3 Reasons to Help You Budget Without Struggling

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereHow can I budget without struggling? I can't! It is not possible!

These were my thoughts as I sat down one day years ago and began to create my budget for the first time. Things didn't add up at all! I just couldn't do this budget thing at all.

Now your turn!

You are financially struggling, and you know you have to do something about it. You know you have to start a budget, but you know money is so tight, you don’t even know where to begin.

I know you are asking yourself how did I do it and how did many people manage to create a budget when money was so tight.

The good news is that you can learn to budget your money, even when there’s hardly any money to be managed. Learning how to budget without struggling will help you create a budget that works for you.

3 Reasons to Help You Budget Without Struggling

Change the attitude

I remember thinking that budgeting was such a struggle, that it wasn’t for me. The reality is that I was doing it all wrong; I was irritated and annoyed that I was doing something I didn't want to do at all.

A budget was for the wealthy, for other people that had money that allowed them to budget. It wasn't for me.

The negative attitude didn't help me at all, and it didn't make creating my budget any easy. We all know that when we are dealing with fixing our finances is not easy at all and adding this attitude made it even worst!

I related budgeting with something negative. Something that wasn’t for me because I didn’t have the money even to have a budget. Yes, it was a stupid way of thinking, but it was my reality. Sadly, in 2013, 32% of American didn’t keep a household budget according to Daily Finance.

Be honest

Let's be real here for a minute and talk about the top reason we are in a financial mess, us. We are the reason we are in debt. I was the reason that in less than two years I was over $14,000 in debt and counting.

Check these money saving posts out:

- 8 Tips On How To Not Spend Money This Month

- 10 Things You Shouldn't Buy When You Are Struggling Financially

- 7 of The Best Pantry Essentials for a Budget

My spending was out of control. I was living in the make believe world of having money where I thought money and living to expectation were it.

The hardest part of creating a budget when you are financially struggling is to accept that you have to change and you have to change now. That’s the hard part, to be honest; because, to create a budget you have to be honest with yourself and be ready for the hard road of debt elimination.

Be ready for the challenge

We know that we have to have a positive attitude because honestly, you are going to need it. You are changing your life, the way you are living but the result will be fantastic.

Budgets will change, and you will have to create another one and another one until you have a budget that will work for you. I created so many budgets to adust life changes such as a new baby and jobs.

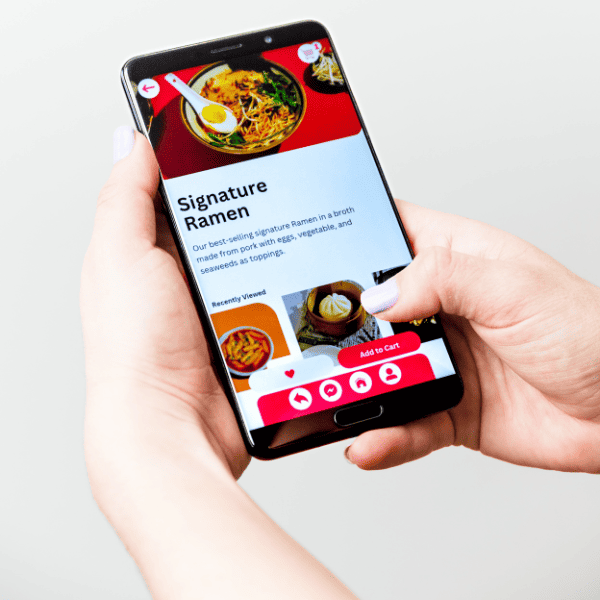

We even used different forms of budgets apps and templates and still do till this day. I went from pencil and paper to budgeting apps to cash envelope system.

I made budgets that were too complicated to budgets that didn't make sense. There were good days, and there were bad days but to be honest, it was all worth it!

As the days turned into weeks and weeks turned into months, and the debt went down it was so worth it!

Now that you have established that you are so ready to do this and ready for the road ahead, it is time to create a budget.

Remember to make a budget without struggling by leaving the negativity away, being honest and accepting the journey. Granted it won't be easy but if you go into creating a budget with a negative attitude and not being honest, budgeting is not going to work at all, and you will fail.

Budgeting tips to help you create a budget without struggling so much

Budgeting tips to help you create a budget without struggling so much

Write down all your bills and all your income. Go over all your expenses and break it down.

Categorize your expenses over the past weeks and separate the needs from the wants. Always remember what your needs are; if you are not sure, let me give you some examples:

- Rent/Mortgage

- Utilities (Electricity, water, etc.)

- Food

- Medicine

Some needs require you to ensure you have money to pay for them. These categories are top priorities. What is not a priority is cable television and satellite. Each month you need to make sure that your needs are paid first, always, before anything else. Always remember this: NEEDS COME FIRST.

The point of a budget is to make sure you are spending less. If you noticed that you are spending more than what you are receiving, then you have to analyze where your money is going and start from there.

You have to cut back on spending, but please give a little room for some fun in your budget. Eliminate cable/satellite until you have room in your budget to be able to pay for it. Look at your cell phone plan and see if you can go to a lower plan; if you can’t, call your cell phone provider and see if you can suspend the service for at least a month until you get your finances under control.

For my cell phone plan, I use Republic Wireless because their plans are so affordable.

Look at your utilities and see how you can save money. There are tons of ways to save money on utilities. From unplugging unused appliances to covering your windows with plastic to save on heating cost, these tips will help you save money on utilities.

Have fun being frugal and saving money. There's nothing wrong with living a frugal life. You get to discover the real you and a way of life you will enjoy.

Creating a budget might be difficult but it is necessary, and once you start creating a budget it will get easy!

If you think the “creating a budget” is the hard part, you are wrong. It's the road to a financial journey that will be the challenge.

The struggle will come mentally, but not when creating a budget and sticking to it.

How did you manage to make your budget less of a struggle?

I didn’t struggle coming up with a budget, my struggle is sticking to my budget month in and month out. -Kayla

Kayla, when I first started doing a budget I so over did it that thing like crazy. I couldn’t just make a simple budget, I had to do a BIG budget. Oh the fun days! Thank you for commenting girl. Have a great weekend.

Oh boy, I love that you pointed out cable television as not being a necessity. All week I’ve been putting off calling the cable company to discuss lowering our service plan, hopefully switching down to basic cable or just cutting out cable and signing up for a streaming service like Netflix. Also, since I’m at home 5 days out of 7 we’ve been considering disconnecting my cell service.

This is great advice I’m happy to implement some of it into our family budget planning.