Subscriptions To Cancel To Save Money

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereAre you tired of realizing that you've spent more money on subscription services than you thought? It's easy to forget about those monthly or annual fees that can add up and significantly impact your budget. According to a recent study, the average consumer pays $2847.96 per year for subscription services. That's a lot of money that you could use for other things, like building up your emergency fund or making a down payment on a car.

So why not look closer at your subscriptions and see which ones you can cancel or pause to free up some cash?

In this blog post, we'll explore six useless subscriptions to cancel in 2023 and other common subscriptions you might want to consider canceling to save money.

The rising costs of subscription services.

Subscription services have become a staple in modern-day living, with every imaginable service having a subscription option. However, many people fail to realize the rising costs of these subscriptions. A recent study shows that consumers spend an average of $133 more each month on subscriptions than they realize.

This can be quite significant, especially for those trying to save money. People often forget to cancel subscriptions they are no longer using, adding to their monthly expenses. It's important to keep track of these expenses and evaluate which subscriptions are necessary and which ones can be canceled to save some money.

With the ever-growing number of subscription services available these days, it's easy to let them stack up and forget about them. But canceling unused services can save you hundreds of dollars over the course of a year and help keep your finances in check.

It's important to take the time to evaluate which subscriptions you are actually using and which ones can be let go.

Not only will it free up some extra funds, but it can also help declutter your life and reduce stress. So, look at your bank statements and start canceling those unnecessary subscriptions to save money!

You might enjoy these posts:

- How To Get Free Magazine Subscriptions

- Ways to Hang With Friends and Not Waste Money

- 6 Things You Are Not Doing That Are Costing You Money

What percent of people forget to cancel their subscription?

Did you know that almost half of the population forgets to cancel their subscription before they get charged? According to surveys, 48% of people forget to cancel a free trial before being auto-charged. On top of that, 42% of consumers forget that they are still paying for a subscription they no longer use.

It's always a good idea to check your bank statements regularly to avoid getting charged for subscriptions that you no longer use. So, make sure to remember to cancel or pause your subscriptions before the free trial period ends and before any auto-renewal period.

Is it better to pause or cancel a subscription?

Deciding whether to pause or cancel a subscription ultimately depends on the specific circumstances. Pausing a subscription may be a better option if you plan on resuming the service in the future. This way, you don't have to sign up again and won't lose any saved preferences or data.

On the other hand, canceling a subscription may be more appropriate if you no longer need the service. It can also save you money if you're trying to cut down on unnecessary expenses. Be sure to evaluate your situation and choose the option that works best for you.

How much money do people waste on subscriptions?

Many people unknowingly waste a significant amount of their monthly budget on subscription services. A recent survey found that consumers spend an average of $133 more per month on subscriptions than they realize. This is because subscriptions are often charged automatically, and users may not notice the cost.

Also, many people forget to cancel subscriptions that they no longer use, which can add up over time. Individuals can save substantial money yearly by keeping closer track of subscription costs and canceling unnecessary services.

Common Subscriptions to Cancel In 2023

Shopping Memberships

Shopping memberships might seem like a great deal initially, but they can drain your wallet. Many stores offer free shipping or discounts with a minimum purchase amount, so paying a monthly fee for a membership might not be necessary.

Additionally, it's easy to forget about these memberships and continue paying for them even if you're not utilizing the benefits. Look at your shopping habits and determine if membership is worth the cost. Canceling unnecessary shopping memberships can save you significant money each year.

Gym Memberships

Gym memberships can be a great way to stay in shape and maintain a healthy lifestyle. However, they can also drain your wallet if you're not using them enough. With the rising costs of subscription services, it's important to evaluate whether or not your gym membership is worth the expense.

Keeping your membership might be the right choice if you're committed to staying dedicated to your fitness goals. But if you find yourself slacking off or only going to the gym occasionally, it might be time to cancel and save yourself some money.

Cable or Livestreaming Services

Cable or live streaming services can be a major monthly expense, especially if you're not enjoying all the content offered. With rising prices and the increasing number of streaming services, evaluating which services you truly need and which ones you can cut is important.

For a true cord-cutting experience, consider ditching live TV altogether or using an antenna to access free local channels. And don't forget about the power of free trials and basic, non-premium subscriptions to save even more money. By being strategic in your streaming choices, you can enjoy the content you love while keeping your budget intact.

Credit Monitoring Services

Credit monitoring services can be a helpful tool in keeping your credit score in check and protecting yourself against identity theft. However, it's important to weigh the cost of these services versus their benefits.

Some credit monitoring services offer a free basic option, while others charge a monthly fee for additional features such as credit score updates or alerts for suspicious activity.

It's important to read the fine print and understand what you're paying for. If you're on a tight budget, canceling unnecessary credit monitoring services can be a great way to save some extra cash each month.

Cloud Storage Services

Cloud storage services are a great way to store and access your files from anywhere but they can also drain your wallet. Most cloud storage services charge around $10 per month for basic storage options. While this may not seem like a lot at first, it can quickly add up over time if you have multiple accounts or need more storage space.

To save money, consider canceling any unnecessary cloud storage subscriptions and only signing up for the ones you truly need. Additionally, consider looking into alternative options such as external hard drives or USB drives for extra storage.

Meal Kit Services

Meal kit services like HelloFresh and Blue Apron have recently gained immense popularity. These subscription-based services deliver preportioned ingredients and step-by-step recipes right to your doorstep, making it a convenient option for time-strapped individuals. However, it's important to evaluate the value these services truly offer critically and if they align with your personal preferences.

The cost-saving strategy is to choose vegetarian meals and replace meat with alternatives such as cashews. Moreover, the excessive waste generated by meal kit delivery services has become a real reason to cancel subscriptions and seek more eco-friendly alternatives.

Dating Apps

Dating apps are a convenient way to meet new people but they can come at a cost. Many of these apps offer a free version but also have premium options requiring a subscription and a monthly fee.

It's important to assess whether the additional features are worth the price tag and if they truly enhance your experience on the app.

If you find that you're not getting your money's worth, consider trying out other free dating apps or taking a break from dating apps altogether to save some extra cash.

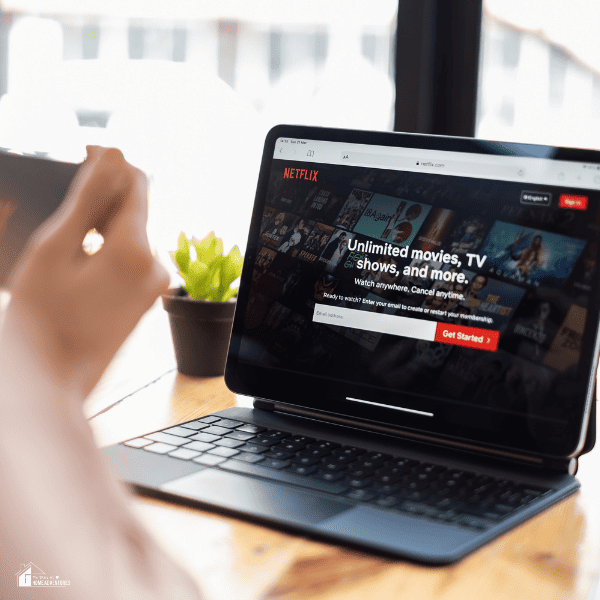

Premium Streaming Services

Premium streaming services like Max and Netflix have become household names, but their rising costs are becoming a concern for many consumers. While these services offer a vast selection of movies and TV shows, it's important to look closely at your viewing habits to determine if the added expense is worth it.

With the option to pause or cancel subscriptions easily, consider only subscribing for the months when you have shows or movies you really want to watch. By being strategic with your subscriptions, you can enjoy premium streaming services without breaking the bank.

How Much Can You Save?

By canceling unnecessary subscriptions, you can save substantial money yearly. Shopping memberships, gym memberships, credit monitoring services, meal kit services, and streaming services are all potential areas to start cutting costs.

Be mindful of your budget and evaluate which subscriptions offer the most value for your money. By looking through these costs, you'll find that small savings add up quickly and can save a lot of money in the long run.

So, make sure to assess your subscriptions regularly to ensure that you are not wasting money on services that are no longer providing value. Ultimately, being intentional with your subscription choices allows you to enjoy all the benefits without breaking the bank.

| Company/Service | Estimated Monthly Cost | Yearly Estimated Cost |

|---|---|---|

| Netflix (Basic Plan) | $8.99 | $107.88 |

| Hulu (Basic Plan) | $5.99 | $71.88 |

| Amazon Prime Video | $8.99 | $107.88 |

| Spotify Premium | $9.99 | $119.88 |

| Disney+ | $7.99 | $95.88 |

| HBO Max | $14.99 | $179.88 |

| Planet Fitness | $10 | $120 |

| Gold's Gym | $40 | $480 |

I've listed some subscription companies/services in this table, including Planet Fitness, Gold's Gym, and six streaming services with their estimated monthly costs.

However, as I cannot predict how much you can save without knowing your current plans or usage, I cannot provide the estimated monthly savings.

The savings would depend on factors like promotions, bundles, or switching to a lower-tier plan based on your usage. The yearly estimated cost is calculated by multiplying the monthly cost by 12.