Where To Get Your Free Credit Score

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereHave you ever wondered what your credit score looks like but hesitated to pay for it? Or have you signed up for a free trial only to be charged hefty fees afterward? Well, the good news is that there are legitimate ways to get your actual credit score for free.

Let's explore various methods to help you access accurate information about your credit report without costing you a penny.

So, if you want to take control of your financial wellness and have a better understanding of your creditworthiness, keep reading!

How can I get my actual credit score for free?

If you want to get your credit score for free, you have a few options available. Firstly, you can visit AnnualCreditReport.com to request a free copy of your credit report from each of the three major credit reporting companies, which will include your credit score. You can also visit websites like Credit Karma to get free credit scores from two of the major credit bureaus, Equifax and TransUnion.

These websites make money via advertising and product recommendations, but you are not required to purchase anything to access your scores. It's important to note that different scoring models may produce different scores, so checking your credit score from multiple sources is a good idea. Be cautious of websites that claim to offer free credit scores but may charge hidden fees or require you to sign up for paid services.

You might enjoy these posts:

- Here's “The How” You Are Going To Save Money This Fall

- 8 Ways for Millennials to Avoid Credit Card Debt

How can I check my credit score for free without damaging it?

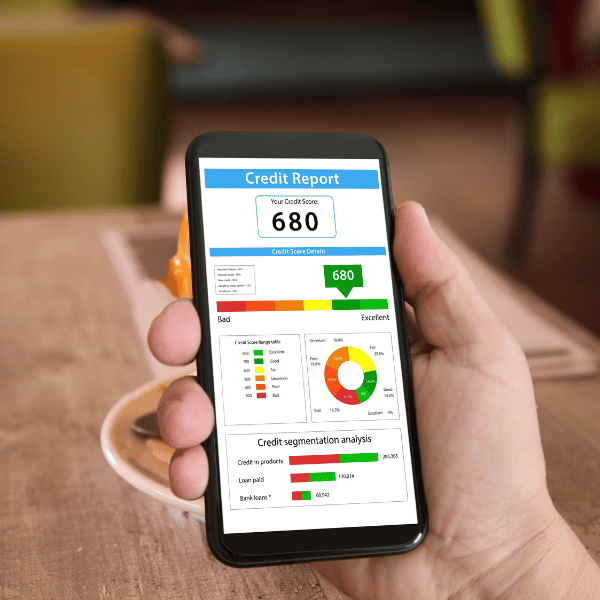

If you’re looking to check your credit score for free without damaging it, Credit Karma can help you out. By downloading the Credit Karma app, you can access your VantageScore 30 credit scores from Equifax TransUnion without worrying about it affecting your scores. It is important to note that Credit Karma doesn’t offer FICO credit scores, as they are calculated differently from VantageScore credit scores.

You should check your credit scores regularly to track any important changes in your credit profile. Remember that your credit scores from Equifax and TransUnion may differ due to different reporting by lenders and other factors.

By checking your credit scores on Credit Karma, you can use them to guide your overall credit health and make informed decisions in your financial journey.

How to find out my credit score?

To find out your credit score, there are several options available. One way is to use a credit monitoring service such as Equifax, which allows you to access your 3-bureau credit scores and report. This service also provides alerts for potential fraud and dark web monitoring for your Social Security number.

Another option is to request a free credit report from each of the three major consumer reporting companies, Equifax, Experian, and TransUnion, once a year through AnnualCreditReport.com. Some credit card companies and financial institutions also offer free credit scores to their customers.

It is important to be cautious of websites that offer free credit reports as they may require the purchase of other products or services. Monitoring your credit score regularly can help ensure accuracy and better manage your credit.

Have you ever wondered what your credit score looks like but hesitated to pay for it? Or have you signed up for a free trial only to be charged hefty fees afterward? Well, the good news is that there are legitimate ways to get your actual credit score for free.

Let's explore various methods to help you access accurate information about your credit report without costing you a penny. So, if you want to take control of your financial wellness and have a better understanding of your creditworthiness, keep reading!

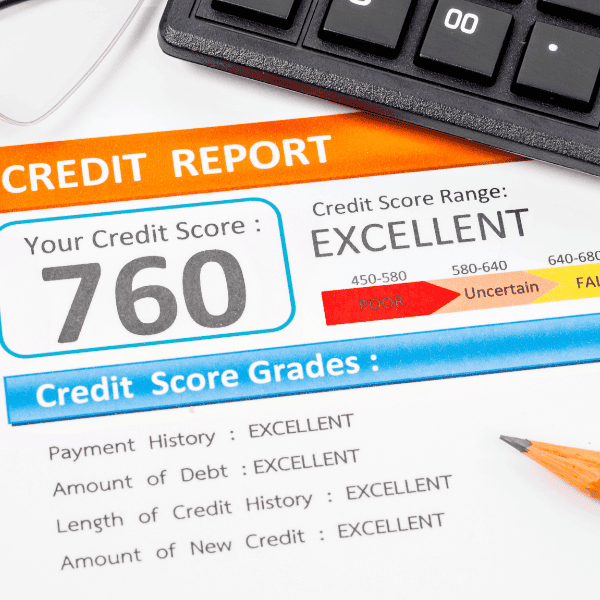

Understanding Credit Scores

Understanding credit scores is essential for anyone who wants to manage their finances effectively. A credit score is a three-digit number that indicates someone's creditworthiness. The score can range from 300 to 850; the higher the score, the better.

Several factors determine a credit score, including payment history, credit utilization, length of credit history, and types of credit accounts. Lenders use the credit score to decide whether someone is a risky borrower or not. A high credit score can lead to better interest rates and approval for loans and credit cards.

It is essential to regularly check credit reports to ensure accuracy and protect against fraud. Requesting a free credit report annually from the three major credit reporting companies through AnnualCreditReport.com is a great way to monitor credit scores. Understanding credit scores can lead to better financial decisions and improved credit standing.

Importance of Knowing Your Credit Score

Knowing your credit score is extremely important for your financial life. It accurately represents your creditworthiness, which determines your ability to get approved for loans, credit cards, insurance, and even a job. A higher credit score means you are more likely to be approved for credit with better rates, while a lower score may result in being denied credit or paying higher interest rates.

Keeping an eye on your credit score can help you avoid costly mistakes and make better financial decisions. Fortunately, you can get your credit score for free from credit monitoring websites and some credit card companies.

Also, checking your credit report can help you spot any errors that could be affecting your score. Knowing your actual credit score can help you stay on top of your finances and make informed decisions.

Free Credit Score Options

There are several ways to get a free credit score. Some credit cards offer free credit scores to their customers, and some banks may provide a free score if you have a checking account with them. Some websites, such as Credit Karma and Credit Sesame, regularly offer credit scores for free.

However, remember that the score provided for free may not be the same one lenders use when making credit decisions. For a more accurate and up-to-date score, consider signing up for a credit monitoring service that regularly updates your score and credit report.

Some services, like TransUnion Credit Monitoring, also provide personalized tips on improving your credit health and protecting against identity theft.

Remember that while a credit score is an important part of understanding your credit health, it is not the only factor that lenders consider when making credit decisions.

Using Credit Card Companies and Financial Institutions

Using credit card companies and financial institutions is a viable option for those who want to obtain their credit scores for free. Many financial institutions now offer their account holders free access to their FICO scores. One such company is Discover, whose free credit scorecard program provides customers with their FICO score every 30 days.

American Express also offers free access to FICO scores for its cardholders, while Chase provides their credit journey tool for anyone with a Chase account. Wells Fargo's FICO 9 Score is available for eligible customers, and Capital One provides its CreditWise program to both customers and non-customers.

These institutions aim to help people monitor their credit scores regularly, allowing them to make informed decisions about their finances.

Utilizing Loan Statements for Credit Scores

Utilizing loan statements is one way to monitor your credit score for free. Loan statements provide information about your payment history, which is a significant factor in calculating your credit score. Reviewing your loan statements regularly ensures that the information reported to credit bureaus is accurate and up-to-date.

Monitoring your loan statements can also alert you to any potential errors or fraudulent activity. It is important to note that not all loan statements include credit scores, so you may need to request this information separately.

Many lenders now provide free credit score updates to their customers, so it is worth checking with your lender to see if this service is available. By utilizing loan statements and free credit score updates, you can stay informed about your credit and take steps to improve it as needed.

Using a Credit Score Service

One option for obtaining a credit score for free is through a credit card company. Some companies include credit scores on monthly statements or offer them through online account access. However, it is important to note that these scores may not be the same as the ones used by lenders.

Purchasing a credit score directly from a credit reporting agency or scoring company is another option, but be sure to double-check the information in your credit report for accuracy. Be cautious of third-party programs offering free credit scores, as they may require enrollment or purchase of a product.

Always be mindful of sharing personal information with unfamiliar companies. Knowing and monitoring your credit score is an important aspect of financial responsibility.

Utilizing Free Credit Scoring Sites

When it comes to monitoring your credit score, many free options are available. Credit Karma offers free credit scores and reports from both Equifax and TransUnion using the VantageScore 3.0 model. This service does not require a credit card to register and is updated weekly. Another option is WalletHub, which also provides free credit scores, reports from TransUnion, and credit monitoring alerts.

Some credit card companies also provide cardholders with their credit scores. It's essential to regularly monitor your credit score, as it can affect your ability to obtain credit and impact the interest rates and terms you receive on loans and credit cards.

Utilizing these free resources can help you stay informed about your creditworthiness and make informed financial decisions.

Confirming Authenticity of Free Credit Score Services

It's important to confirm the authenticity of free credit score services before using them. Not all free credit score websites are trustworthy and reliable; some may even be scams or phishing attempts. The best way to ensure the authenticity of a free credit score service is to research the company and read reviews from other users.

It's also important to check that the website uses encryption to protect user information and that they do not ask for sensitive information such as social security numbers or bank account information.

Also, checking if the website is affiliated with a reputable credit bureau or financial institution is helpful.

Individuals can safely and confidently use free credit score services to monitor and improve their credit by taking these steps.

AnnualCreditReport.com for Free Credit Reports

Are you aware you have the legal right to request a free copy of your credit report from each of the three major consumer reporting companies annually? AnnualCreditReport.com is the only authorized website that explicitly directs you to obtain these reports without any cost.

It's essential to regularly review your credit reports to detect any suspicious activity or signs of identity theft. Checking your reports will also help you ensure that the information stays accurate and up-to-date.

You can request all three reports at once or order one report at a time to monitor your credit report throughout the year. Credit reporting companies cannot charge you more than $14.50 if you need additional reports.

Be aware that some websites might claim to offer free credit reports, but you may need to buy other products or services or sign up for a subscription to access them. To avoid these scams, visit AnnualCreditReport.com or call (877) 322-8228.

Safeguarding Personal Information When Checking Credit Scores

When checking credit scores, it is important to safeguard personal information. This includes avoiding using public Wi-Fi networks and only using secure websites that begin with “https.” It is also important to regularly monitor credit reports and report any suspicious activity or errors to the credit bureaus.

Consumers can obtain a free copy of their credit reports every 12 months from each of the three major credit reporting agencies by visiting AnnualCreditReport.com. It is important to be cautious of websites that claim to offer free credit reports, as some may require the purchase of additional products or services.

Additionally, it is important to never provide personal information to unsolicited callers or emails, as these could be scams attempting to obtain sensitive information. By following these guidelines, consumers can protect their personal information while checking their credit scores.

We love credit sesame in our house! While it’s not your exact number, it comes pretty dang close! And I love how they update you on changes to your credit usage…could help detect fraud early.

The number sure come close and is so simple to use and figure out.