Sinking Funds Guide (Free Printable Tracker)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereAre you looking to get your finances in order but feeling overwhelmed? Setting up a sinking fund is one of the easiest and most effective ways to save money. An organized system can help you stay on track and reach your financial goals faster than ever!

In this blog post, we’ll provide all the information about how to set up a sinking fund and what it should be used for, and show you step-by-step how to get started with our amazing free printable tracker! All you need is 5 minutes and some determination! Let’s dive into it now.

Let's begin.

Chances are you’ve heard the term sinking funds or Dave Ramsey's sinking funds and wondered what it meant. If you’re trying to get your finances in order, sinking funds are something you should definitely pay attention to.

Love printables? Visit Cash Envelopes Template!

Such an account can make a difference when it comes time to take care of certain expenses. Let’s take a closer look.

What are Sinking funds?

A sinking fund is an account set up to save money for expenses that naturally occur but doesn’t occur often. These expenses aren’t part of your regular monthly expenses. The money saved in a sinking fund is held for some time and will not be used for any other purpose.

Rather, these expenses, such as life insurance, may occur with regular upkeep of a home or car or are due annually.

A sinking fund allows you to save money until you need to cover these expenses so that you don’t have to reach into your emergency fund.

Why is it called a sinking fund?

It is thought that the term sinking fund refers to how the account is used to pay for an upcoming expense. In other words, the total you’ll owe for the upcoming expense is “sinking” as you put money into the account.

Why is a sinking fund important?

Sinking funds are important because they help you to save for large expenses without having to dip into your regular savings or take out a loan. Sinking funds allow you to prepare for large expenses in advance, meaning you won’t be stressed out when a big bill comes up. Additionally, it helps you keep track of your savings goals easily and will ensure that you can stay on track without overspending.

How many sinking funds should I have?

How many sinking funds you should have depends on your financial goals and needs. Some people may find that having one or two sinking funds is enough, while others may need more. It’s important to keep track of your spending and savings goals to ensure that you set up the right number of sinking funds for your needs.

Creating a sinking fund that makes sense for you means thinking about the bigger picture of your financial goals. For example, if you want to save for a vacation in a year, having a separate sinking fund dedicated to that goal will make it easier for you to reach your destination.

Additionally, if you want to save for a large purchase like a car or a down payment on a house, you can make separate sinking funds to help track those expenses.

How do sinking funds work?

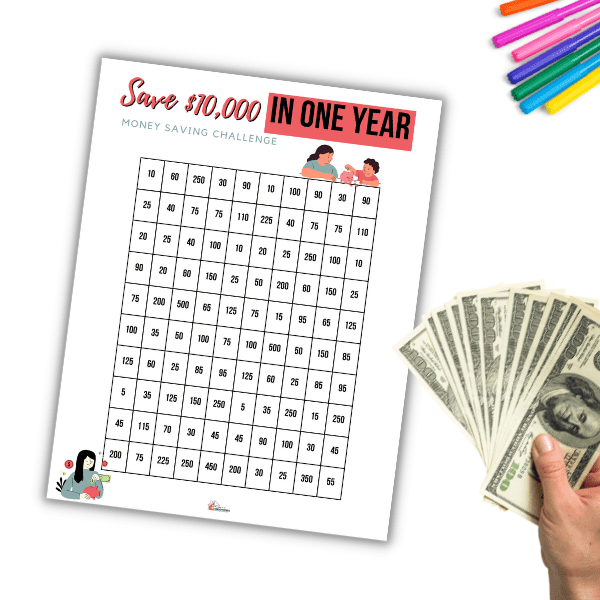

Sinking funds work by setting aside a certain amount of money each month for a specific purpose. This makes saving up for a large expense much easier, as you know exactly how much money will be allocated each month. You then keep track of your sinking fund by tracking the amount of money you have saved each month and your total balance.

An example of this would be setting aside $200 every month for a vacation you plan to take next year. By the end of the year, you should have saved $2,400 for your trip!

What accounts should I use for my sinking funds?

The best type of account to use for your sinking funds is a separate savings account, specifically one that earns you interest over time. Setting up an online account is the easiest way to do this. Additionally, it's important to ensure that the account you use has no transaction fees or minimum balance requirements so that you can easily keep track of your savings and not worry about any extra costs.

An example, look for bank accounts that give a good reward for savings or have a no-fee option.

Sinking fund categories

Now that you know the basics of sinking funds, it’s time to get organized and start tracking your progress. To do this, it’s important to create categories. This will help you easily track how much money you have saved in each area and ensure that you stay on track with your financial goals. Some categories to consider when creating sinking funds include:

- clothing and shoes

- car

- home

- medical

- gifts

- holidays

- pets

- vision and dental

- life insurance

- appliances

- kid expenses

- vacations

Remember that you can create a sinking fund for any expense you incur, so be sure to think about your needs and come up with categories that work for you.

How do you budget a sinking fund?

A sinking fund is a savings account used to set aside money over time for large purchases or anticipated expenses. Start by identifying the expected purchase cost or expense to budget a sinking fund. Then, decide on a reasonable timeline for making the purchase or paying the expense and determine how much should be saved each month to reach your goal in that time frame.

Once you have determined your savings goal, set up a separate account for this fund. This will make it easier to track how close you are to achieving your goal. Then, set up automatic transfers from your checking account into your sinking fund each month. This will ensure that the money is saved consistently and on time.

Finally, review your budget regularly to ensure that you are still on track with saving for the purchase or expense you have budgeted for. This will help you stay motivated and on target to meet your goal. You can easily budget a sinking fund with a little planning and consistency.

If you need assistance managing your finances, speak with a financial advisor who can provide personalized advice and guidance. Together, you can develop a plan to save for the right purchase or expense for your financial situation.

Related posts:

- Financial Life Goal List (What You Need to Know)

- 6 Annual Expenses You Need To Save For This Year

- Save Money on Life Insurance

How to keep track of a sinking fund

If you are learning about sinking funds and need to learn how to keep track of them, the best way is to write it down, use a budgeting app or create your spreadsheet.

First, write down all of your necessary expenses that need to be allocated to the sinking fund. This should include the amount you will need to save each month to reach your goal and the date by which you need to meet your goal.

Then, set up reminders to review your budget and ensure you are staying on track with contributing to your sinking fund. Using a budgeting app, you can easily track your progress and receive notifications when it’s time to make a contribution.

Finally, consider automating your contributions. Setting up automatic transfers from your checking account into the sinking fund each month will help ensure that you save consistently and on time. This will also help to keep you motivated and remind you of your financial goals.

By following these steps, you can easily keep track of your sinking fund and stay on target to meet your savings goal.

Sinking fund samples

Here are some great sinking fund samples to help you get started:

1. Vacation Fund: Set aside a certain amount each month to save for your dream vacation. You can use this fund to pay for flights, hotels, and activities when it’s time to take that long-awaited trip.

2. Home Improvement Fund: If you’re a homeowner, you know how expensive it can be to make repairs and improvements. A sinking fund for home projects will help you stay ahead of the curve when it comes time to fix up things around the house.

3. Car Fund: Cars are expensive and need regular maintenance. Set aside a certain amount each month so that you’re always prepared when it’s time to take your car into the shop.

4. Wedding Fund: If you’re planning a wedding, you know that it can be quite pricey. Rather than relying on credit cards or loans to pay for your special day, create a sinking fund and start saving early so that the bill doesn’t come as such a shock when it’s time to pay.

5. Heating Maintenance Fund: Make sure you're prepared for cold weather and heating system repairs by creating a sinking fund that you can use when it's time to pay the bill.

6. Holiday Fund: Instead of going into debt during the holiday season, set aside small amounts each month so that your wallet won't take such a beating to come December.

7. Back to School Shopping Fund: Save money for school supplies, clothes, and other back-to-school items by setting aside a certain amount each month. This will help you budget more effectively during the busiest shopping season of the year.

By creating these sinking funds and depositing them regularly, you’ll be well on your way to financial freedom and security. Get started today, and you’ll be glad you did!

Emergency fund vs. Sinking fund

The main difference between an emergency fund and a sinking fund is the purpose of the money. An emergency fund is meant to cover the unexpected, and sinking funds cover the expected.

An emergency fund is set aside for unexpected expenses, such as medical bills, home repairs, or job loss. On the other hand, a sinking fund is used to save for expected expenses that occur on a regular basis, such as vacations, holidays, or car repairs.

An emergency fund is considered an absolute necessity and should be built up to cover at least 6 months’ worth of basic living expenses. A sinking fund is helpful but not always necessary. The amount you set aside for a sinking fund will depend on your individual needs and goals.

It’s important to remember that an emergency fund should always be your priority, but if you have the means, setting up a sinking fund can also help you achieve financial security by taking some of the stress out of expected expenses.

The Benefits of Sinking Funds

A sinking fund can provide several benefits to help you with long-term financial planning. Here are just a few of the advantages that come with using this money saving tool:

• You’ll be prepared for upcoming expenses: By setting aside money each month, you won’t have to worry about coming up with cash for big bills when they hit.

• You’ll create a sense of financial security: Knowing that you have money saved for an upcoming expense will give you peace of mind and help to reduce financial stress.

• You’ll be less likely to dip into your emergency fund: Having money saved specifically for expected expenses, you won’t have to rely on your emergency fund when something comes up.

• You’ll save more money in the long run: Creating a sinking fund will help you avoid making impulse purchases or turning to credit cards when it’s time to pay up.

Overall, setting up sinking funds can help you stay ahead of the curve when it comes to preparing for major expenses. Get started today, and you’ll be on your way to financial freedom!

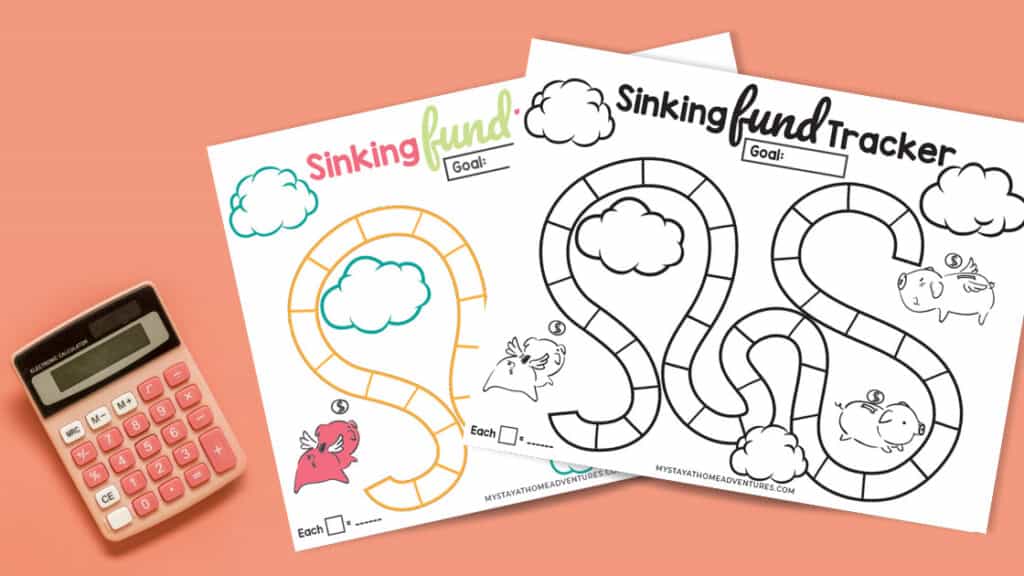

Sinking Fund Tracker Sheets

If you need help tracking your progress in setting up the perfect sinking fund for yourself and your family, don’t worry! We offer a free printable sinking fund tracker to help you stay on track with your goals.

Ready to get started? These sinking fund tracker sheets are available in color or black and white and are free for you to enjoy when you subscribe to our newsletter.

Fill out the form below to obtain these sinking fund printables.

One Comment