Emergency Fund (Why you should have one)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereLet's talk emergency fund for a minute today. Do you have an emergency fund? Do you know what an emergency fund is? Why is having an emergency fund so important?

There are so many questions about emergency funds, and not many people don't either have one or don't know why having one is important.

Why Having An Emergency Fund Is Important?

I didn't know anything about an emergency fund. You heard correct; I didn't know what an emergency fund was and why it was so important. I grew up not knowing about budgeting, saving money, and saving money for an emergency.

I grew up believing that taking care of your finances and managing your finances were for the wealthy. We were too poor to have a budget, let alone save money. This was what we believed, and it was later in life that we learned the hard way.

Later in my adult life, it started to make sense, and I managed my finances and saved money. I'm a firm believer that we should be saving for rainy days.

Before we keep going about emergency funds, let me make something clear. An emergency fund is not for:

- bank fees

- overdraft fees

- house down-payment

- wedding

- vacation

- yearly subscription payments

- credit cards

- line of credit

In case you think that you have money saved for something physical like the latest iPhone. I need you to understand that these, and other things, are not why we save or add money to an emergency fund.

Check out these posts:

- Fall Energy Saving Tips To Help You Save Money

- Learn To Coupon On A Low Income

- 154 Resources to Make Money On The Side In 2017 That Do Work!

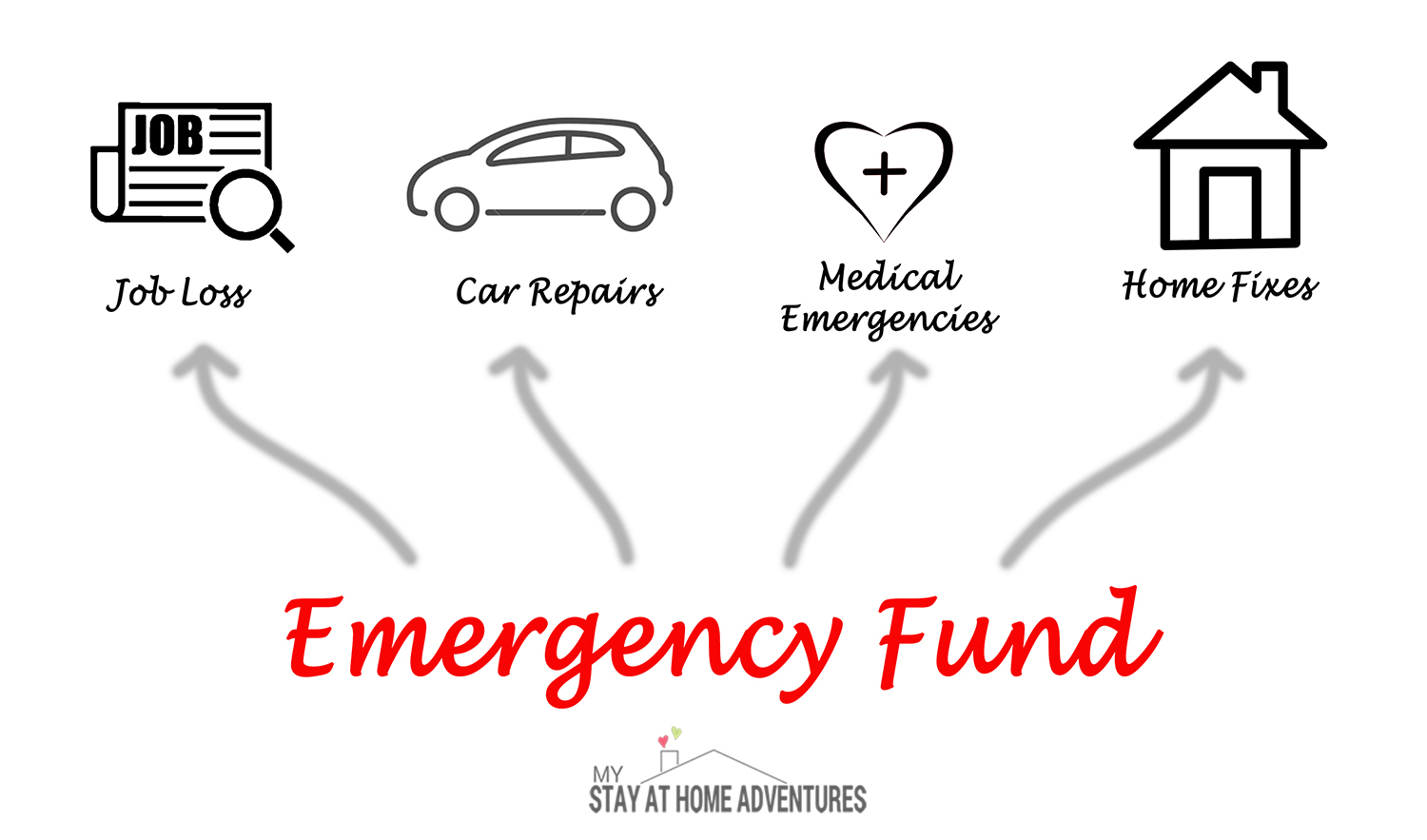

I believe that having an emergency fund is important. An emergency fund is money that is set aside for use only in emergencies. Having money put away for an emergency should be a top priority before your iPhone.

This is a difference between staying afloat or sinking into more debt. Having an emergency fund will help you break the cycle of debt.

Having that extra money set aside for unpredictable life events will prevent you from getting into more debt.

If you didn't have the fund saved up, you would be borrowing from somewhere. Either by paying with a credit card, not paying critical bills, etc., which will cause stress. Doing this will cause you to accumulate more debt, and that’s what we are trying to avoid.

When my car would break down because I didn't have an emergency fund to pay for the repair, I would use my credit cards instead. When you don't pay a bill or pay with a credit card, you create more debt and more stress in your life.

The good thing is that you can save money with the help of money-earning apps and with apps such as Digit that help you put money on the side. Just in case you are trying to make excuses for not being able to save money. Below is a list of money-making apps we use.

You can save and manage your money regardless of income.

Saving money nowadays can be done, and it doesn't matter the income! We don't make much, and we save money, and using your income as an excuse not to save money is not valid. Emergencies don't care whether you have an excellent salary or no salary at all.

A car breaking down, illnesses, you name it, it affects everyone no matter our income. Whether you save $500 or $1000, having that amount of money saved helps you pay for unexpected expenses, and it gives you peace of mind knowing that you will be able to pay it without breaking the bank.

No emergency fund will cost you more money

Like stated above, if you don't have the funds to pay for an emergency, it could cost you more money. Not having money to fix your car you decided to charge it to your credit card.

Credit card will charge you an outrageous amount of interest if the balance is not paid in full that month. If you don't use your credit card and use a cash advance place, you will pay fees and interests as well.

If you decided not to pay one of your household bills and use that money to pay for your car service bill, you would pay a late fee for not paying your bill one time. If your service gets shut off, you will pay a reinstated fee due to no payment.

Do you see the effects of not having an emergency fund? Credit cards, cash loan services, and not paying your bills are not ways to pay for emergencies. An emergency fund is what you need to pay for your emergencies—no extra cost at all and no stress.

How much money should you save?

Experts always suggest having an emergency fund to cover 3-6 months of expenses. If you are low income, I suggest planning to save $500 until you have your finances under control and increase it to $1000.

Remember that anything is better than nothing. Set an amount that is right for you. If you think $5000 will help you through 3 months, then go for it. I feel that $5,000 is right for our family of 6, but that’s what works for our family and our situation.

How much money should you have in an emergency fund?

Let’s be honest. There are so many financial gurus giving different advice on what you should have in your emergency fund. First, I feel it’s important that you have a firm understanding of what an emergency fund is and what it should be used for.

According to Investopedia, “The purpose of an emergency fund is to improve financial security by creating a safety net that can be used to meet unanticipated expenses, such as an illness or major home repairs.”

A great takeaway from this is notice that it says major home repairs. People often use an emergency fund for smaller home repairs and that’s not what it’s for.

You should have a separate account to handle home repairs that fall under home maintenance. As a safety net, how large should your emergency fund be?

The answers used to range from $1000 to six months' worth of expenses. However, the recent pandemic showed us that having one year of expenses on hand would be useful.

And, for some, that wouldn’t have been enough either. It’s easy to become overwhelmed just trying to figure out how much you need.

Instead of worrying about how much you need, spend that energy on getting an emergency fund started. If you want some direction, there is an awesome calculator you can use that lets you input specifics that relate to you and your lifestyle to get you a close answer.

Is a $1000 emergency fund enough?

A $1000 emergency fund is a wonderful starting point. It’s enough money to cover some emergencies. According to Dave Ramsey, if you’re paying off debt, $1000 should be all you invest in an emergency fund.

On a personal note, I feel that saving and paying off debt should be done simultaneously. With what 2020 brought in store, we saw that $1000 in savings was not enough. But hey, it's better than nothing.

Let's continue.

The rest of the money should be spent on getting your debt paid off. But, as Ramsey and many other financial gurus will tell you, debt or not, everyone needs an emergency fund. A $1000 stashed away in your account can help you out of a bind.

It would be best to remember that the amount you need in your emergency fund will greatly depend on your lifestyle and cost of living. If your mortgage is $1200 a month, $1000 will not help you if you lose your job.

But, if your home is paid off, $1000 will cover a lot of smaller expenses. This is why it’s so important that you always have a budget and know how much each expense is. If you don’t know where your money is going each month, you’ll never be able to be prepared for the unexpected.

Is a 3-month emergency fund enough?

How old are you? Are you in good health? Are you qualified to work in a different career field? You need to consider so many things when determining if a 3-month emergency fund is enough for you.

You might also ask yourself if you’d be willing to take a job in retail or fast food to make ends meet, should you lose your job.

Also, know that jobs in 2021 are available in just about any area, so this might affect how much you want to save and how much you want to spend on debt.

If so, how much of your expenses would that job cover? Would it be enough? These are all things you must consider. You also need to think about what would happen if you had an accident that led to disability.

Disability payments don’t start coming immediately. It can take months to get approved. During that time, you’ll need to cover your expenses. It’s a lot to take in, but as a reminder, the important thing is you start somewhere.

Think of $1000, 3-months, and 6-months as steps along the way. Vanguard suggests starting with $25 a week and working your way up. Remember, though, if you have debt, stick to $1000 until you’ve paid it off.

Is $5000 a good emergency fund?

What are your monthly expenses? How far would $5000 go if you were paying only the essentials? The answer will be different for everyone.

Something that many people never consider is that their emergency fund may be too large. How could that be possible? Well, you have to think about where your money will be housed.

You want an emergency fund to be easily accessible. That means storing the money in an account that will earn 2% or less in interest.

How is this a problem? The return on that money could be so much larger if it were in a retirement account. Speaking of which, you also lose out on tax benefits.

When money is stored in retirement accounts, you reduce the amount of taxes paid each year. Remember that an emergency fund won’t be your only source of funds.

The average American has over 30 items in their home that could sell for over $3500 on eBay! In other words, you’ve got money sitting around you right now. From video games to old books, you’d be surprised at how much money you really have.

How to get started?

There are so many ways to start your emergency fund. You can place your fund in a checking account, or savings account that is not readily available.

Start by saving the amount that meets your income. When I started my emergency fund, I barely made enough. I would automatically transfer $20 a week from my checking into my saving accounts.

At first, it was hard because I was so used to spending ALL my money, but then things got easier for me. Automating my savings is something I continue to do even now, and again, it will get easy.

Remember to pay attention to your bank institution as many will require a minimum balance of at least $100. If not, they will charge you a fee. So look around and see what account is good for you. Online banks don't have fees, and I use CapitalOne360.

You can also try many saving challenges to help you save money and keep you motivated.

Conclusion

Having an emergency fund is important and should be considered a top priority. An emergency fund will keep you away from getting into more debt and paying more.

Starting an emergency fund is as simple as putting away a few extra bucks away. Whatever the amount of money you want to save, you decide. Remember that an emergency fund is the difference between financial failure and financial success.

Now that you understand why having an emergency fund is important, what are your plans to start your emergency fund?

Great tips. This is my top priority this year!

WTG, Sherry! You can do this. Thank you for commenting.