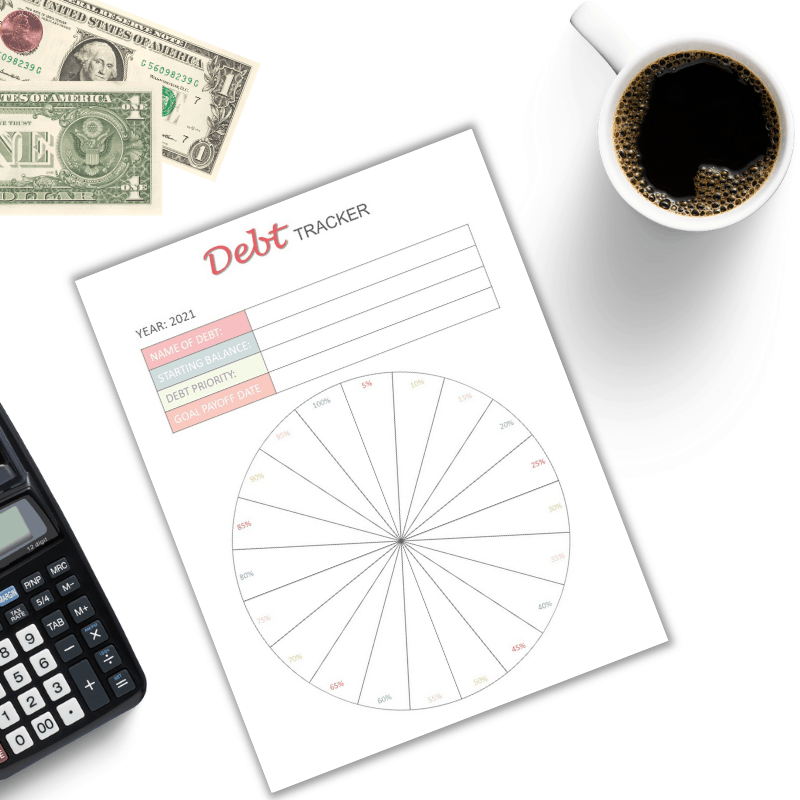

Debt Tracker Sheet

I believe that visuals are a great way to keep you motivated and focused on eliminating debt.

Using the Debt Tracker Sheet (formerly Snowball Tracker Sheet) is a great way to track your debt on each of your debt accounts.

How to use the Debt Tracker Sheet

Year – Write down the current year.

Name of Debt – Identify the debt by giving it a name. If this is an Amazon credit card, write down Amazon. If it’s a Citi Bank, then write down the name. A name that you can associate the account with instead of Visa or Master Card. Doing this will be confusing if you more than one Visa card.

Starting Balance – When you decide to start tackling your finances and create a budget binder, use the current starting balance.

Debt Priority – Remember the Debt Priority Sheet we mentioned earlier? Debt was written down by priority, and on the left side of the page, you saw numbers. So this is where the priority number is going to go.

Goal Payoff Date – When you created your plan to attack your debt, write it down if you decided on a payoff date.

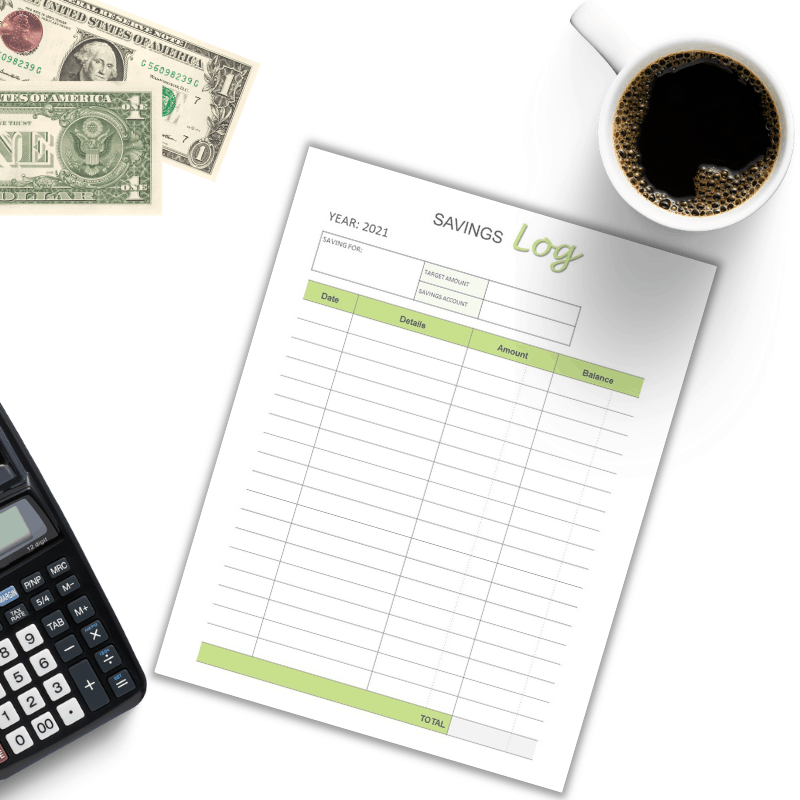

How to use the Saving Log printable

The Saving Log printable is used to store all your savings accounts. Write down your saving accounts, money earning app account, and any account you use to save money.

Use this sheet to keep track of all your saving accounts.

Our budget binder is a great tool to help you keep stay on task regarding your finances.

Because this information given above is long, we wanted to cover the yearly budget binder printables first before discussing the monthly sheets, which will be on a different post.

How to Use the Monthly Budgeting Printables

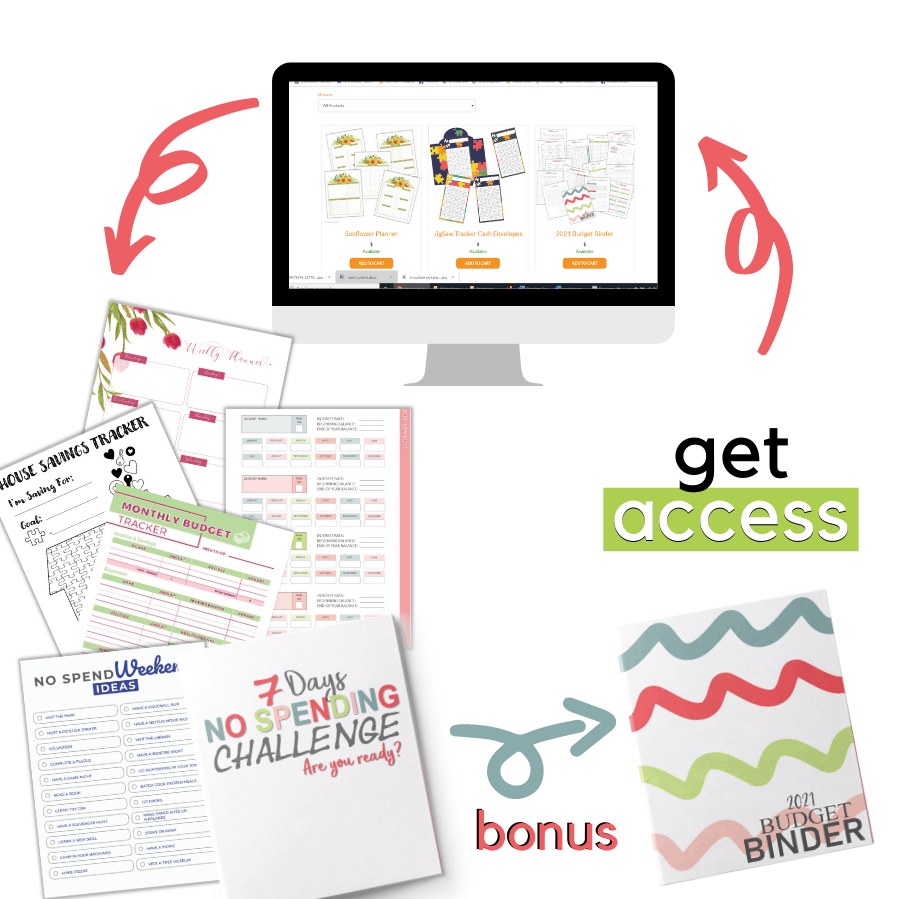

Where to Get Your 2021 Budget Binder Printables

There are two ways you can get the Budget Binder.

#1 – Hit the buy button and buy the binder. Remember, this is a digital product.

#2 The best deal is to become part of Begin with a Budget and not only get the binder but future upgrades to the binder, printables, cash envelopes, blank calendars, and exclusive monthly printables for a LOW price!

You can learn more about our latest budget binder printables when you click this link.

13 Comments