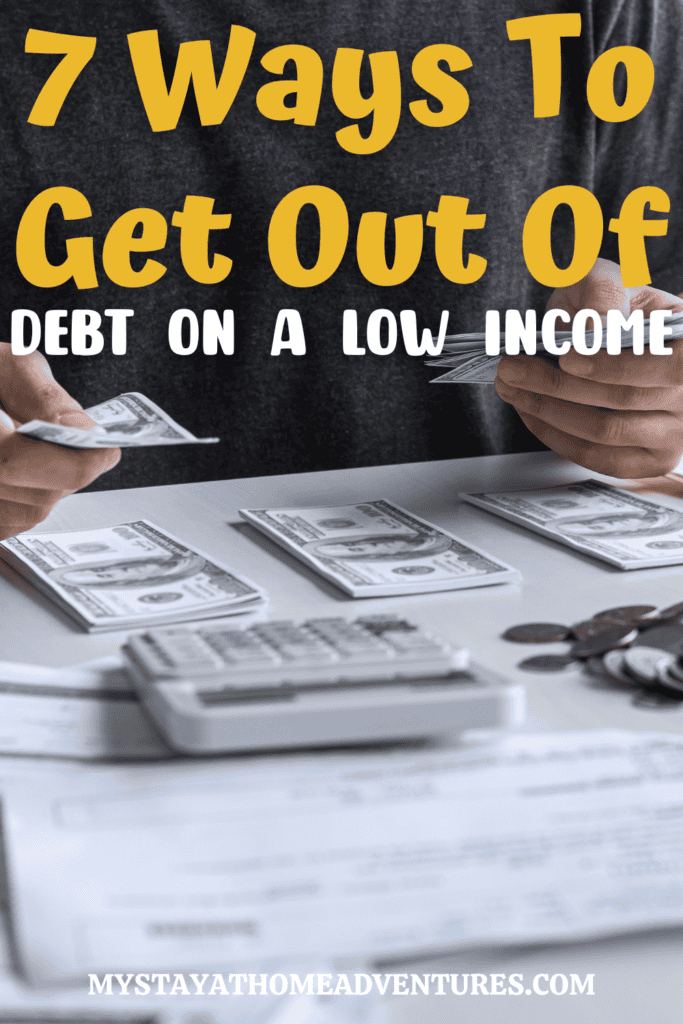

7 Ways To Get Out Of Debt On a Low Income

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereNavigating the labyrinth of debt can feel daunting, especially if your income is veering close to the frugal side. But fear not; financial freedom is not exclusive to high earners. If you're a part of the workforce managing a low income, understanding the pathways to alleviate debt is crucial. This comprehensive guide unveils specific strategies tailored to empower low-income earners with the tools to chip away at debt and reclaim their financial future.

In a financial landscape where nearly half of Americans (49%) can't cover a $1,000 emergency with savings, the importance of escaping debt on a low income becomes clear. The challenge intensifies as 22% have no emergency savings, making unexpected expenses a gateway to deeper debt.

I write about these practical strategies for those striving toward financial stability despite limited resources because this is personal to me.

Before we dive into the strategies, I want to share a personal note. I have walked this challenging road myself, having successfully eliminated my debt on a low income. It was no easy feat; it required discipline, perseverance, and a whole lot of hard work. But it was entirely doable.

The sense of liberation and the dramatic change it brought to my life and lifestyle were profound. This experience has taught me valuable lessons and showed me that achieving financial freedom is possible, no matter your income level.

One realistic approach to eliminating debt on a low income is to start by meticulously tracking all your expenses and identifying areas where you can realistically cut back. This might mean assessing your spending habits and differentiating between wants and needs.

Often, daily expenses add up over time, and eliminating or reducing these non-essential expenditures can free up more money to put toward your debt.

Creating and sticking to a strict budget requires discipline, but it's vital to understand where your money is going and how best to allocate it to paying down debts. This method doesn't promise overnight success, but it's a sustainable way to gradually reduce debt without drastically altering your quality of life.

Here's a structured approach to eliminating debt on a low income, incorporating insights from various sources:

| Step | Action | Realistic Time Frame | Tips |

|---|---|---|---|

| 1 | Take Inventory of Your Debts | Immediate | List all debts including amounts, interest rates, and due dates. Use tools like spreadsheets or budgeting apps for organization. |

| 2 | Create a Realistic Budget | 1-2 Weeks | Track all income and expenses. Identify necessary expenses and areas to cut back. Allocate savings towards debt repayment. |

| 3 | Avoid Any New Debts | Ongoing | Use cash or debit instead of credit. If you need to use credit, ensure it's for essentials and that you can pay it off immediately. |

| 4 | Try the Debt Avalanche Method | 2-5 Years | Focus on paying off debts with the highest interest rates first while maintaining minimum payments on others. This reduces the amount of interest paid over time. |

| 5 | Cut Expenses | 1 Month | Review your budget for non-essential expenses that can be reduced or eliminated. Consider cheaper alternatives for services and goods. |

| 6 | Find Additional Income Sources | 1-3 Months | Look for side hustles or part-time jobs. Sell unused items. Apply skills or hobbies to earn extra money. |

| 7 | Prioritize an Emergency Fund | 6-12 Months | Save a small emergency fund to avoid new debts from unexpected expenses. Even a small amount can provide a buffer. |

Tips for Success:

- Stay Motivated: Keep your goal in sight and remind yourself why you're working hard to eliminate debt.

- Use Tools and Resources: Budgeting apps and debt calculators can provide clarity and progress tracking.

- Seek Support: Join online forums or local groups for encouragement and advice from people working towards similar financial goals.

- Review and Adjust Regularly: Your budget and strategy should evolve with your financial situation. Regular reviews allow you to adjust as needed to stay on track.

Combining these steps with patience and persistence will help you effectively manage and eliminate debt, even on a low income.

Now, let's dive deep into the seven steps.

Step 1: Understanding Your Debt

Before you can conquer your mountain of debt, it's essential to understand what it looks like. Begin by tracking every single cent owed. Organize your debts into high- and low-interest categories. Knowing the numbers will be your first step to freedom.

Calculate What You Owe

List all your debts, from credit cards to student loans. Be thorough—whether it's a forgotten library fine or a standing electricity bill, all debt counts.

Know the Costs

Not all debt is created equal. Pay close attention to high-interest loans like credit card debts, which can balloon if left unattended.

Categorize and Prioritize

Debt snowball or debt avalanche – choose a strategy that works for you. With the snowball, you pay off the smallest debts first for quick wins, while the avalanche focuses on the highest interest rates to save money over time.

Step 2: Budgeting for Success

Creating and sticking to a budget is the key to conquering debt on a low income. Budgeting is not about restricting spending; it's about prioritizing your spending to align with your financial goals.

Zero-Sum Budgeting

Assign every dollar of your income to a specific expense, savings, or debt payment. This proactive approach avoids dollars languishing aimlessly, prone to being spent on whims.

Needs vs. Wants

Distinguish between what's necessary for survival and what's a luxury. Cut discretionary spending ruthlessly to free up more cash for debt repayment.

Use Cash Envelopes

Allocate cash for varying expenses into labeled envelopes. This tangible method makes it difficult to overspend – once the envelope is empty, you're done for that category.

Step 3: Earning Extra Income

While increasing income might seem outlandish, possibilities exist if you're creative and resourceful.

Side Hustles

Explore part-time jobs on the weekends or evenings. The gig economy offers numerous opportunities for additional income, from tutoring to ridesharing.

Monetize Skills

Are you a great baker or skilled in a foreign language? Monetize these abilities with a small business or freelance work.

Sell Unwanted Items

Selling things you no longer need can provide a much-needed financial boost. Platforms like eBay, Facebook Marketplace, and Poshmark are your allies.

Step 4: Cutting Costs Without Sacrifice

Cutting costs doesn't have to mean diminishing quality of life. It requires thoughtfulness, not deprivation.

Ditch Subscriptions

Assess your subscriptions – do you really use that gym membership or streaming service? Cancel what's unnecessary.

Lower Utility Bills

Simple changes like turning off lights, unplugging electronics, and using energy-efficient bulbs can slash utility expenses.

Meal Planning

Spend an hour each week planning your meals and purchase accordingly. This reduces food waste and impromptu, costly takeout orders.

Step 5: Utilizing Debt Management Tools

Fortunately, a wealth of tools is at your disposal to manage and reduce debt.

Debt Management Plans

Credit counseling agencies can facilitate debt management plans that may lower interest rates and consolidate payments.

Debt Consolidation

Consolidating multiple debts into one could simplify payments and reduce interest rates.

Balance Transfer Cards

Transferring high-interest balances to a card with 0% APR can provide temporary reprieve and allow you to focus on principal payments.

Step 6: The Importance of Building Emergency Savings

An emergency fund is your financial safety net and a vital tool in preventing future debt accumulation.

Start Small

Even saving $10 a week adds up. Aim for a fund covering three to six months of living expenses.

Automate Savings

Set up automatic withdrawals to your savings account right after payday – out of sight, out of mind.

Use Windfalls Wisely

Tax refunds, bonuses, and unexpected cash should go straight to your emergency fund, not fleeting wants.

Step 7: Staying Motivated

The path to debt freedom is laced with challenges, but staying motivated is key to your success.

Visualize the End Game

Create a visual representation of your debt, and watch the visual change as you pay it off, reinforcing the progress.

Celebrate Milestones

Whether it's paying off a credit card or saving your first $500, celebrate these financial victories. They're hard-earned and deserve recognition.

Build a Support System

Debt can be isolating, but a support system can provide much-needed accountability and encouragement. Share your goals with a trusted friend or family member.

Conclusion

Your financial situation does not define your destiny. With meticulous planning, strategic approaches, and a dash of perseverance, escaping debt is a viable feat, even on a low income. By following these steps, those clutches of debt will weaken, and the empowerment of financial control will be within reach. Take that first step today.

Great tips! We’re at the beginning of our pay down debt process (crossing our fingers the jobs stick!) I can’t wait to start paying off our debt!

Good for you Lindsay! I’m excited for you. If you need any support shoot me an email! Let me know how you are doing, Lindsay.