How Technology Transformed The Way We Manage Our Finances

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereAs the years pass, technology seems to be evolving at a rapid pace. Things that we were so used to doing just 5 years ago, seem to be almost obsolete. The way we even do our finances has evolved, all thanks to technology. Whether you like it or not, technology has transformed the way we manage our finances today.

Finances and the way we manage them have changed tremendously; thanks to the internet. Love it or hate it, the world of personal finances is evolving from pens and papers to smartphones, tablets, personal computers, to even smartwatches. No matter where you go these days, you can see the evolving changes to our finances, all thanks to the fast-evolving world of technology.

How Technology Transformed The Way We Manage Our Finances

Paychecks and Cards

Over the years, companies have stopped handing employees paper paychecks. Instead, many companies in the USA are offering direct deposit or debit cards to their employees.

Why are companies and other institutions moving away from paper paychecks? It saves money! Direct deposit is extremely convenient and fast, and it saves companies a lot of money. Printing checks, mailing them, etc., costs more money, so direct deposit eliminates the additional cost of paper paychecks.

It also helps us out. I remember having to drive on my day off from work to get my paycheck. Not only was this so time-consuming, but I would spend money on gas driving across town to get my paycheck, then head to the bank to have it cashed. Direct deposit completely changed all of that and then some.

Many companies offer cards (debit/credit cards) to employees who don’t have a regular bank account. Companies like Walmart offer employees an alternative to direct deposit by offering them a Visa card, and the payroll department can direct deposit their checks right away.

Many institutions, like unemployment and other government programs, are also requiring people to use electronic means instead of paper.

Banking

Thanks to the Internet, banking has evolved immensely as well. No more heading over every Friday or every other Friday to the bank to wait in the long lines to get your check cashed or deposited. Online banking has given consumers a new and better way to do banking that saves them time and money.

Here are 3 benefits of banking online:

- Convenience

- No lines

- Availability

We are able to check our bank accounts at any time and from anywhere we want. If we have a question about our account, we can do it online via email or chat. The new way of banking has really helped us costumes and gives us more control of our money as well. Transferring money is so simple, thanks to technology.

Related posts:

- Fighting Back The Urge To Spend Money – 5 Tips to Help You!

- What to Save For This Year (8 Top Money Categories You Must Save For Today)

- 20 Tips To Spring Clean Your Home Finances

Paying bills

Again, if you have a bank institution that helps you pay your bills through them, take advantage of it. Paying bills online is the best thing ever! No more writing checks or going to different places to have your bill paid.

Many places charge fees to have bills paid through them. The internet has made paying bills convenient and straightforward. If your bank doesn’t offer bill pay, that’s OK. Many companies offer to pay online options through them.

For example, you can pay your electric bill online through the electric company's website. You can pay for your phone online the same way as well.

4 Reasons to use online billing;

- Fast

- Safe

- Credit cards allowed

- Easy to keep organized

There are many other benefits of paying bills online, all thanks to the latest technology.

Thanks to budget apps and software, managing your finances has gotten simpler. Now, people can control their finances at their fingertips. No more pencil and paper, writing a budget, and constantly keeping it updated. Technology makes budgeting and managing our finances simple and less stressful.

Apps like Quicken Simplifi, Personal Capital, and many more help you manage your finances and make smarter decisions.

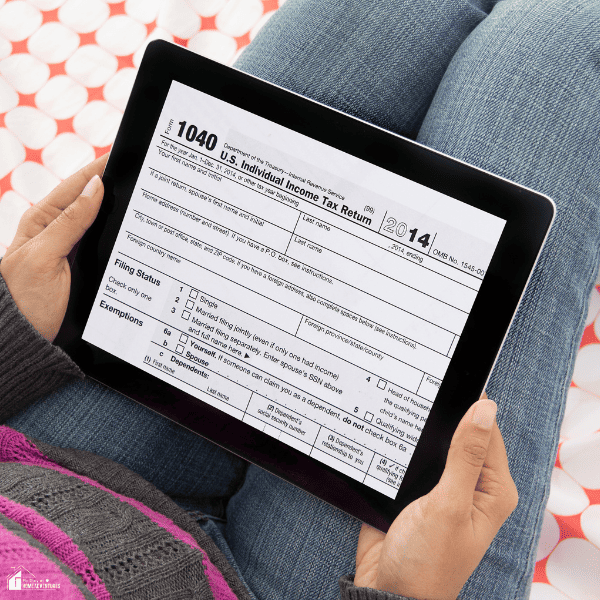

Filing Taxes

I remember dreading doing my taxes. It seemed like it was the most complicated thing to do. All the paperwork and the time it took to get your taxes done was simply crazy! Thanks to technology, filing your taxes is much simpler than before. Though, I’m not so sure if the outcome for some people has changed 😉

Thanks to the internet and software, filing your taxes doesn’t cost as much as it used to (to some of us!). I remember paying hundreds of dollars to have my taxes done. They charged by form, and if you had stock and other assets, you had to pay a pretty penny!

Save money

This is something I love about how technology has transformed the way I manage our finances. Thanks to the latest technology, people are able to save money. How? Let’s look at it from this angle; not only do you have access to your money, but you also have ways to save money as well.

Apps and software that help you save money when you shop. You have access to see sales, promotions, stock prices, etc; all the information you need to save money is available to you without waiting for the mail, making a phone call, or driving to the location.

An example of how we save money on groceries is we look at the ads earlier, thanks to the internet. We use electronic rebates. We are constantly looking for ways to save money simply by looking online

Make Money

Again, when we need to come up with ways to make extra money, where do we go? The internet! Thanks to the World Wide Web, finding ways to make extra bucks has helped our personal finances.

From selling stuff to doing online surveys, making money online has become easier than it was a few years ago. How could one make extra money without leaving your home 20 years ago? The convenience of making money is possible thanks to technology.

There are so many ways that technology has transformed the way we manage our finances. Personally, I can’t complain. I feel like I have a better handle on my finances. Thanks to technology, we have been able to budget, save, and make money. Heck, if it wasn’t for technology, I wouldn’t have discovered what debt freedom was all about!

How has technology transformed the way you manage your finances? Please share it with us!

I’m right there with you on taxes! So much easier now!

Sure is. I remember being so scared about messing up the papers when I filed my taxes.

Great post! I love the reflections of how technology has changed our finances and the pros and cons of it. 🙂 -Kayla

Thank you Kayla!

I remember when I was a kid and going to the bank with my parents on payday was a 30 minute wait in line! When I got my first job at as a teller there would be lines, but nothing too crazy. I haven’t been in a bank branch in over 2 years! (Which is a good thing because I never changed banks when we moved…the nearest branch is an hour away). My favorite technology is being able to deposit checks from my phone.

I think that’s one of my favorite things ever! I can’t believe how easy it is to deposit a check! I’m there with you on that part of technology.

Great advice, I learned a few things! Thanks